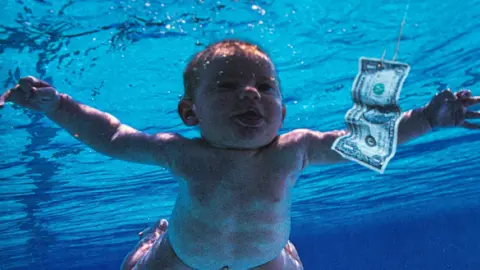

ING’s April Monthly: Hello, hello, hello, how low?

We’re giving a nod to Nirvana this month, one of the greatest rock bands of all time. And the chorus from Smells Like Teen Spirit could certainly be answered by central banks in the coming weeks. The global economy is certainly showing signs of recovery, although we’re far from that ‘perfect place of peace and happiness’ suggested by the name

Executive summary

The 'hello, how low?' question is soon to be answered

Indulge me! It's 30 years since my favourite singer, Kurt Cobain, left this world. And listening to Nirvana's Smells Like Teen Spirit did allow me, among other things, to reflect on where the world is right now. For central banks, the question of “hello, hello, hello, how low?” will be answered by the balance between cyclical upswing and resilience on the one hand and inflation developments on the other. The stronger the growth component, the more significant any disinflation will have to be in order to justify rate cuts.

And while Nirvana tracks were rarely upbeat and uplifting, we are finally becoming more optimistic again about the global economy after a long period of rather depressing forecasts and macro developments. One reason is the ongoing resilience of the US economy. So far, higher interest rates, banking sector turmoil, public debt tensions and student loans have been unable to derail the US economy. This strong resilience combined with signs of reflation is pushing out the timing of a first Fed rate cut even further into the future.

Admittedly, it sounds like the explanation of a sour loser, but we cannot stop pointing to the currently large disconnect between hard and soft macro data in the US. We still fear that the hard data will eventually budge, but until it happens, Fed rate cuts look unlikely in the short term.

A late victory for 'Team Transitory'

In the eurozone, inflation has come down faster than the European Central Bank had expected, giving Team Transitory a late victory, just like an athlete who gets a medal years after the event after the original winner's been disqualified for doping. At the same time, similar to what we are seeing in the US, hard data has turned somewhat more promising than survey indicators. Even in Germany, green shoots came out earlier than expected, a bit like the summer temperatures in early April, reducing the risk of yet another lost quarter.

In the eyes of the ECB, the cyclical upswing should counterbalance the faster disinflationary process, keeping the room - and need - for rate cuts limited. In any case, we are about to witness the almost unique situation where Europe will start a new rate cycle before the US. And not only by one week but by a few months. This, however, is not the result of the ECB suddenly becoming the world’s leading central bank but rather the result of diverging economic trends.

America's exorbitant privilege

But there is more this month than just central banks. Over the past few decades, the US enjoyed the so-called ‘exorbitant privilege’, the benefits the United States has due to the US dollar being the international reserve currency. The term was introduced by former French President Valery Giscard d’Estaing. Next year, the world could see another form of an ‘exorbitant privilege’, and that's the fact that the American elections could have farther-reaching economic implications in the rest of the world, above all Europe, than at home.

Even though Biden and Trump have barely any official policy proposals, we are going to present a first assessment of what the US presidential elections could mean for the US but also for Europe. To keep it short, the November elections could be a game-changer for Europe as a new Trump presidency is likely to bring stagflationary forces to Europe.

For next year, the US elections will not only entertain us but could further deepen the current economic divergence between the US and Europe. Not preparing for every possible scenario could eventually make European leaders feel “stupid and contagious”—wise words from my favourite rockstar.

Carsten Brzeski

Download

Download report

11 April 2024

ING Monthly: Hello, hello, hello, how low? This bundle contains 14 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more