Will house prices continue to rise forever?

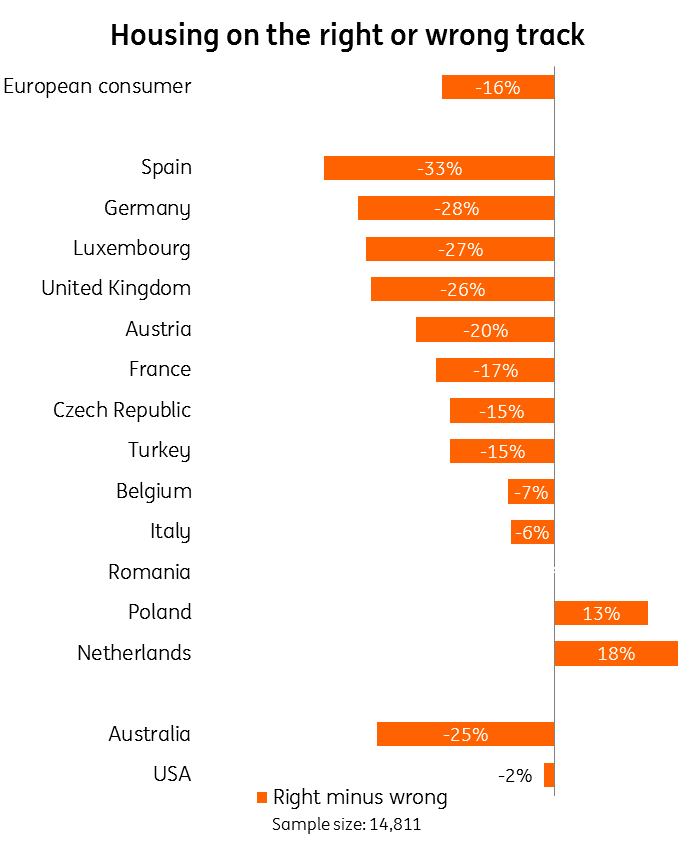

House prices are high, and many expect them to continue rising. Four in ten of those who thought about their housing costs the last time they moved ended up paying at the top end or more than they planned. And one in five find it difficult to pay their rent or mortgage each month, so it’s little wonder that 45 percent in Europe believe housing is on the wrong track.

These are the main findings of the sixth ING International Survey Homes and Mortgages 2017 in which 15,000 people in 15 countries were surveyed.

The story behind the figures

We could argue the toss about these figures. For example, it’s hardly surprising many push their budgets to the limit when it comes to housing, and while one in five find it difficult to pay the rent, that implies four in five don’t.

The history of housing markets is filled with bursting bubbles yet many remain oblivious to the risks.

But this misses the point. There is widespread concern about housing in many countries, and many people appear to be pushing their finances to the limit to get the housing they want or need.

The idea that this occurs only in a few countries could not be further from reality. The survey shows similar concerns in many countries. Arguably the situation is worse in Spain, Germany, Luxembourg, the UK and Australia but better in the Netherlands and Poland. Comments from ING’s economists in many of the countries surveyed suggest these concerns are felt most keenly in larger cities –a opinion supported by an IMF blog post from December 2016.

Caught in a trap

The idea that many people consider housing to be expensive but still expect house prices to continue to rise could be rational. Demand for housing can exceed supply for a long time, especially in the main cities. However, one in three also agrees with the statement that ‘house prices never fall.’ That’s where alarm bells start to ring.

The history of housing markets has many examples of falling house prices - either quickly or on a sustained basis. Yet many appear oblivious to the risks they are exposed to when taking their housing cost to the limit. Those who buy are more vulnerable. Digging into the survey data 45% of those owning a home either outright or with a mortgage bought at the top of or above what they planned. For renters it’s 35%.

But what are people meant to do? Everybody must live somewhere. It appears new houses cannot be built fast enough to meet demand, so housing sets to remain expensive for a long time.

If so, the ability of central banks to raise interest rates may be limited by the ability of households to withstand any further increase in housing costs. But the greater tragedy is that many people’s prospects will remain constrained by high housing costs.

For more Homes and Mortgages trend analysis and other ING International Surveys, visit our sister site eZonomic's here.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).