Slower speed, tighter control for European road haulage

Following a correction of elevated spending on goods, European road haulage is set to see some pick-up in 2024. However, economic stagnation is curbing the upward potential for volume and investments. In turn, cost control will be plunged into the spotlight – and sustainability will also become a more crucial part of the deal

Pandemic aftershocks and economic headwinds send good flows down

Road haulage companies may have reaped the benefits of strong demand combined with limited transport capacity in recent years – but it now looks as though the tide has turned. Consumers started to shift spending back to services, which led to aftershocks in demand. At the same time, international trade flows face the impact of the economic slowdown, war-related sanctions, and geopolitical tensions. This has sent throughput figures in the seaports of Rotterdam, Antwerp-Bruges, and Hamburg down 6% over the first three quarters of 2023, alongside lower hinterland traffic. In turn, road transport volumes have been pushed into negative territory and made some haulage companies active in manufacturing to temporarily idle capacity, which has been rare for years.

European road transport heading for mild recovery in 2024

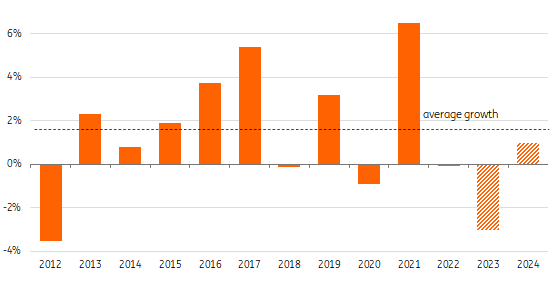

Evolvement of European road transport volume in million ton/km, in % y.o.y.

The sluggish transport demand is reflected in German truck mileage volume, which was down some 3.5% up to October 2023 year-on-year. While the weak performance of the German economy, in particular, has weighed on this figure, it also paints the broader European picture as one of the larger players (as Waberer’s also indicates). Competition from Ukrainian drivers on the Polish and Slovakian border also signals current market weakness.

In the run-up to 2024, the European Purchase Managers Index for manufacturing (PMI) still signals a decline (+link), and the significant impact of the sharp interest rate rises is yet to follow. This all leaves the outlook for 2024 rather bleak. Nevertheless, we expect a return to slight growth as the comparative base of 2023 is low, the normalisation of retailer stocks is completed ,and ordering should begin to pick up.

Transport costs continue to rise while pressure on freight rates returned

European haulage companies face a challenging combination of continued rising wage costs (covering up to 50% of the cost bill) and a deteriorated tariffs outlook. Spot rates dropped below contract rates over the course of 2023. Lower fuel costs (accounting for some 20-25%) tempered total costs, but many carriers have hedged diesel price risks in contracts. CO2 pricing also starts off in Germany, which significantly raises charges (see below). All in all, keeping margins up is set to be more difficult.

As soon as demand recovers, structural capacity and available supply of drivers may again prove tight. Therefore, some shippers may also consider securing long-term availability and value sustained relationships with haulage companies, which may help in re-contracting.

Diesel prices eased from peak levels while volatility continues amid geopolitical tensions

The European road haulage sector has a number of large international trucking companies – such as Girteka, Warberer’s, Primafrio, Raben and Vos Logistics – but the far majority are still small and medium sized companies. In the Netherlands, larger trucking companies are getting bigger, and more drivers are also starting their own companies. Amid more challenging market conditions, the sector could also see more acquisitions in 2024. Scale also becomes more important in order to effectively keep up with and progress further in both digitalisation and sustainability (fleet and reporting).

Truck driver shortages won’t disappear

Truck driver shortages in road transport have become a serious supply constraint over recent years. The setback in transport demand has brought relief, but larger shortages are likely to return quickly and resume their upward trend. The incentive for driving international trucks has also dropped among Westerners, as they're able to earn similar wages in other jobs.

So, what are the main reasons that shortages could be here to stay? There are a few key drivers to note:

- The labour force ages, and this pushes up outflow. Currently, most European truck drivers are aged around 44, and 21% are older than 55.

- The availability of potential workers in the EU and Central and Eastern European countries is becoming increasingly limited. Workers also have more alternative options for earning similar wages elsewhere.

- New generation truck drivers prefer shorter working hours and weeks. Many are reluctant to spend weeks on the road and away from family.

Another ongoing constraint remains the relatively low representation of women in the sector. In order to attract drivers, larger transport companies have already turned to regions outside of Europe, such as Asia. Many forward-looking larger companies continue to hire and educate a flow of truck drivers through the cycle.

Short term investment climate under pressure

Following a slowdown in transport demand, economic headwinds and higher interest rates, the investment climate has clearly deteriorated. But delivery times have improved, and transport equipment is also more accessible now. Still, there remain both positive and negative drivers for investment.

The positives

- Delayed investments and an ageing fleet both create an underlying solid demand for the replacement of transport equipment. With trailers, this is less prevalent due to longer life cycles and a slower pace of technological renewal and greening.

- Efficiency improvements provide an incentive for carriers to invest. New generation models of trucks – such as the DAF, XF and XG models – are typically 10%-15% more fuel efficient than the previous generation.

- Increasing policy pressure to decarbonise transport in Europe will support investment activity. Manufacturers started to produce electric trucks in series, and retail clients across Europe will aim to start deploying them.

The negatives

- Sharp rises in interest rates – between 1 July 2022 and 1 October 2023, the Euribor monthly interest rate rose rapidly from -0.5% to almost 4%, which has lifted borrowing costs.

- Softened transport demand reduced the urgency to invest.

- Prices of new equipment have risen sharply and have not dropped materially. Electric trucks are also still much more expensive to buy.

The shortage of drivers still limits companies' ability to grow in some cases.

Sustainability regulation progresses, with multiple focus points on the road to 2030

On the road to 2030, a range of new regulations are set to come into force which will sharpen the focus on sustainability for investments in transport equipment. CO2 pricing will be introduced for the first time, and CO2 reporting should provide a push for large corporates and manufacturers to produce zero-emission vehicles.

Multiple new sustainability-linked regulations upcoming for truck manufacturers, hauliers and shippers

Emissions pricing enters road transport sector for the first time in Germany and changes market dynamics

The emissions profile of transportation is becoming increasingly important. Taking the lead in Europe, Germany will put a price on emissions from 2024 by including the costs in the road mileage charging (MAUT). This pushes up transport rates for EURO VI heavy duty 5 axles truck and trailer combinations by almost 16 cents per kilometre to just under 35 cents per km, resulting in an increase of over 80%. The cost increase benefits the business case for electric vehicles but could also lead to a modal shift to rail in specific long-distance cases.

On a European scale, the road transport sector will be submitted to the Emission Trading System (ETS) from 2027. This means that moving forward, companies will need to buy carbon allowances to compensate for emissions.

The European Mobility Package storm has calmed

The European Commission's Mobility Package and the introduction of rules surrounding the return of vehicles to member states have generated much discussion and raised questions over efficiency. Throughout 2023, however, we've seen much of the debate begin to die down. In practice, the impact of these changes appeared to be almost non-existent – and in November, it also emerged that the European Court of Justice would likely cancel the highly disputed return home vehicle element. A repeal would offer trucking companies greater flexibility in optimising the deployment of internationally operated trucks (often registered in Central and Eastern European countries). As a result, we could begin to see increased efficiency gains, although larger companies have also adapted.

Cabotage rules are also more restrictive under the Mobility Package, which does show in transport activity. The cooling-off period of four days makes cabotage (max. three domestic rides in a seven-day time frame following an international ride) less attractive. As a result, total cabotage in the EU fell to 4.5% from 4.9% in 2022. The new rules are particularly relevant for Germany and Belgium, with cabotage levels doubling Europe’s current average.

Download

Download opinion

7 December 2023

A greener future ahead for truck and trailer markets This bundle contains {bundle_entries}{/bundle_entries} articles

Rico Luman

Rico Luman is a senior sector economist with a focus on transport, logistics and the automotive industry. He also looks at ports economics and mobility in general. Formerly he worked as a credit analyst and joined ING in 2001. Rico studied economics as well as law at the University of Amsterdam.

Rico Luman

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more