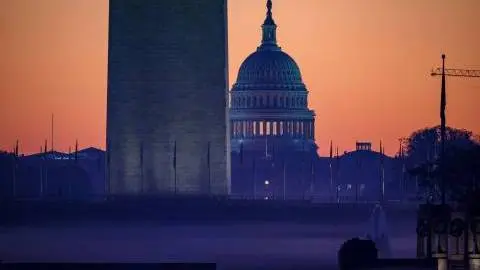

November Economic Monthly: Navigating a sea of waves

Hopes of a 'blue wave' in the US election are giving way to concerns over a second wave of Covid-19 across several major economies. This poses serious challenges for an economic recovery that still has a long way to go

Executive summary

Navigating a sea of waves

− Hopes of a 'blue wave' in the US election are giving way to concerns over a second wave of Covid-19 across several major economies. This poses serious challenges for an economic recovery that still has a long way to go

US: Groundhog Day

− Indications point to a Joe Biden presidency, absent the 'blue wave' that markets had been anticipating. Political animosity means a substantial near-term fiscal support package is less likely at a time when incomes are being squeezed and rising Covid-19 cases mean containment measures are looking more likely. Economic risks are mounting

Eurozone: The second leg of the recession coming up

− The second wave in Covid-19 infections has led to new lockdowns in the eurozone, most probably leading to a fall back into recession in the fourth quarter. With inflation close to 0%, the European Central Bank has announced more policy action in December

Eurozone: a joyless November

− As the second wave of Covid-19 sends much of Europe back into lockdown, we take a look at what you can and can't do in various Eurozone countries

China: Next Five Year Plan starts in 2021

− The Chinese government's views on technology development are the most important feature of China’s 14th five-year plan, which begins in the new year

UK: A turbulent November

− We expect England's lockdown to trigger a sharp contraction in November GDP, albeit perhaps not as steep as we saw back in March/April. Alongside fresh Bank of England stimulus, these tighter restrictions could put additional pressure on the UK and (to a lesser extent) the EU to agree a trade deal over coming days

CEE: Riding the second wave

− The CEE region is feeling the heat of the second Covid-19 wave. But with less severe restriction, the economic hit should be less painful too. We also think there will be less pronounced fiscal and monetary support, as deflation seems unlikely. CEE FX remains a global beta, rather than a local alpha story

FX: Lowering your sights

− FX markets have reacted to news of a much closer US election by selling currencies most exposed to the global recovery story and buying USD and JPY. Certainly, the prospect of at least smaller fiscal stimulus, if not an outright contested election – combined with poor Covid-19 trends – favour more defensive positioning this month

Latam: Post-pandemic challenges

− As the Covid-19 health crisis abates across the region, investors are eager for signals that governments will be able to transition to a more hawkish fiscal policy stance in 2021, amid mounting fiscal concerns

Rates: You think you’ve seen it all? Wait for it…

− Picture what many term the most important US elections in living memory. Frame it within a global pandemic not seen in 100 years. Add massive supply to get economies off their knees to a pervasive dusting of structurally negative rates. And then try to make sense of it all for rates - US rates still look like they want to look upwards, even if they go down first

Download

Download report

5 November 2020

Making waves: Covid-19 and the US presidential election This bundle contains 12 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more