Sustainable borrowing goes truly global

Borrowing with a sustainability ilk is on a tear for 2021 so far. We note three key nuances. First, USD borrowing is now ahead of EUR borrowing for corporates. Second, US corporates are embracing sustainability-linked loans. Third, a more global sustainable tune is being played for 2021, as the reach extends to Asia, and to some more Latam

Sustainable borrowing is running at 30% up from 2020, and we still have a full quarter to run

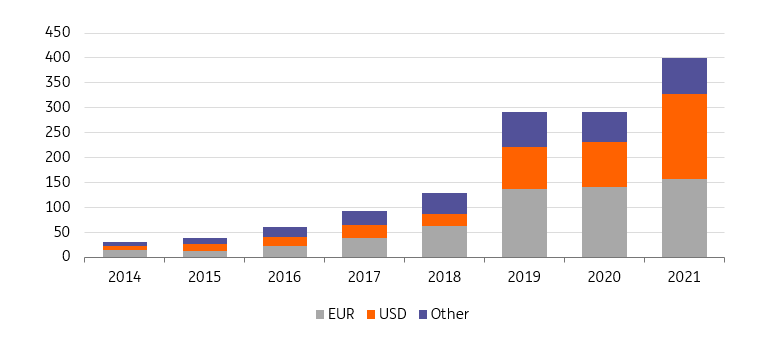

Sustainable borrowing (including green and social) has lept and bounded through 2021, already running at up 30% on 2020, and there is still a quarter to run. Strikingly, the proportion written in USD is well up. It accounts for 36% of total issuance, eating into the typically dominant proportion done in EUR, which is running at a still impressive 44% of total issuance. As is typical, a decent rump of this USD issuance is done by non-US players, but US domiciled players have also shown an increased representation, with the proportion done by such players running at 19% of the global total, which is up on last year.

The corporate space is where the dynamics are interesting, especially on US sustainable-linked borrowing

USD-denominated borrowing accounted for 43% of overall borrowing, knocking EUR-denominated borrowing into second place

The standout numbers come from corporates though, on a number of fronts. First overall sustainable borrowing by corporates on a global scale is already running at up 37% on the full 2020 numbers. Second, and perhaps even more remarkable, is that USD-denominated borrowing accounted for 43% of overall borrowing, knocking EUR-denominated borrowing into second place. For corporates, the USD has been the currency of choice for their sustainable issuance for the first time since 2015 (when overall sustainable issuance numbers were a fraction of what they are today).

It's not usual for USD-denominated issuance to dominate in the wider world of bonds, but to have it overtaking EUR-denominated sustainable issuance is relatively novel. Tighter spread into US yields may be one factor, but we feel it is more reflective of an upping in the representation of US corporates and other non-eurozone corporates generally.

Corporate sustainable borrowing (USDbn)

Indeed, US corporate sustainable borrowing has jumped this year, running at 26% of global issuance, compared with 16% of total 2020 issuance. Clearly there has been a step up in interest in sustainable financing from US corporates, in tune with an increased volume of sustainable-related conversations.

The bulk of the incremental US sustainable borrowing has been in loans (as opposed to bonds), and the bulk of this has been sustainability-linked loans

When we look at the breakout of borrowing between loans and bonds there is an additional important nuance. The bulk of the incremental US sustainable borrowing has been in loans (as opposed to bonds), and the bulk of this has been in sustainability-linked loans. In fact these have mushroomed from practically nothing in 2020 to in excess of USD50bn in 2021 so far. From accounting for 3% of sustainability-linked borrowing in 2020, US corporates have accounted for 28% of sustainability-linked borrowing so far in 2021. The Euro market continues to dominate here overall, with USD88bn of borrowing done EUR-denominated, or 48% of overall issuance. But it is clear that this segment has caught the ear of US corporates.

Sustainable-linked loans have become a nice entry point into the sustainable borrowing space for many US corporates

Indeed, sustainable-linked loans have become a nice entry point into the sustainable borrowing space for many US corporates that have an interest in growing in this space. Most corporates have revolver facilities, and adding a sustainability-linked portion to the loan portfolio presents a soft step in the direction of doing more business in this area in the future. It can in fact be a lead into future sustainable issuance through bonds, as a next logical step, and especially should the sustainability linked loans prove a welcome addition.

