Central banks and rates, the definitive guide

What to expect from the major central banks over the next few months

Federal Reserve: Dismissing the sceptics

Financial markets continue to doubt the Fed will carry through with the four rate hikes officials are predicting by the end of 2018. Some scepticism is justified given subdued inflation readings, the potential for an unsettling government debt ceiling crisis in December and uncertainty over who will lead the Fed from February 2018.

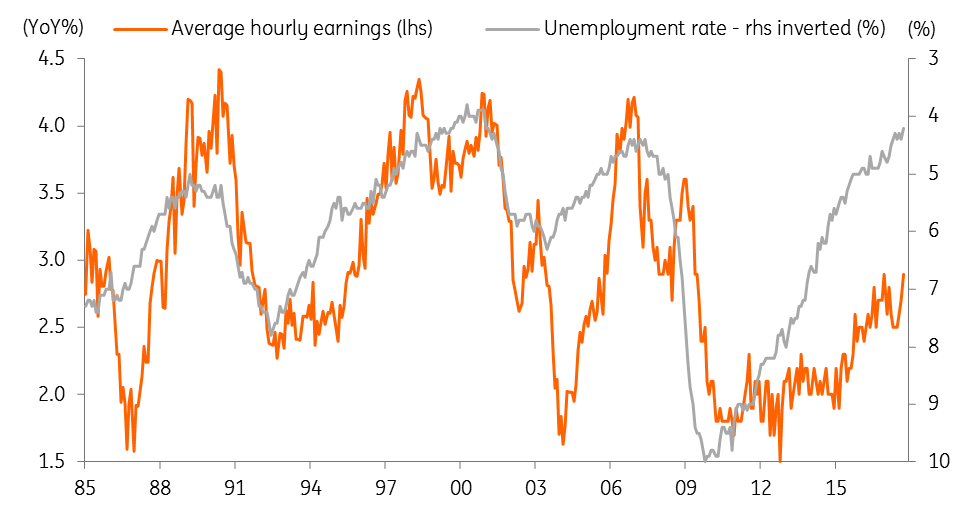

However, the growth story is looking strong with business surveys at decade-plus highs, while unemployment is extremely low and wages are finally showing some signs of life. These factors should push inflation higher with a softer dollar and the producer price report hinting at pipeline price pressures.

With Fed officials also suggesting the prolonged period of low rates is generating financial stability risks while also warning of “somewhat rich” asset valuations, we think the market is being overly cautious in terms of its pricing. If President Trump chooses to nominate a “hawk”, such as John Taylor or Kevin Warsh, as the next Fed Chair then there could be upside to our prediction of a December 25bp Fed rate hike, followed by two more in 2018.

Pay starting to respond to tight jobs market

European Central Bank: The 'lower for longer'

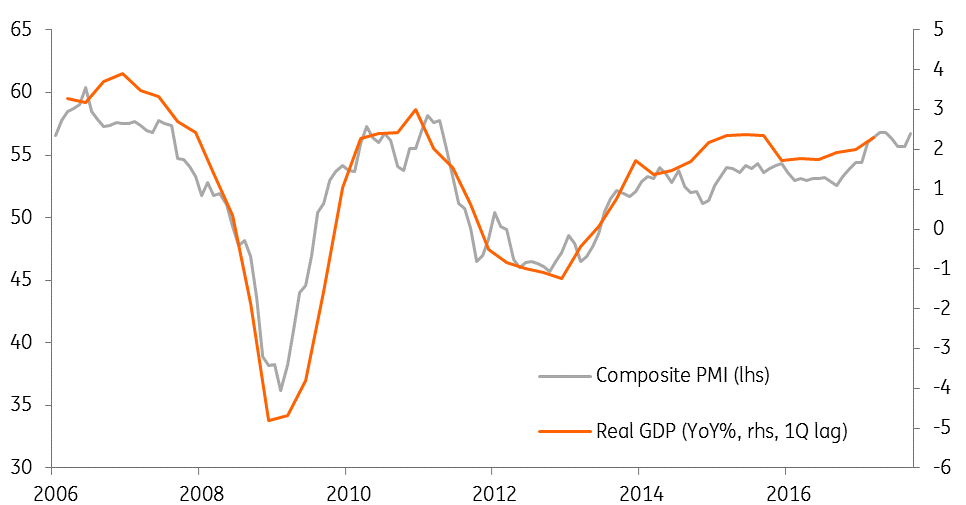

With a strong cyclical upswing underway and an increasing scarcity of bonds to buy, the ECB looks set to finally embark on its long-awaited tapering programme.

The question is how? ECB officials appear unanimous on the need to taper, but there are diverging views on how it should reduce the monthly purchases. We think the ECB will first identify a targeted, final, size of the balance sheet before it derives paths towards it. The latest press reports suggest the increase of the balance sheet could be between 200bn and 300bn euros. So, how will the ECB spend it?

