Bitcoin: Is there a link between its hype and FX markets?

The crypto-debate is really about people, networks and trust and the hype in emerging markets suggests that double-digit inflation and FX volatility could be the real drivers

Decoding the crypto-conundrum

Although economists are still learning about the demand function for cryptocurrencies, there is a reason why the debate can get heated. The crypto-debate is not really about innovation, technology, finance or money. Instead, it’s about people, networks, and trust.

In the age of digital information and social networks, prices hardly match the unit cost of production. Digital products typically require substantial costs in research and development, but marginal costs to service one additional client are often zero. Consequently, the cost of servicing only a few customers is high but as the number of users reaches a ‘critical mass’ costs spread out, and the product is then driven by what is called the 'bandwagon effect' of positive feedback-loop from the customer base.

Let’s now apply this concept to bitcoin for example. If we take a closer look at its price action, we see a strong co-movement with its popularity on Google Trends since its inception.

Bitcoin's 'hype' and the 'critical mass'

Even though we don’t know if the ‘hype’ was driving the price or the price was driving the ‘hype’, the relationship is quite telling - although it does seem to have broken down more recently. Equally, the same dynamics seem to apply if we zoom into a typical emerging market like Nigeria.

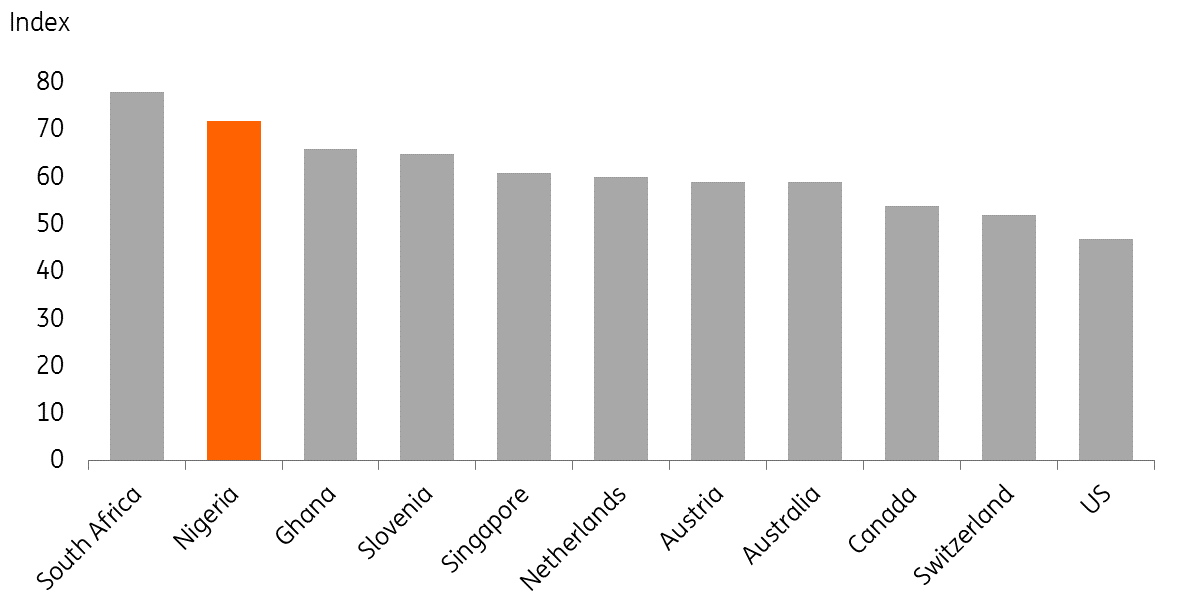

The country has experienced one of the strongest 'bitcoin hype’ waves since the inception, only surpassed by South Africa. Textbook economics suggests this isn't surprising. Countries which have less efficient payments systems, less liquid currencies and more volatile exchange rates are in theory more likely to see a surge in demand for alternative payments system.

