Australian 2Q21 inflation overshoots target - no worries

3.8% annual inflation sounds alarming, but it was only slightly higher than expected - with core and trimmed mean inflation measures all more reasonable. We don't see this altering the RBA's assertion that rate rises are a long way off

| 3.8%YoY |

CPI inflation0.8%QoQ |

| Higher than expected | |

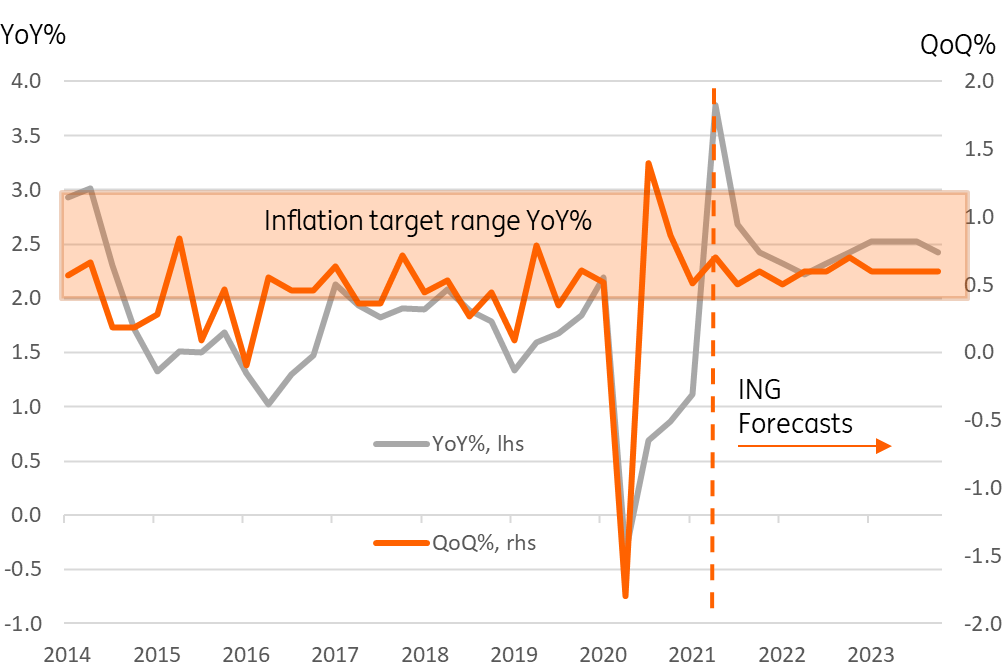

Australian inflation and forecasts

Will be dismissed as "transitory"

Central Bankers' favourite "T" word, "transitory" will likely be dusted off again after Australia's 3.8%YoY inflation print for the second quarter of 2021. This is up from an inflation rate of only 1.1% in 1Q21. However, almost 2 percentage points of this inflation increase is entirely due to base effects. The CPi index for 2Q 2020 fell by 1.9% from the previous quarter. And of the 0.8%QoQ print for 2Q21, we probably would have anticipated something around the 0.6-0.7% range even in normal times, so this doesn't look at all like what is going on in the US, where the run-rate of CPI really has picked up dramatically, making it more than just a base-driven increase.

Without a monthly release, it is harder to perform an equivalent run-rate analysis for Australia. But it is instructive to look at the trimmed means and weighted median inflation measures to get a similar idea of what is really going on once all the frothy outliers are removed. These measures are certainly reasonable substitutes for annualised run rates. And they show a much more moderate pick up. The trimmed mean CPI inflation rate rose to just 1.6%YoY from 1.1% in 1Q21, thanks to a 0.5%QoQ increase. And a similarly modest quarter-on-quarter increase took the weighted median inflation rate to 1.7% from 1.3%.

So underlying inflation is rising. It just isn't rising very fast. And it still looks quite subdued relative to the RBA's 2-3% longer-term target, which as we all now know, they aren't too worried about exceeding in the short-term.

Subcomponent story hasn't changed much from 1Q21

In terms of the drivers of QoQ inflation, which is a much more meaningful metric than the year-on-year measure when base effects are as large as they are right now, the story has moved on very little from the first quarter. Transportation continues to show a big increase - a combination of retail gasoline prices reflecting higher crude, plus a global shortage of vehicles due to semiconductor shortages keeping prices elevated.

Healthcare costs also remain high, for obvious demand-related reasons. Services are also seeing prices rise a bit faster than elsewhere, which is perhaps more interesting as this could imply faster-rising wages growth. But we'll have to wait and see on that. And besides those components, nothing rose much more than 0.5% on the quarter, with quite a few sectors seeing weak pricing pressure persisting.

Inflation for subsectors of CPI (QoQ%)

Reserve Bank of Australia won't be too bothered by this

We can't see the Reserve Bank of Australia (RBA) being too alarmed by this data. They have made it quite clear that they anticipated a short-lived spike in inflation above the upper bound of their target and were unlikely to be moved by this. In recent months, we have seen the RBA statements on policy change to allow for a more flexible response to growth, inflation and most importantly, labour market developments. And in due course, we suspect that they may concede that a rate hike before 2024 is possible. That is not their current guidance though. And this data won't influence that decision if and when it is eventually made.

The wage price index released on 18 August has a greater potential to influence the official policy stance, and there is another RBA meeting between now and then, which is unlikely to shift guidance meaningfully in the meantime. So a period of "watching and waiting" beckons. Australian FX and bond yields are more likely to be influenced by external factors in the meantime, as well as the authorities' response to local pandemic problems, rather than by any monetary policy thoughts.

Download

Download snap

29 July 2021

Good MornING Asia - 29 July 2021 This bundle contains {bundle_entries}{/bundle_entries} articles