Australia: March inflation falls further

The March inflation rate came in lower than expectations at 6.3%YoY. The slow-moving quarterly series also showed a big drop in 1Q23 from 4Q22, while the core measures also all undershot expectations. 3.6% is looking as if it might have been the peak for cash rates in this cycle

| 6.3% |

March CPI YoY%Down from 6.8% |

| Lower than expected | |

Focus on the monthly numbers

The consensus for Australian inflation is still transitioning to the new monthly series, which is why there is a disconnect between the outcome relating to the old, quarterly series, and the new, more timely monthly numbers. While both inflation rates dropped sharply, the March monthly inflation outcome of 6.3% YoY, undershot the median expectation for a 6.5% inflation rate. In contrast, the quarterly inflation rate for 1Q23, dropped from 7.8% to 7.0%, slightly ahead of the 6.9% consensus.

The reason for this discrepancy seems to be that many forecasters are still not producing forecasts for the monthly series, which is curious, as it is more timely, and more instructive than quarterly figures, which are already looking very dated at the time of publication. Almost twice as many forecasters delivered a quarterly prediction as those for the monthly series. And it appears that those that did produce the monthly forecasts are still finding their feet when it comes to the numbers, and were much more accurate with the old quarterly series. This will change.

Our focus is on the more up-to-date monthly figures. The market seems to concur. The AUD weakened in the immediate aftermath of the data, and 2Y bond yields were also down.

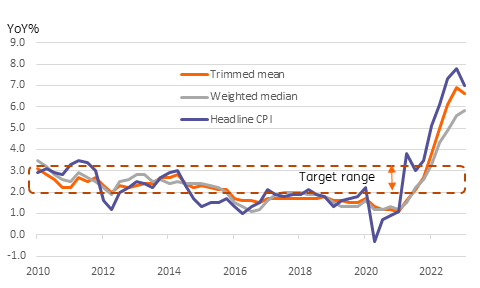

Quarterly headline inflation and core rates

What's driving the monthly inflation series?

The monthly CPI data registered a rise of 0.6% MoM, which at an annualised rate would deliver inflation of about 7%, so there is still a need for this to fall further. The three-month run rate is closer to 0.1-0.2% though, which may be a more accurate guide for how rapidly we might expect inflation to fall from here. If CPI rose at 0.6% again next month, inflation would tick slightly higher, by about 0.3pp before turning lower again. Bigger falls would occur towards the end of the year so long as there was no repeat of the floods/bad weather that led to spikes in both agricultural prices and energy at the end of 2022. Sadly, given the vagaries of global climate these days, such caveats are not worth as much as they once were.

In March, we saw a further slowdown in food price inflation to 0.4%. Rents dropped back to 0.5% MoM from 0.7%, and we would expect this component to slowly drift lower over the coming months, perhaps even turning into a drag later in the year. The unwinding of the recreation index spike in December appears to have come to a halt, however.

We also saw a decline in one of the core measures of inflation that the RBA also focuses on, and one of the other measures also appears to be peaking out. Both core measures came in below expectations.

Where do we go from here?

The next month will show whether 3.6% marked the peak for the cash rate or not. Anything around the 0.3% MoM mark for the April monthly series will enable inflation to at least tread water until base effects in the subsequent months meaning that a 0.2-0.3% MoM run rate will pull inflation down into the 3-4% range by the end of the year.

If there is no repeat of last year's food and energy price spikes, then it is just possible that inflation will fall back within the RBA's 2-3% inflation target range when the December CPI data is released in early 2024, a full year ahead of the RBA's forward guidance for inflation.

And if it looks like this is the direction of travel, then we believe that there is a fair chance that not only did 3.6% mark the peak for the cash rate, but that we could also see the cash rate being trimmed before the end of this year.

Download

Download snap