All aboard the aluminium rollercoaster

LME prices and premiums have lept on news of Rusal sanctions. It's been quite the ride but we continue to caution against a potential divergence between premiums and LME prices whilst Rusal is deliverable. LME data released today suggests a good portion of stock is likely Rusal brand.

Premiums take a leap & spreads are squeezed

The US Aluminium premium contract on the CME lept as much as 23% across 2019 dates yesterday as consumers fear the loss of c.20% of US imports under Rusal sanctions.

We continue to highlight the importance of the Rusal brand being deliverable on the LME. So long as this is the case the LME price could underperform premiums. The LME market remains an open-end customer to Rusal material whilst this supply is effectively cut off from US consumers and the premiums that they pay. In practice, we suspect the issue will extend across other regions and multinational consumers who fear secondary sanctions, supporting premiums globally.

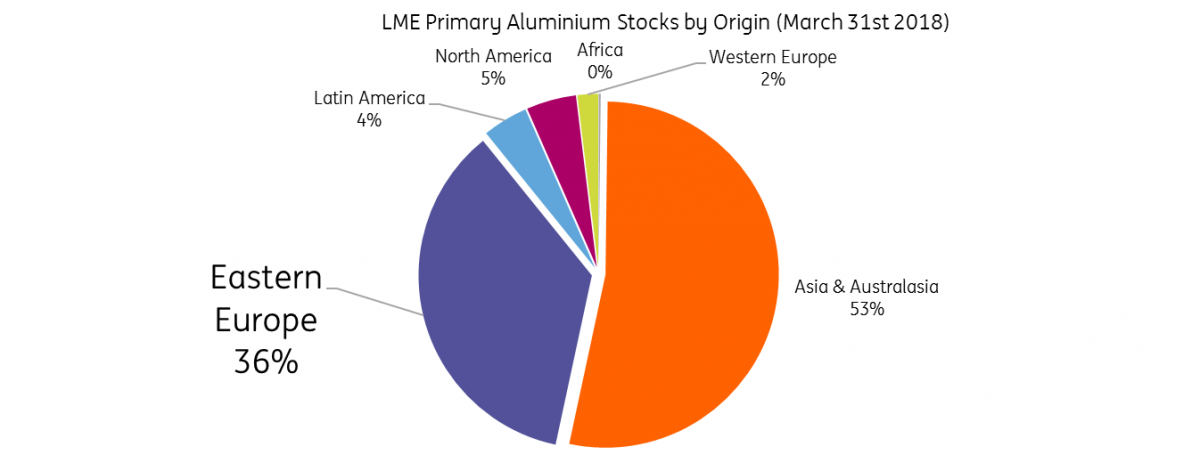

450kt (36%) of LME stock is likely Rusal

LME Stocks by Origin Report (March 31 2018)

Spreads, however, were massively borrowed yesterday. The LME Cash-3M flipped from a contango of $20.5c on Friday to a backwardation of $16b yesterday as shorts were rolled on masse. Market participants are inferring the likely ex-China tightness less Rusal (c.13% of non-China production) to the situation on the LME. Indeed, 18.5kt was cancelled from Port Klang today, likely to be sold for rising premiums.

However, the LME stocks by origin report released today also highlights that 36% or 450kt of stock is Eastern European origin, most likely Rusal. We would be cautious this stock becomes highly available, “free-float” and as it is churned over (repeatedly sold back to the exchange) it has the power to loosen spreads at the front of the curve. Should traders choose to deliver more Rusal stock on to the LME, in absence of premium paying customers, then a further loosening of the spreads and pressure on the LME benchmark could take hold. For now, it’s been quite the ride but note the risks of premium vs LME divergence.

US Premiums Surge as Rusal imports under sanctions (CME Forward Curve, c/lb)

Download

Download snap