Why India is bucking the global slowdown trend

India is the fastest-growing major economy this year. While others in the region look to be struggling, there are few clouds on the horizon for India. Inflation is high, but falling, and the rupee is one of the strongest currencies in the region, which will be further helped as Indian government bonds are set to be included in global indices next year

Economic growth - firming, not stalling

In the second quarter, India recorded a growth rate of 7.8% YoY, which was a marked increase over the 6.1% rate of growth recorded for the first quarter. This makes India the fastest-growing major economy in the world and leaves growth on track to achieve 7% for the full year.

India’s growth momentum is in stark contrast to the rest of the Asia Pacific region, where economic growth is generally slowing – a response to the slowdown in the West, and more importantly in recent months, to the slowdown in China, topped off with weakness in the global semiconductor industry, which is an important driver for many regional economies.

Growth is coming mainly from domestic demand and is spearheaded by capital investment. This bodes well for future growth too, with investment likely to raise India’s non-inflationary growth potential. Net exports aren’t helping much, but weaker imports have helped offset falling exports.

Contribution to GDP growth (pp)

Household consumption is also holding up well too, helped by improvements in the labour market, falling unemployment, rising labour participation, and falling inflation. Government spending is not directly adding anything to growth, but as we shall shortly explain, indirectly, targeted spending is helping.

India unemployment rate and labour force

Budget deficit reduction is mindful of growth

The Union budget this year set what has been described by some as an "unambitious" target for deficit reduction, taking the targeted deficit to 5.9% of GDP down from 6.4% in the fiscal year ending March 2023.

It might be fairer to describe this budget as one aimed at growth, containing a lot of capital expenditure measures aimed at bolstering India’s infrastructure, with an assumed goal of “crowding in” private business expenditure. In that respect, judging by the run of GDP so far this year, it seems to be succeeding.

India’s sovereign credit rating of BBB- puts it precariously at the edge of investment grade and leaves the bond market vulnerable to downgrade risk. Those fears seem to have been allayed with the recent announcement of global bond index inclusion for Indian government bonds.

India's deficit - on track so far

So far as India’s progress in gradually reducing the deficit and its debt-to-GDP ratio, things seem to be roughly on track this year, and maybe a little ahead of the game.

In order to hit the 5.9% deficit ratio, and assuming real GDP growth of around 7% and inflation averaging about 4%, India’s cumulative deficit needs to come in at about INR 16.9tr by March next year. So far, the monthly deficit figures have kept close to the projected “on target” track required to achieve this, and there seems little danger of any credit downgrades on this basis, with the debt-to-GDP ratio still high but likely to moderate to about 81.5% by the end of this fiscal year, down from 83.8% last year.

External balance and the INR

One of the surprises of the year so far has been the resilience of the rupee. Since October 2022, the INR has inhabited a very narrow range against the USD, between about 80.5 and 83.0. Over recent months, the range has been narrowing, centred on 82.5. To put this into perspective, this makes the INR the third best-performing currency in the APAC region year-to-date and represents a substantial outperformance relative to other APAC FX peers, where, for example, the Japanese yen is 11% weaker, and the Chinese yuan 5.84% weaker against the USD.

Policy rate spreads over USD and FX performance

Stable INR thanks to the RBI

While India’s economy has also outperformed many of its peers, we aren’t putting this FX performance entirely down to structural factors, although the positive spread of policy rates over US rates is clearly helping. Rather, we think the stability of the currency all year is mainly due to Reserve Bank of India (RBI) intervention.

Normally, the INR tends to track according to inflation differentials, such that it maintains a more or less constant real exchange rate.

Indeed, there have been times this year when Indian inflation was lower than that of the US, and that could certainly have been consistent with a firmer currency. But more recently, apart from a relatively brief interlude a few months ago, the Indian inflation rate has pushed sharply higher again, while US inflation has consolidated at just over 3%, and the INR’s resilience is looking more questionable and less supportable now.

Saying this, there seems no shortage of ammunition for the RBI if it decides it wishes to persist with its INR support. Import cover is not only holding up well above the six months usually reckoned to be a minimum requirement for emerging market economies but has been rising recently.

FX Reserve import cover

The trade balance has deteriorated

This healthy FX reserves position hasn’t owed anything to the trade sector, which is currently running a deficit, though not a particularly large one by historical standards (the current account deficit is only about 2% of GDP).

Like everywhere else in the region, India’s exports have fallen from their 2021 peak, but it has been quite a slow decline, and India may have benefited from two factors. The first is that India’s direct trade with China is far more limited than most of the rest of Asia. The other is that India is not yet a big player in the semiconductor sector, which has been particularly hard hit this year, and which is only now troughing.

That said, India’s aggregate export performance relative to the rest of the region is not great, and it ranks towards the bottom of the pack in terms of relative year-on-year growth rates. This appears to be down to a couple of things. The first relates to what is usually very strong jewellery exports, which have been very soft this year. This is a big part of India’s export basket and accounted for about 8.5% of total exports in 2022. This is one area where weak Chinese demand could be having an outsized impact, as it is one of the largest markets for Indian jewellery after the United States, where demand has also been hit hard by high inflation rates.

