Australia: Inflation not beaten yet

The November monthly inflation series surprised markets with a stronger-than-expected rise. While this will be a disappointment for the Reserve Bank of Australia, many of these factors look likely to reverse in the months ahead

| 7.3% |

November inflationYoY% |

| Higher than expected | |

A bad number, but it should soon fade

After falling to 6.9% in October, the return of inflation to 7.3% in November is quite disappointing and highlights the fact that inflation in Australia is not going to be a pushover for the Reserve Bank as it tries to squeeze it back to its 2-3% target. A relatively muted month-on-month gain in the price level in November last year meant that at best we were only likely to have seen a modest further reduction in inflation this month instead of the rise we actually saw. But some outsize rises in the price of a number of components mean that we may be waiting another month or two before we can confidently call "peak inflation" in Australia.

Rain stops play

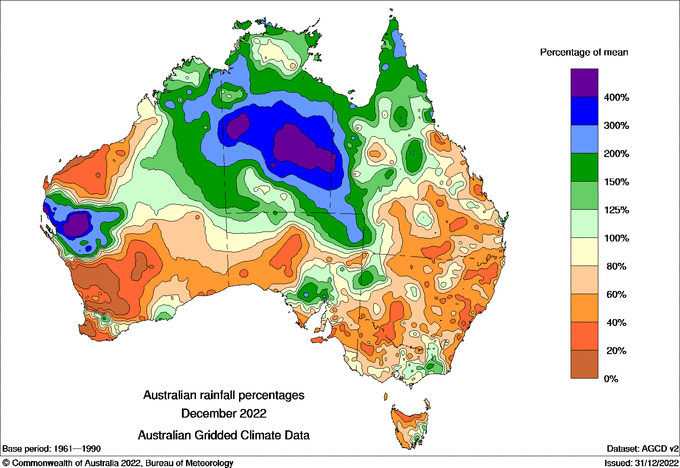

The monthly data tells the story quite well. Let's start with food. And after two consecutive months of large declines, food prices, especially fruit and vegetables, were pushed strongly higher. Poor weather and more flooding in New South Wales and Victoria are probably to blame for much of this. And December wasn't by any means a return to normality either, with the Bureau of Meteorology noting rainfall was 33% above average for the month as a whole with temperatures below or very much below normal (though New South Wales and Victoria were drier than normal after the previous month's rain).

Australian December rainfall - percentage of mean

Oil isn't helping

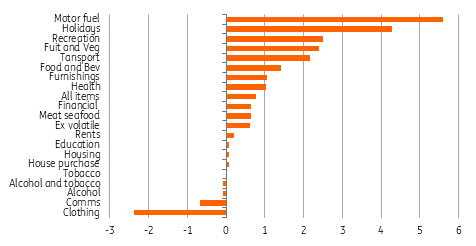

The second 2.2% month-on-month increase in a row for the transport component is largely a reflection of crude oil and retail gasoline prices, with the motor fuel component up 5.6% MoM after a 7% MoM increase in October. National pump prices in December more than reversed the November increase, though they are on the rise again in January, so any respite in December may be short-lived.

Then there is the recreation component, which is being driven by holidays, the price of which rose 4.3% in November due to a choppy and hard-to-forecast combination of air fares (a derivative of oil prices) and pressure on holiday vacancies (a function of global reopening). Rising overseas visitors for Christmas mean that these November figures may only partially reverse in December after the latest spike.

Australian inflation by component MoM%

Better news buried in the detail

However, all of this could be regarded as the death throes for inflation in Australia, as there are some encouraging developments elsewhere that could signal lower inflation once this latest volatility is out of the way, and absent any renewed climate-related impacts (a very big "if" these days).

Firstly, clothing, which is a good reflection of discretionary spending strength, dropped 2.4% MoM, though it is also extremely volatile, so we aren't reading too much into just one month's reading. More importantly, housing registered only a 0.1% MoM increase in November, with house purchase costs also only up 0.1%, while rents rose only 0.2% MoM, down from 0.6% in October. These prices tend to be much less volatile, and having softened, we could anticipate even weaker figures in the months ahead, which may help to soften any residual volatility in the other components that we still need to work through.

What does this mean for markets?

Interestingly, after a brief spike higher on the news, 10Y Australian bond yields have tended to drift lower today following the CPI numbers. This could indicate that markets also view this as a last hurrah for inflation rather than any meaningful setback for the Reserve Bank of Australia. The same seems true for RBA expectations, where December 2023 bank bill futures have risen, signalling an expectation for lower, not higher yields. The Australian dollar did push higher against the US dollar following the release, though drifted back before strengthening again later, though not clearly a direct result of today's data.

Certainly, today's data adds more risk to our view that the RBA will stop raising rates once it reaches 3.6% (another two 25bp rate hikes from here), and we may have to raise that to 3.85% if we don't see some more encouragement from other figures, for example, the labour data. But we are not throwing in the towel just yet. This latest inflation data offered just enough hope that this is a temporary setback to enable us to defer that decision for a little while longer.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap