Following the collapse of Silicon Valley Bank, where do the risks lie for small banks?

We examine the genesis of the gap between bank deposits and loans. Small bank loan books represent a greater proportion of deposits relative to large banks. This is fine and quite different to Silicon Valley Bank. The outsized exposure of small banks is in commercial real estate, so it's better to keep an eye on that than worrying about a deposit flight

A few weeks ago there was concern about a material deposit flight from small banks. A deposit outflow of some US$200bn occurred in the space of a couple of weeks, representing almost 4% of small bank deposits. But the good news is these outflows seem to have stopped, as last week saw a small build in deposits at small banks. The other sliver of positivity comes from the flat-lining of the take-down of emergency liquidity from the Federal Reserve, now in the area of $350bn. So we’re in a holding pattern, which is a tolerable outcome so far.

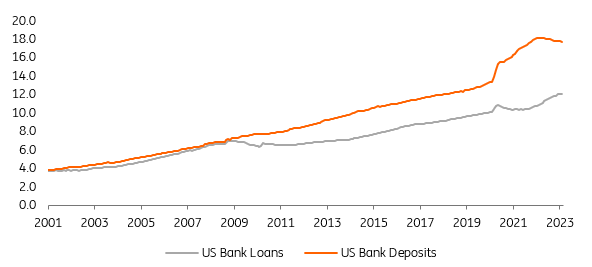

As we pan back and examine the balance sheets of US banks, a number of unusual circumstances jump out. First, US bank deposits are significantly higher than their loan portfolios. This is unusual in the sense that commercial banks take in deposits primarily to write loans against them, thereby benefitting from the difference between the deposit rate and the lending rate. It’s clear from the graph below that a significant change occurred as a fallout from the Great Financial Crisis, where on the one hand considerable consumer deleveraging occurred, and on the other the Federal Reserve expanded its balance sheet, pushing significant liquidity into the system through its bond-buying programme.

US bank deposits as a base from which to write loans (US$ tr)

The Covid-19 pandemic saw a repeat of this. There was the impact of re-leveraging in the corporate sector as loans were taken down to help build cash positions. On top of that, the Federal Reserve and the Treasury boosted liquidity conditions at a multiple of the pace seen during the GFC, manifesting in a significant build in bank deposits. Such was the rise in deposits that by the middle of 2021 the large banks had loan books that were only 55% of their deposit base. This was a remarkable state of affairs, as typically the loan portfolio has been 90% or higher as a proportion of the loan book. Theoretically, it should be at around 100%, with any deviation taken up by the purchase of securities, which from the point of view of the bank is effectively the same as writing a loan.

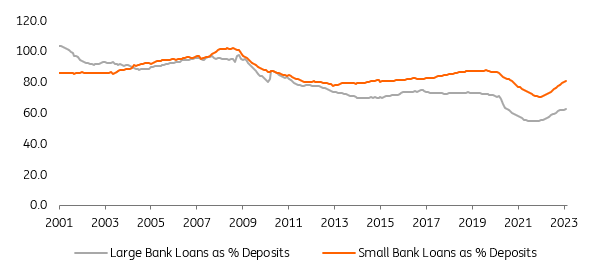

Small banks have more loans versus deposits than large banks (%)

That proportion (of loans to deposits) has since risen to moderately above 60%. Silicon Valley Bank had a ratio of loans to deposits of 43% and thus was significantly out of kilter relative to typical banks. Its securities portfolio was a remarkable 68% of deposits, and it was the reduction in the market value of this portfolio that added to consternation as demands were made to withdraw deposits.

And what about small banks? Well, the good news here is that the ratio is far higher – currently, loans account for about 80% of deposits. The ratio of loans to deposits is in fact far more lopsided among the large banks. Importantly, the typical small bank looks nothing like Silicon Valley Bank on this particular metric.

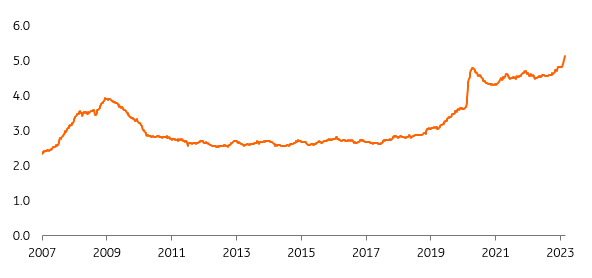

How do we square the circle here? Basically, the excess of deposits over loans is a consequence of the expansion of the balance sheet of the Fed, and the counterpart of this can be found in banks’ excess reserve holdings at the central bank. These are renumerated at the fed funds rate plus 15bp (currently 4.9%). Banks can then pay deposit holders at a rate below this to ensure they achieve a suitable net interest margin.

Money market funds have seen significant inflows (US$ tr)

Some players had been careful to take deposits out of the banks, moving funds into money market funds to get a better running yield (closer to the 4.9%), well before the recent banking troubles. The demise of SVB gave this an additional push, so much so that in the past few weeks some $300bn of new money has piled into money market funds.

This does not look like it's becoming a rout. It’s more a measured allocation shift where feasible and sensible. It should not really “threaten” the banks. But we still need to monitor it.

Where does this leave the risks for small banks?

Currently, small bank deposits have stabilised following an initial fall. Some 80% of those deposits show up as loans. So the exposure to bond portfolios for small banks is less the case than for large banks. As noted, Silicon Valley Bank had quite a large bond portfolio, which was a problem if mark-to-market (although it did not actually have to be). In that sense, SVB is actually not representative of small banks, at least as typified by this measure. In any case, such security portfolios are now fully liquefiable at the Fed. We can, or should, relax on this front. A deposit flight is unlikely to happen just for the sake of it. And in any case, deposits are impliedly protected, at least for now.

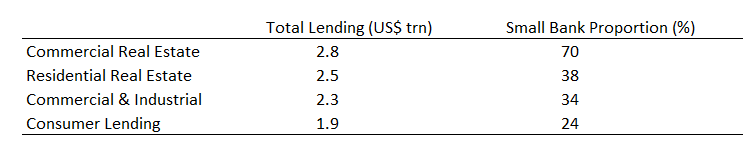

The breakout of lending, and small bank exposure to commercial real estate

What about lending books?

The large banks have bigger lending books, both proportionally and in an absolute sense, in residential real estate, commercial and industrial and consumer loans, meaning hits here (should they occur) are less impactful for small banks.

The area where we need to pay attention is small bank exposure to commercial real estate, primarily as they account for some 70% of total lending in this segment; a remarkable statistic that clearly identifies where the real vulnerability may lie. And the post-pandemic implications in this space have yet to be fully played out.

These proportions will change from institution to institution, and some will in any case be stronger and capable of taking more hits than others. But this is the space to watch carefully ahead.

Padhraic Garvey, CFA

Padhraic Garvey is the Regional Head of Research, Americas. He's based in New York. His brief spans both developed and emerging markets and he specialises in global rates and macro relative value. He worked for Cambridge Econometrics and ABN Amro before joining ING. He holds a Masters degree in Economics from University College Dublin and is a CFA charterholder.

Padhraic Garvey, CFA

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more