Platforms: Bigger, faster, stronger

The extraordinary prospects for platform companies

The extraordinary growth of tech giants

The growth of tech giants such as Google and Amazon has been impressive. Companies such as Uber and Airbnb grew from zero to dominance in only a few years. They all have characteristics in common that make them so called “platform ecosystems” or “platforms” with the core function of facilitating interactions between suppliers and consumers. What explains the rapid rise of some of these platforms? Will the business and consumer worlds be dominated by just a few platform giants and will all non-platform businesses be squeezed out eventually? We'll outline our findings in this article, but do download the full report which you can find towards the end.

A platform and its ecosystem

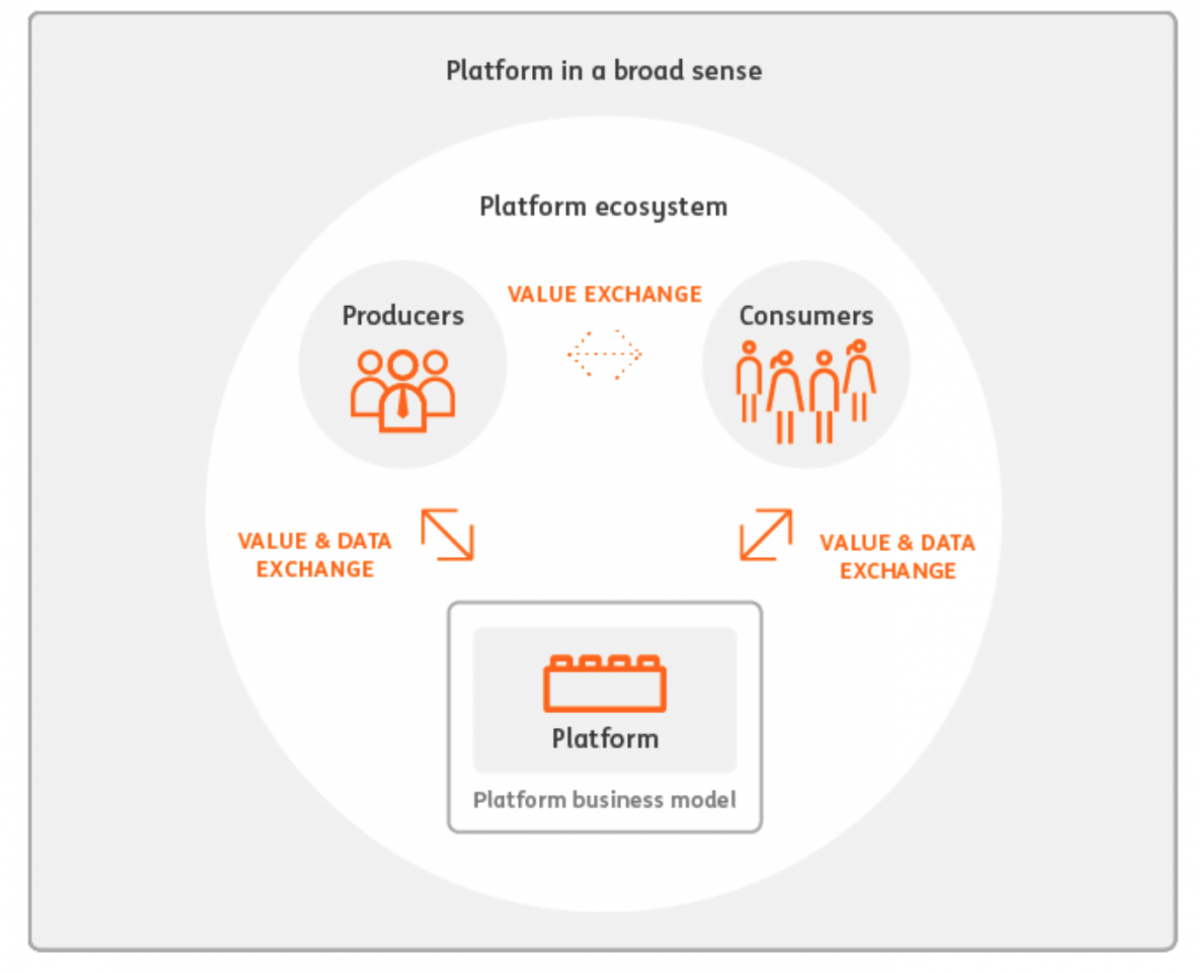

Platforms revolve around interactions between participants in order to generate network effects through the ecosystem. As a result, successful platforms may come to dominate the markets in which they operate.

What is a platform?

Platforms have been around for millennia. They are essentially businesses that bring supply and demand sides together. For example, a local market, where buyers meet suppliers and come to interactions that add value to both, is a platform1. What has been a game changer in the recent decade is that technology has turned non-digital platforms into digital ones. More importantly, a data layer has been added to platforms and is crucial for value creation and for scaling up platforms. It is one of the essential reasons why platforms have become a dominant force in the economy.

The algorithms used can help remove frictions and enable the digital platforms to create value for all parties involved. Data can, for example, be used to match different participants from various sides of the platform. For example, Facebook feeds users with content based on users’ “Likes”. The word “platform” in the strict sense refers to the underlying technical infrastructure. However, in practice “platform” often refers to the combination of technical infrastructure, the platform company itself, the business models and ecosystem.

Platforms' growth to dominance

Platforms have rapidly become an important part of the global economy. Currently, five of the world’s 10 largest listed companies by market cap are platform companies. In the period 2014 to 2016, the revenue of the five largest platform companies in the US grew more than three times faster than US GDP. Several elements help explain their rise: positive network effects, digital technology, high levels of customer engagement and the development of complementarity of goods and services.

Platforms’ ability to curate relevant information from data and to stimulate users to generate new content and data is key to understanding why they succeed in personalising and enriching services. Platforms turn consumers into producers and turn both into value-creating partners. Platforms scale quickly and, as a result of all of that, provide lower cost structures for suppliers’ offerings.

Moving towards more 'platformisation'

These benefits in terms of value created and advantageous price setting suggest that the “platformisation” of the economy will continue. At the same time, we also think that the traditional pipeline business model will also exist. Pipeline companies are less complex and provide owners with more control, and several parts of the economy are not ripe for platformisation. Moreover, pipeline and platform business models can co-exist within companies.

Still, the “underlying economics” favour further “platformisation”. We expect to see more and more pipeline companies adopt a platform strategy. This is likely in the parts of their businesses where value creation can better be achieved by leveraging data and interactions with and between customers, rather than by optimisation of the traditional value chain. We would expect more platform giants to emerge, notably in the area of the Internet of Things.

Looking to the future

With their rapid growth, platforms are profoundly changing the global business landscape. We expect “platformisation” to continue given platforms’ strong benefit in value creation for suppliers and consumers. We also expect to see more and more pipeline companies adopt a platform strategy, and pipeline and platform business models to co-exist in many companies.

Download

Download report"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).