3 Central banks cut 110bp yesterday - who’s next?

It's all kicking off in Central Bank space with three cuts yesterday from the Bank of Thailand, Reserve Bank of India and the Reserve Bank of New Zealand. Pressure must be building on BSP Governor, Diokno, to deliver more than 25bp today, and the ECB too after dreadful German production figures raise spectre of recession. The Fed won't be far behind…

But is this actually good news?

Yesterday could hardly be described as "yet another day in the office".

We started off being surprised by the RBNZ move. I think it is fair to say that no-one saw 50bp of easing coming. We were even thinking of chopping our rate cut call altogether - here is our longer view. We then moved on to disappointment, that the RBI did not pause, mixed with bemusement at the 35bp easing. I love the tweet from Lorcan Roche Kelly (see below) which offers an excellent if tongue in cheek answer as to why this odd number.

We switched to elation later on, as the Bank of Thailand finally delivered 25bp of easing, and was probably the only move of the day that was fully justified. I might add, it would not have upset us to see 50bp of easing from the BoT, nothing from the RBI and only 25bp from the RBNZ - that is, if our job was to forecast what central banks "should" do (we do stray into that territory from time to time), not what they will do.

BSP today - 25 or 50bp?

Yesterday's CB action puts pressure on Philippine Central Bank Governor Diokno to deliver more than the 25bp of easing priced in by markets. He has already suggested that there will be 50bp of easing before the year-end. but that view may have lengthened after yesterday.

The main thing that may dissuade him would be the PHP, which has been in the vanguard of EM currencies hit by recent market turmoil kicked off by China's relinquishing of the USDCNY 7 level. So 25bp is the more likely outcome, but let's not rule anything out. See Nicholas Mapa's thoughts following recent Philippine inflation figures. GDP data out this morning may add to the debate if they come in on the weaker side.

Will the Fed get in on the action?

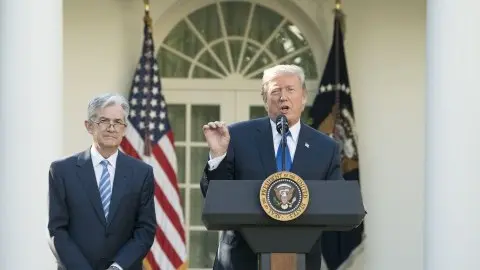

It seems that all this rate-cutting is making President Trump jealous he does not have such an acquiescent central bank. Well, we think he does, he just needs to be a bit more patient. James Knightley has just added another cut from the Fed to our house forecast - that's on top of the September cut we had in before. Just for the record, they have already finished quantitative "tightening" though the term is a horrible misnomer. No time for a rant on that today - and it's only a few days since I last let rip on this subject too.

I told you commodities were looking miserable

While I am peppering today's note with tweets, I might as well add one from our Head of Commodity Strategy, Warren Patterson, who more eloquently summed up my clumsy observations on commodities in yesterday's note with this simple tweet...

Back to the matter in hand

This has rather taken me off track from whether any of this is good news or not. Equities have bounced a bit overnight, though in Asia the futures markets look a bit mixed. Good, I think that for once, this is an appropriate response. Yes the prospect of further easing does help the discounted cash flow calculations for equity valuation purposes, but it only makes sense to rally every time a central bank hikes if you don't change your earnings outlook, and that is the point that Warren's commodity chart is screaming loud and clear - the global demand backdrop is clearly slowing.

As for whether it makes sense to front-run or over-deliver on monetary easing - there are many conflicting arguments here, and the answer is partly dependent on what you think the demand outlook really is, the prevailing very low level of interest rates and bond yields, and the absence of much fiscal support. We could spend all day on this, which really means - it isn't obvious.

ECB?

It won't surprise anyone that we are looking for a return to incremental easing from the ECB in September. Yesterday saw some squalid production figures from Germany that suggest GDP growth may have now turned negative. This may not be the time for half-hearted measures.

But with all this monetary easing going on, the principle currency pair - EURUSD, seems relatively stable at about 1.12. If this was a tug-of-war between the ECB and Fed, they both seem fairly evenly matched right now. Currency wars really are a zero-sum game.

Asia today

Two other main events to watch today - both of them China-related:

- Yesterday's CNY fix at 6.9996 indicates that we should expect a 7 - something fix today. That would be the first in a very long time, so watch out for the market reaction to that. Hopefully quite modest.

- Chinese Trade data - Exports figures could look quite soft, and of course, this is pre-new tariffs, so whatever we see today, might not mark the low point.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion

8 August 2019

What’s happening in Australia and around the world? This bundle contains 14 Articles