Why this Fed meeting won’t be a non-event

Downgrades to the infamous dot diagram could complicate Yellen's efforts to convince markets they are too complacent

Wednesday's meeting: ignore at your peril

This week's FOMC meeting may not be the non-event that many in the market are seemingly viewing it. While the long-awaited announcement of the Fed's balance sheet unwind will be the main event, there will be keen interest in the new official forecasts. These may be used to reinforce the message that, while there is little need for aggressive interest rate hikes, the market remains too complacent on the prospect of higher interest rates.

Don't rule out a dots downgrade

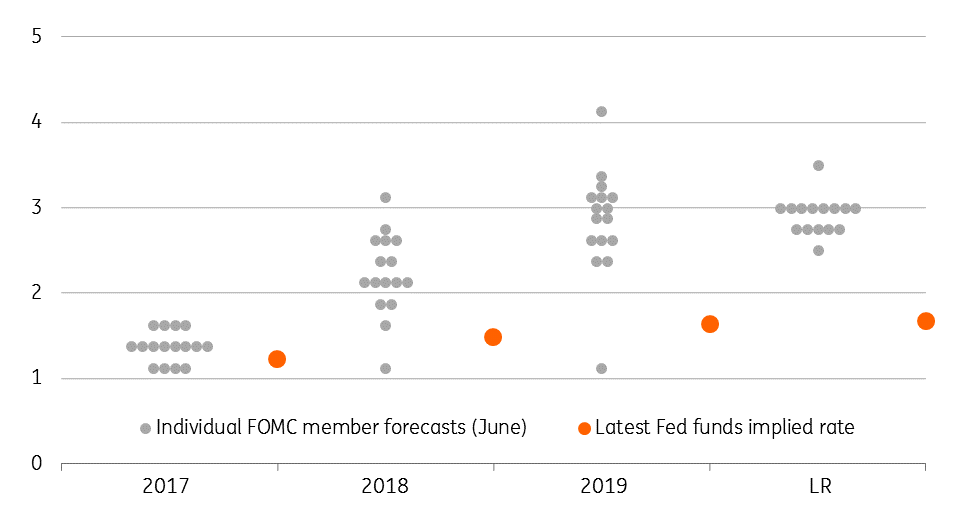

With just one hike priced in by the end of 2018, the market's view on interest rates is still worlds apart from the Fed's June projections, which pencilled in 100bp of rate hikes over the next 18 months.

We think the Fed will keep its longer-term forecasts unchanged but we're looking for a December hike followed by two more next year

Some market scepticism is understandable. The Fed has signalled higher interest rates on numerous occasions over the past couple of years, only to then subsequently not follow through with them. But also with several measures of inflation well below 2%, there is a sense that there is little need for tighter policy.

This latter point, in particular, may see some officials becoming less aggressive on their expectations for the path of interest rates. As such, we would not be surprised to see the dot diagram move closer to our forecast of three rate hikes rather than the four previously indicated.

Markets still very sceptical of Fed's dots

What could seal the deal for a December hike

While there may be some added caution on the dots, the encouraging economic outlook means the core message from the Fed is still that the market remains too complacent on rate hikes. The economy grew 3% in the second quarter, and there will probably only be a marginal slowdown in the third (despite some soft retail sales numbers) given the prospect of a significant inventory rebuild. We don't see any long-term economic disruption from Hurricanes Harvey and Irma. In fact, in the medium term, they are likely to boost growth due to rebuilding efforts and households and businesses replacing lost equipment and belongings.

We also note inflation could rebound more quickly than the market anticipates. Headline CPI is back to 1.9% and with gasoline prices having spiked, dollar weakness is pushing up import costs, and there are tentative signs that wages are again on the rise given the tight labour market.

We therefore suspect the Fed will keep its positive, longer-term forecasts unchanged and we currently look for a December rate rise followed by two more 25bp hikes next year.

Politics, not data, the main risk to a December hike

The recent hurricanes saw President Trump push and get a three-month extension of the debt ceiling. While this is positive as this allowed relief funding to be released for affected areas but it now means the 13th December FOMC meeting will coincide with a new debt ceiling deadline.

Given the divisive nature of politics in Washington right now, we are somewhat nervous that there could be major market worries about a government shutdown, the furloughing of workers and the potential talk of debt default, although this would be highly unlikely to happen.

The result is that the Fed could conceivably choose to wait until early next year given the potential for a pickup in market volatility - although that is not our base case.

Don't rule out impact on yields once normalisation begins

In a bid to avoid taper tantrum 2.0, the Fed has for many months made it clear that it wishes to 'normalise' (or shrink) it's USD 4.5 trillion balance sheet. We already know this will be done by a very slow tapering of the reinvestment of maturing assets - you can find out more in five charts explain how the Fed plans to shrink its balance sheet.

Now we know most of the details, the formal announcement of an October start to the balance sheet unwind should be taken in the market's stride. But given the process will leave a sizeable extra chunk of bonds for the private sector to absorb, our Debt Strategy team estimate that this could in itself add 5-10bp on the 10-year yield.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more