Bitcoin's popularity by country 2014-18

This also resonates with our ING International survey, where around half of the people surveyed in Turkey and Romania consider digital currencies such as bitcoin to be the future of online spending. It should be even less surprising in an environment where headline inflation runs above 10% while food price inflation – which accounts for more than 50% of the headline basket – has been above 19% year on year, according to the IMF.

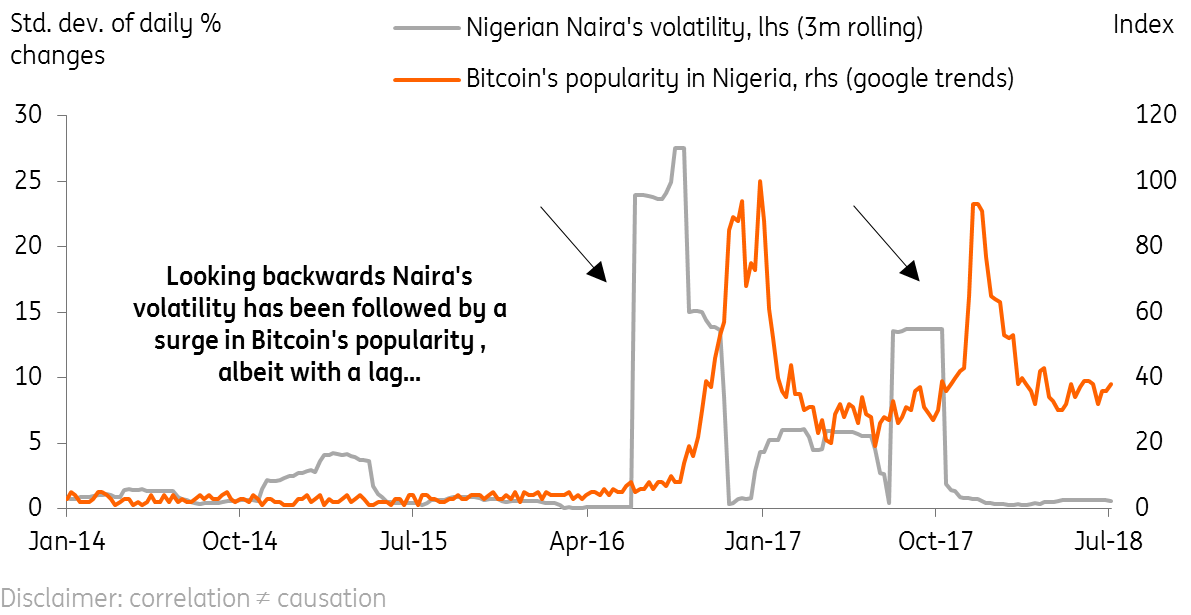

Furthermore, the ‘bitcoin hype’ seemed to have moved in sync with the volatility of the Nigerian Naira: when the volatility of the currency went up, the ‘bitcoin hype’ also went up - albeit with a lag of a few months.

Bitcoin and Naira’s volatility

Therefore, we think that in a typical emerging market environment, the cryptocurrencies’ hype might reflect the demand to diversify risks posed by double-digit inflation and FX volatility. Ultimately, it's worth noting that according to the Financial Stability Board crypto-assets don't pose risks to global financial stability as their combined market value remains less than one percent of global GDP, at least as of March 2018.

For this reason, we don’t think the link between bitcoin's hype and the FX markets is as strong as the data might suggest. Having said this, we think that applying the mechanics of network analysis to gauge the demand of cryptocurrencies is a good place to start.

Download

Download opinion27 July 2018

In case you missed it: From ‘foe’ to friend? This bundle contains {bundle_entries}{/bundle_entries} articles

Carlo Cocuzzo

Carlo is an Economist at ING and has been with the firm since January 2016. He is mainly interested in the future of banking, blockchain and virtual currencies. He began his career at Barings Asset Management and holds an MSc in Economics.

Carlo Cocuzzo is no longer part of the ING THINK team

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).