Australia: Wage price index inflation rises

There was a time when a 3%+ wage inflation rate might have mattered for the Reserve Bank's rate-setting decisions. Right now, data does not appear to be a very important input for their decision-making process

| 3.1% |

3Q22 YoY%Wage price index |

| Higher than expected | |

Its all about where you are, not what's happening

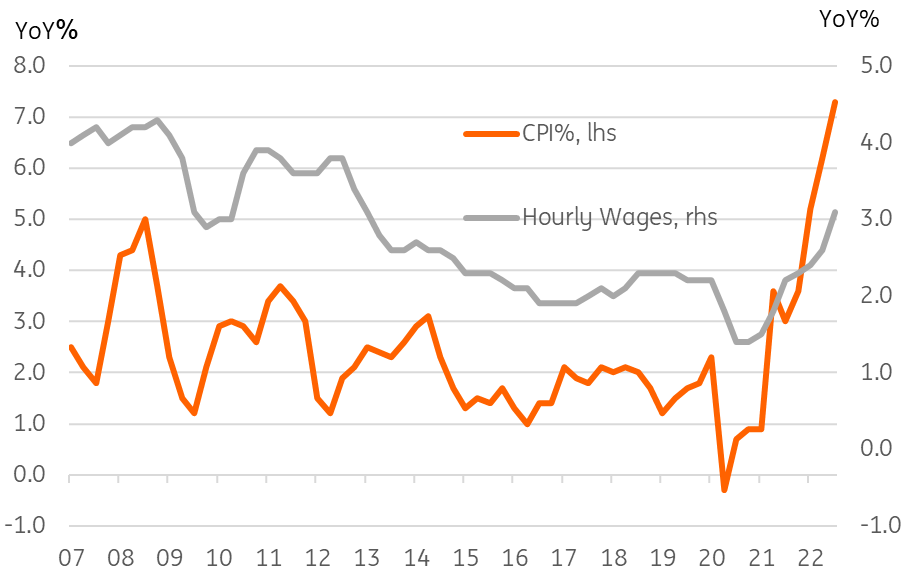

At 3.1% in 3Q22, the latest wage price index result is finally consistent with what the Reserve Bank of Australia once thought was a necessary condition for achieving their 2-3% CPI inflation target. With CPI inflation actually at 7.3%YoY currently, this particular metric ceased to have much relevance a long time ago.

Even so, 3.1% wage growth is a long way below 7.3% price inflation, indicating that in real terms, wage growth remains strongly negative. Even if the RBA were paying much attention to the run of data in its rate-setting deliberations, this latest wage data print is still innocuous.

Annual wage and price growth

Steady as she goes

At 2.85%, the current cash rate target is probably just slightly in a neutral to restrictive policy setting. Here, any further increases in rates are likely to weigh on growth a little bit more than previously. And this, rather than the run of data, seems to be what is driving Reserve Bank (RBA) policy setting.

The RBA expressed concern in their latest statement about overdoing the tightening, and for this reason alone, they seem to be content to slow the pace of monetary adjustment right down to help them finesse the end game in this tightening cycle.

Consequently, even with the last inflation and now wages data surprising on the upside, we don't believe they will shift back to their previous 50bp pace of tightening and will continue at a 25bp pace at coming meetings, with the peak for cash rates likely to come in 1Q23 as the cash rate hits 3.6%.

The RBA will also be keeping a weather eye on the AUD. The recent spell of weakness has been abruptly shattered as thoughts of a US Fed pivot have gained ground, and the Reserve Bank will be keen not to encourage the AUD to rise much faster due to their actions.

Download

Download snap