India's exports by type

The second is bans on exports of agricultural products. Non-basmati rice exports were banned on 20 July, and this followed a ban last year of broken white rice last year. Exports of sugar after the current export season ends on 30 September will also add to the export gloom after sugar exports were capped at 6.1 million tonnes this season. Sugar exports have already almost stopped.

Indian agricultural exports

Helping to square the circle between ongoing central bank support for the currency, export weakness and stable FX reserves, we can refer to the financial account of the balance of payments.

India's financial account (2Q moving average)

Inclusion of government bonds into global indices to provide further support

Along with a consistent inflow of foreign direct investment, the category “other investment,” makes up much of India's financial account inflow. This category is made up mainly of American and global deposit receipts (ADR and GDRs) and shows that overseas equity listings have been a reliable source of foreign exchange receipts over the last 18 months.

Portfolio flows have been more erratic, as one would expect, but the direct and “other” investments should be fairly sticky, which is a comfort when a currency is artificially held away from where the market would like to take it for some time, and where the trade picture looks challenged.

Looking ahead, the recent announcement that JP Morgan will include Indian government bonds in its Emerging Market Bond Index, from 28 June next year, will support further portfolio inflows. This move has been long-awaited after being delayed several times in recent years. Estimates vary, but substantial inflows of foreign capital of between $25-40bn are thought likely to be attracted to Indian government bonds as a result.

It remains to be seen whether the JP Morgan decision will spur others, such as the FTSE Russell to follow suit. Either way, as well as supporting the INR, the decision should also help to reduce government bond spreads over US Treasuries, and also pass through into lower corporate bond rates.

That said, with US inflation heading lower over the next year and Indian inflation likely to stabilise at something around the 4%-4.5% level, we would expect the INR to eventually resume its trend nominal depreciation at about a 2% annual rate in line with maintaining a stable real exchange rate, after first benefiting in the short term from a shift in market expectations for US Federal Reserve rates to price in more easing in 2024/25.

With the currency currently supported in a narrow range, and not having seen the amount of depreciation evident in other regional currencies, we think that the scope for some INR appreciation when the USD finally does turn weaker is more limited than some other currencies, and we’d expect to see the Australian dollar and Korean won doing better if this turn ever does materialise.

Inflation and the Reserve Bank of India

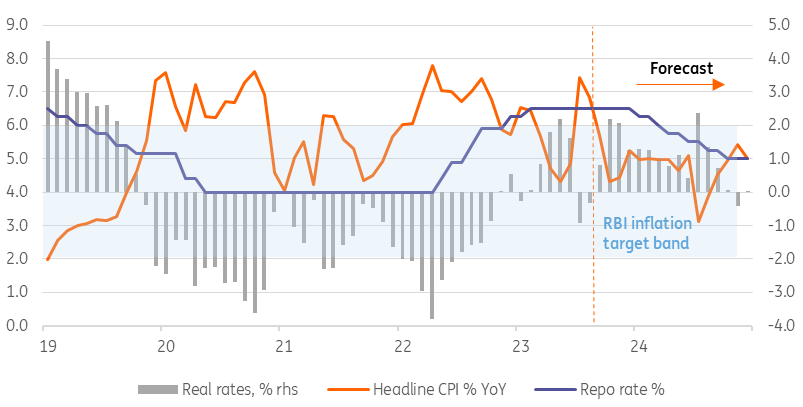

Earlier this year, Indian inflation came down within the RBI’s inflation target range of 2-6% and looked as if there might be scope for policy rate easing before the end of the year. But erratic monsoons have hit agriculture and pushed up seasonal food prices sharply, and that has lifted inflation back above the RBI’s target, though it is beginning to ease lower again now.

We expect inflation to keep moving lower over the second half of the year, as the government shields households from rising energy prices, and we could see inflation back within the inflation target as soon as next month, and close to the mid-point of the target with the release of October data.

India's inflation and rates outlook

That will keep real rates elevated and will make a strong case for some reduction in rates in early 2024. At 6.5%, India’s policy rate spread over the US is 100bp, which is helping support the INR. That is a bigger spread than some of its Asian peers. The main risk to our rates outlook is if the US economy continues to defy logic by failing to slow, keeping the USD strong.

Summary

India is delivering very solid economic growth currently, and there isn’t much in the current run of data to suggest that this shouldn’t continue to be the case. Inflation has spiked higher and that means that we probably aren’t looking at an immediate easing of policy rates and indeed, this will probably not take place until next year. That said, and notwithstanding what is obviously some direct support for the INR from the Reserve Bank of India, the support for the currency from overseas direct investment and equity listing would probably have seen the INR outperform its peers anyway and will take a further boost from the inclusion of Indian government bonds into global bond indices next year. That also removes an impediment to eventual easing, where some other regional peers are deliberately keeping policy tight despite better inflation credentials to offset currency weakness.

2023 should see the economy return close to a 7% growth rate overall, a return of inflation within the RBI’s target range, and sow the seeds of some policy rate easing in 2024, which will help underpin strong growth for another year.

Summary table

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more