Australian labour report soft

With forecasters rushing to predict rate cuts from the Reserve Bank of Australia (RBA), today's February labour release will provide support for newly-found dovishness. It certainly makes our “rates on hold” call feel very uncomfortable.

Consensus was for a modest rise in employment - reality didn't even match that

After a spell of weaker than expected data (house prices, business confidence, retail sales) and tying in with the RBA's shift to a neutral policy bias, today's labour market release must seem like yet another nail going into the coffin for those still forecasting the RBA to leave rates on hold (that's us). Yesterday's further dovish tilt by the US fed doesn't help.

The minutes of the March RBA policy meeting show that labour is one of the key variables for Australia's rate setters, so just how bad was it?

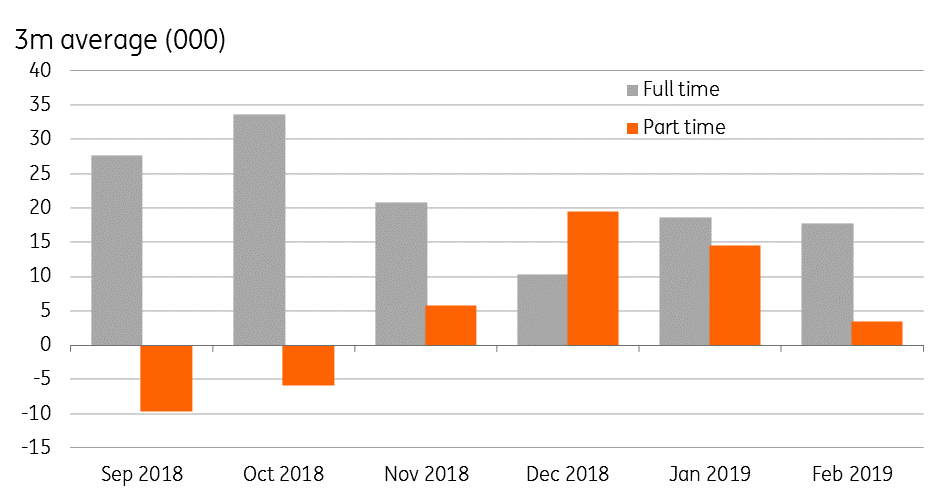

3-month average employment growth

Was it bad? Hard to say for sure - but it wasn't good

Well firstly, you can't take a single labour release in isolation. This is very volatile data. Only a month ago, employment growth was averaging about 30,000 a month. That said, it looks as if there have been some revisions to past data, and this now marks the third fall in full-time employment in four months. The three-month average gain for full-time employment is only positive because of the huge 65,600 increase in January, though that is now beginning to look like an outlier, albeit one that won't drop out fully until April.

Full-time employment in February crashed to a decline of 7,300, leaving total employment up only 4,600. Only part-time jobs moved forward.

So it looks bad. But we do get months like this from time to time, especially after strong months like January, only for the data to come roaring back the following month. Call it "statistical payback". On a longer-term basis, today's figures do not stand out as being any more than noise, so we won't even be able to begin to draw any firm conclusions unless next month's data are also soft. If that turns out to be the case, and other data also remain soft, then we will most likely throw in the towel on our current forecast and join the herd in forecasting rate cuts.