Australian inflation drops sharply in December

A further large fall in Australian inflation will encourage thoughts of earlier and perhaps more aggressive easing by the Reserve Bank of Australia (RBA) this year. But the good news on inflation might be less frequent from now on, and this might not be the right time to jump on the bandwagon

| 3.4% YoY |

December inflationDown from 4.3% in November |

| Lower than expected | |

The rush to price in a more aggressive easing schedule may be misplaced

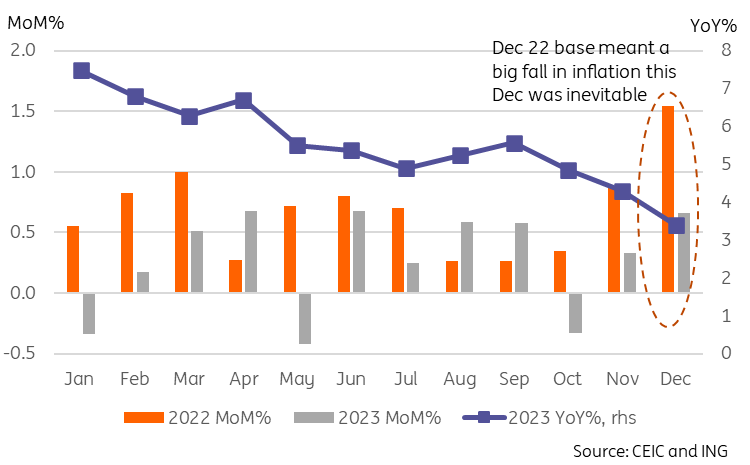

When you look at the run of data in 2022 and 2023, a big fall in inflation in December 2023 was almost inevitable. In December 2022, cold weather and floods combined with a shortage of natural gas for power stations, which together with flooded coal mines delivered a nasty mix of seasonal food price spikes as well as an energy shortage and energy price surges. This unhappily coincided with a big post-re-opening surge for holiday travel at Australia's peak holiday time pushing up recreation prices enormously and delivering the perfect storm in terms of inflation, which briefly hit 8.4% YoY.

Now, although those seasonal factors were still in play to come extent this year, it was a virtual certainty that they would not deliver such a boost to the price level in 2023, and indeed, the 0.66% MoM increase in December 2023 was well below the 1.5% MoM increase for the same month in 2022 - delivering the sub-consensus 3.4% YoY inflation that we saw today.

Decembers inflation print was dominated by base effects

The good news may be missing for a while

However, while it looks as if we are tantalizingly close to the RBA's 2-3% inflation target, we think the near-term is not going to be quite so rosy.

For one thing, every big spike leads to a big fall. This year's spike was smaller than last year's. We'd consequently expect the January 2024 figures to hold up a bit better than they did last year when they fell 0.3% MoM.

That means that inflation in January could push up again, and possibly February too, at least unless we see a substantial weakening in the monthly run-rate for inflation.

Annualized inflation rate

Run rate needs to fall further

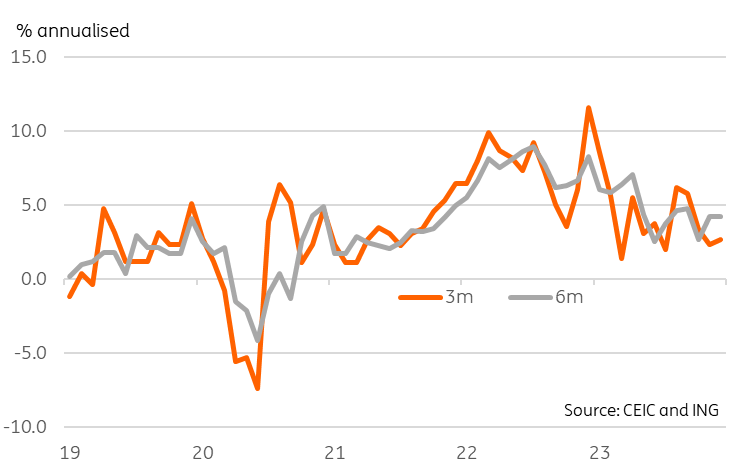

The "run-rate" is an approach that provides some insight into where inflation is heading which downplays the effect of all of the seasonal noise and base effects that plague the data otherwise. Over a full twelve months, all of these effects tend to drop out anyway, so the run rate helps to cut through all this noise and tells us what inflation rate we will get if the current trend of month-on-month changes remains in place for a full year.

Doing this, the 3m run-rate looks fine at 2.7%, though it has begun to rise again, and next month, will likely rise further as the October 2023 -0.33% change will drop out and be replaced by what we expect to be a smaller fall for January. The six-month rate is still stuck at about 4.2%, considerably above the RBA's inflation target, and we need to see some better month-on-month numbers shortly to start bringing that down.

Time to be contrarian?

All of this suggests to us that the rush to price in a more aggressive easing cycle from the RBA, and weaker AUD may be overdoing it. This might therefore be a good time to consider taking a contrarian view as we believe that these current market preferences will be unwound over the coming months.

Download

Download snap