It is possible that this ballooning in sustainability-linked borrowing has cannibalized other sustainable routes for US corporates. But we think this is a minor effect, or at the very least a short term one. On most other measures US corporates have kept the pace with the overall uptrend in sustainable borrowing. For example, overall US sustainable bond issuance (so, excluding loans) is running at USD34bn year-to-date, which is up 30% on full year 2020. This magnitude of increase is in line with the overall increase in sustainable issuance between this year so far versus last year as a whole. Indeed, we find that Euro corporates are seeing a similar proportional expansion in sustainable bond issuance through 2021 so far, running at up a tad over 30% versus full year 2020.

There is also a truly global dimension on ESG bond issuance, with Chinese corporates featuring

Notable jumps in sustainable bond issuance from China-domiciled corporates

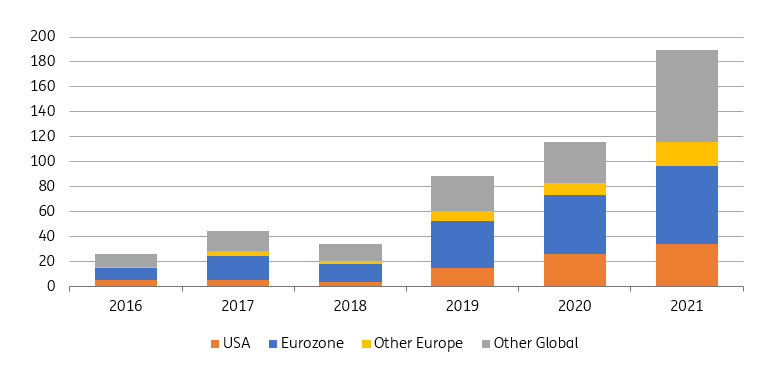

The big expansion in the global corporate bond issuance has in fact been from non-US and non-Eurozone corporates. Notable jumps in sustainable bond issuance from China-domiciled corporates drove this (actually through green bonds), along with leaps in sustainable bond issuance from South Korea and UK-domiciled corporates.

Corporates outside of the US and the eurozone saw more than a doubling of sustainable bond issuance in 2021 year-to-date versus 2020 as a whole. In fact, this bucket is not only running at double the size of US corporate sustainable issuance, but is also running at above the size of eurozone sustainable corporate bond issuance. The likes of Mexican, Japanese and Swedish corporates are some of the other key players in this non-US / non-eurozone bucket.

Corporate sustainable bond issuance by region (USDbn)

A related outcome here is that the currency of choice for global corporates issuing bonds in the sustainable space has been the USD in 2021 so far, accounting for 38% of corporate issuance. That’s up from 35% in 2020, while EUR-denominated issuance fell from 41% in 2020 to run at 33% in 2021 so far. And issuance in other currencies has also risen, dominated by a jump in CNY-denominated issuance (from a USD equivalent of 5bn in 2020 to USD25bn in 2021 year to date).

Lots of moving parts, with US and Chinese corporates stepping up the pace

The dominant outcomes here centre on an ongoing acceleration in sustainable borrowing generally. Within the corporates sphere, there has been a significant build in use of sustainability-linked loans among US corporates, from near zero to quite significant. And the emergence of Chinese corporates as sustainable bond issuers is significant (see more on this space here). In addition, the wider sustainable market currency of choice for corporates as a whole has morphed to USD (from EUR, which is still a close second best). It may prove temporary, but it also signals, in a way, a more normal outcome, where USD-issance tends to dominate on a wider scale beyond sustainability. And there is more on the pivotal Euro backdrop here and on supply here.

From a US perspective, pace is being kept with the growth elsewhere, with a significant positive impulse coming from sustainability-linked borrowing, while US corporate ESG bond issuance is broadly keeping pace with the growth in aggregate sustainable bond issuance.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

SustainabilityDownload

Download opinion

29 September 2021

Sustainability: here comes the hard part This bundle contains 8 ArticlesAuthors

Padhraic Garvey, CFA

Padhraic Garvey is the Regional Head of Research, Americas. He's based in New York. His brief spans both developed and emerging markets and he specialises in global rates and macro relative value. He worked for Cambridge Econometrics and ABN Amro before joining ING. He holds a Masters degree in Economics from University College Dublin and is a CFA charterholder.

Padhraic Garvey, CFA

Coco Zhang

Coco is based in New York, where she covers environmental, social and governance (ESG) topics, typically with a US flavour. Prior to joining ING, she worked at Eurasia Group. Coco holds a dual master’s degree in energy and the environment from Columbia University, and in international public management from Sciences Po Paris.

Coco Zhang