United States

Bundles8 March 2018

Trade war: What is it good for?

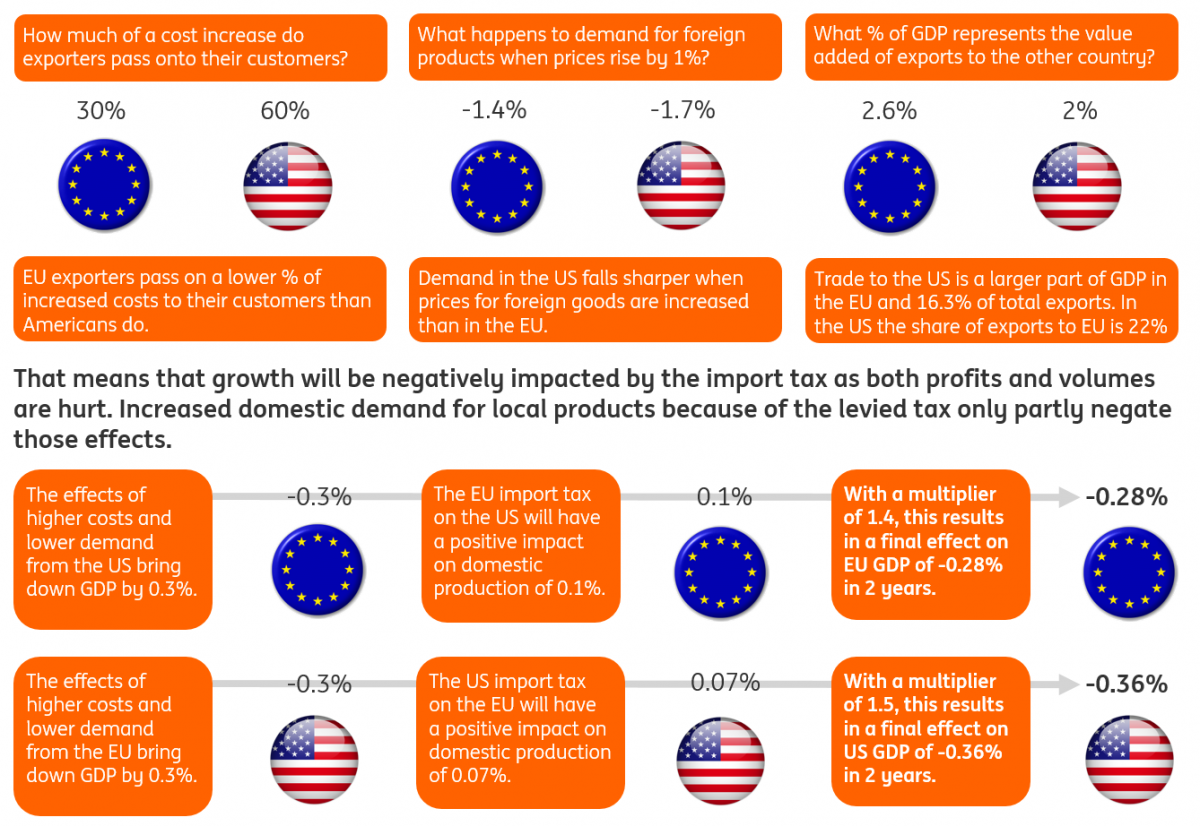

President Trump is today expected to authorise new tariffs on steel and aluminium imports. While the details remain unclear, global trading partners are already considering retaliatory measures, sparking concern about a full-blown trade war. Here's everything you need to know

|