Russia: thinking progressive taxation?

The Russian government is reportedly considering exempting employees earning below the subsistence level from paying income tax. This could ease some tensions in the lower-income regions but would create the risk of tax evasion. This is far from being a base case scenario, but it confirms the preference to use budget tools to boost income

According to media reports, the Russian government may soon start discussing changes to household taxation, exempting employees with after-tax earnings below the subsistence level from paying personal income tax. This is currently collected by the regional budgets from Russia's entire 73 million employees at a uniform 13% rate. Official representatives of the presidential administration have implied that such discussions, if any, are at very early stages, and it is too soon to consider a shift from the uniform taxation regime as a base case scenario. Nevertheless, we believe some preliminary comments on the potential impact of this reform on the Russian macro picture are worth making.

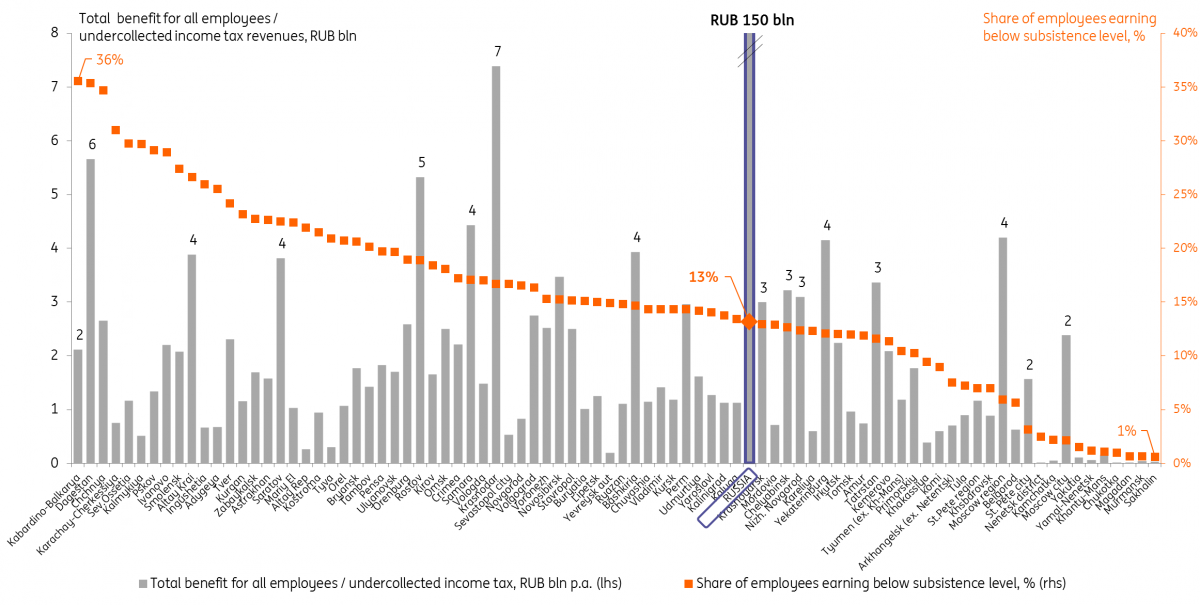

13% of Russia's employees (9.5 million out of 72.6 million) are earning below the subsistence level. Our estimates are lower than the preliminary numbers quoted by the media (15%, 11 million people, based on a top-down Russia average distribution of salaries and subsistence level) as we use bottom-up regional statistics accounting for a wide range of subsistence levels (RUB9.1-22.1k) among Russia's 85 regions and other independent administrative units.

The reform would favour less economically developed regions. The share of employees earning below the subsistence level is above average in 53 regions and may reach 36% in extreme cases, such as the North Caucasus republics, which also might have a higher share of grey income. The population of these republics and other regions lagging in economic development are set to be the main beneficiaries of the reform, should it take place. The below average share of 'poor employees' present in the remaining 32 regions, which include the largest cities, oil-producing regions, and the Far East, with the lowest share recorded at just 1%. These regions can be considered more economically advanced and are unlikely to be materially affected by the reform.

The overall direct financial effect of the reform would be RUB150 billion per annum, or just 0.3% of households' personal income, or 0.4% of the consolidated budget revenues, assuming no artificial lowering of the officially reported pre-tax salaries by the employers to stay within the official subsistence level. As can be seen, the outright macro implication of the tax reform is minuscule, but it would create a number of risks related to regional administration of official subsistence levels and potential tax evasion. We see this as the main argument against the implementation of the reform in its current configuration.

Potential impact of exempting income tax for employees earning below subsistence level (assuming no tax evasion) per region

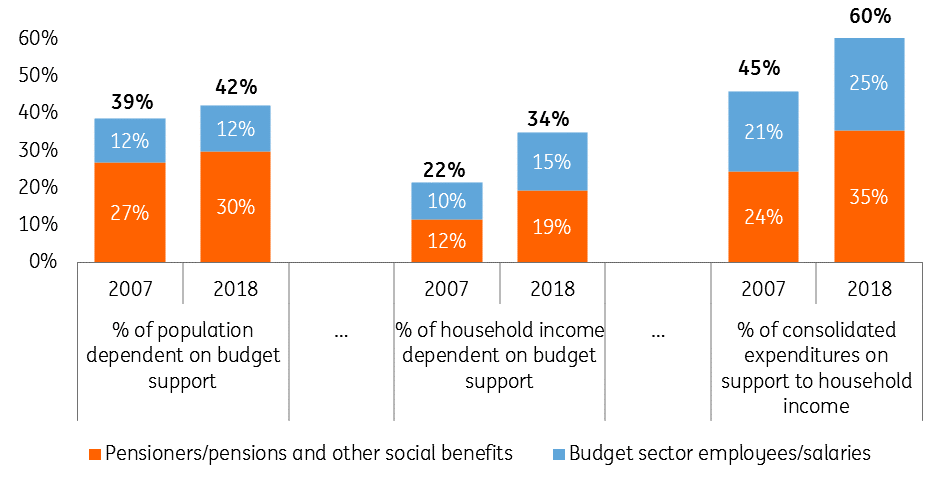

Supporting household income through budget spending is a more plausible scenario. We take this tax proposal as a way to address the weakening of consumption growth and some pressure on the popular support evident since 2018 following the increase in the retirement age and the VAT hike. However, the total direct taxation of households is around 4% of GDP (including total personal income tax collection of 3.5% of GDP), which is low by global standards and suggests little room for reduction. At the same time, state expenditures are a more likely tool that could be used to support households. As a reminder, earlier this year the president announced a list of targeted social measures, costing an additional RUB100-120 billion per year, supporting the overall trend of the growing dependence of household income on the budget policy. We do not exclude that additional spending packages could be announced going forward in case of continued pressure on income growth and popular savings support. Given the current stronger budget execution (RUB550 billion surplus in 1Q19 vs. RUB350 billion consensus, National Wealth Fund set to hit 7% GDP this year, budget breakeven at a 10-year low of US$50/barrel) the Finance Ministry is likely to see increased external pressure to ease budget policy in the coming years.

Social focus of the Russian budget spending

Download

Download opinion18 April 2019

In case you missed it: China to the rescue? This bundle contains {bundle_entries}{/bundle_entries} articles

Dmitry Dolgin

Dmitry is a Chief Economist covering Russia and CIS countries. He joined ING in 2018 and has a decade of experience in macroeconomics and FX strategy with Alfa-Bank and Gazprombank. Dmitry graduated from the Lomonosov Moscow State University and has also studied at the Plekhanov Russian University of Economics and ESSEC Business School.

Dmitry Dolgin

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more