Australian inflation downside miss

Australian inflation shows no signs of coming anywhere near the central point of the RBA's 2-3% range, and we are biting the bullet and changing our “on-hold” call for the RBA to a cut, possibly as early as the 7 May meeting.

A cash-rate cut now seems entirely warranted

Despite strong labour market data last week, which seemed likely to keep a finely-balanced Reserve Bank of Australia (RBA) from any imminent change in the policy cash rate (1.5% currently), the latest inflation data flip the balance firmly back in favour of some easing. Possibly sooner rather than later.

The headline inflation rate for 1Q19 fell to only 1.3%YoY. This was lower even than the 1.5% consensus forecast, which itself was a sharp fall from 1.8% recorded for 4Q18.

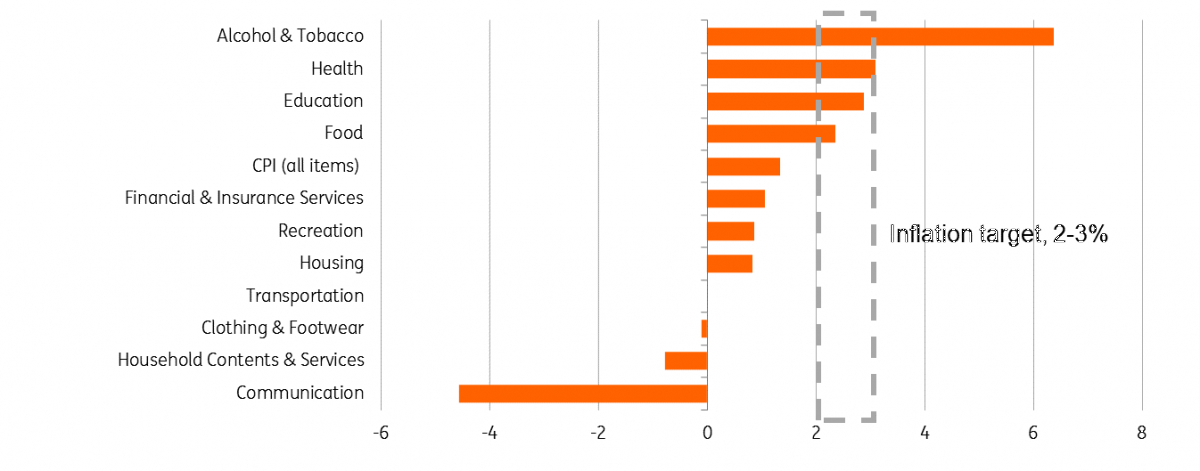

Australian inflation by component (YoY%)

Uniformity in price weakness

By sub-group, goods prices fell 0.2% over the quarter, mainly in the tradeable goods sector. But service sector prices were also softer, though still only managed to eke out a 0.2%QoQ gain. Non-tradeable goods price inflation fell to 1.8%YoY from 2.4% in 4Q18. It hasn't been this low since 3Q 2016.

Inflation wasn't markedly less pessimistic when stripping out volatile items. Indeed, the QoQ ex-volatile items index was slightly worse than the overall headline figure, falling 0.1%QoQ.

At a more granular level, there were big negative QoQ swings in many subgroups from the previous quarter - food, alcohol and tobacco, clothing, furnishings, health, transport, communications, recreation, education, insurance and finance, medical / hospital, in fact, practically everything.

Whither the RBA?

We have been holding on to a low conviction view of "no change" in RBA rates for a very long time now. But this data has painfully jettisoned us off the fence, and we can't now see how the RBA can ignore such a bad inflation miss, even with last week's strong employment gains.

The logic for waiting to assess more data seems quite unnecessary now. Even an August meeting rate cut, as most forecasters have been moving towards, now seems too long to wait, and a cut this quarter, possibly even as soon as the 7 May meeting, would seem quite justified under the circumstances.

Download

Download snap29 April 2019

What’s happening in Australia and around the world? This bundle contains {bundle_entries}{/bundle_entries} articles