Well, we think there are three options, but we think the most likely is a 'lower for longer' scenario, where the ECB reduces monthly purchases to 25bn euros and extends the programme to the end of 2018. That looks set to be announced this month which, together with a clear reminder that the first rate hike won't come until well after the end of QE, should help anchor interest rate expectations and immunise against further exchange rate fluctuations.

A cyclical recovery is in full swing

Bank of England: Big question marks over 2018 rate hikes

Be it at the September meeting or in subsequent comments, the Bank of England has made it pretty clear that a November hike is very likely. The committee appears keen to get out of the "emergency mode" it initiated after the Brexit vote, and with central banks across the globe moving towards the exit, the Bank won't want to get completely left behind.

But there's a myriad of reasons why it's hard to envisage a series of rate hikes over coming months. One major consideration is wage growth. True, we've seen a tentative pick-up over recent months, but this appears to be largely down to a higher national living wage rather than anything more fundamental. Consumer spending is also still very fragile given the ongoing real wage squeeze, and even though inflation has spiked, this is almost entirely a sterling and oil story.

Add in all the latest Brexit uncertainty surrounding the transition period and the possibility of "no deal", which means companies will stay cautious over investment and hiring for the next few months, and it looks like any tightening from the Bank beyond November will be very limited.

UK wage squeeze set to persist

Bank of Japan: Dissent brewing?

The main excitement surrounding the BoJ, arguably one of the least remarkable central banks in the G-7, was the dissent at the last meeting by the newly appointed member, G Kataoka. He dissented on the grounds that even the combination of negative interest rates, and even with QE targeting approximately zero yields on 10Y Japanese Government bonds (JGBs), the 2.0% inflation target was unlikely to be reached.

BoJ Board Member Goushi Kataoka is almost certainly right in our view. The real question is, “Does it matter?”. Since it emerged from outright deflation, inflation in Japan has run well below 2.0% except for brief moments of tax-induced one-off inflation, and it seems none the worse for that. And while there may be some signs of inflation life, that increase is mainly coming from the notoriously fickle elements of food and fuel.

The Japanese economy does seem to be very slowly improving. Growth has been nearly 1.0% or more for six consecutive quarters. Since last month, we don’t think that anything has changed significantly enough for Kataoka to stop dissenting, though that also seems likely to be the case for the next year at least.

We wonder if constant dissenting may in time either become boring for Kataoka, who may throw in the towel and join the consensus, or others may be persuaded that he is right, and voices swell for more aggressive easing action. Neither seems likely at the next meeting and another 8-1 seems probable.

Fickle fuel and food are key Japanese inflation drivers

Bank of Canada: Caution creeps in

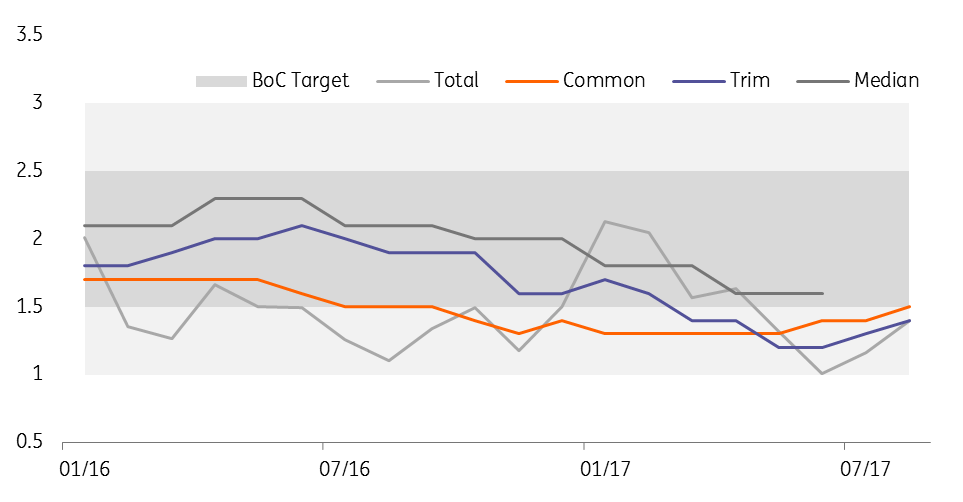

Robust activity and a healthy jobs market led the Bank of Canada to hike rates twice (from 0.5% to 1%) over the summer. They are looking through current inflation figures - which are below target - and are instead concentrating on factors that could lead to higher future inflation.

But with GDP expected to moderate in 2H17 and given current risks, notably the high CAD, NAFTA uncertainty and high household debt, the BoC is likely to take time to assess the impact of their recent action before contemplating further measures.

We believe that the BoC will keep their policy rate on hold at 1% through to year end with two further rate hikes in 2018, a slightly less aggressive series of hikes than what we have seen so far and more cautious than the market and consensus predicts. Upside risk to this scenario could materialise if investment growth accelerates due to rising commodity prices.

Inflation well below target in Canada

Swedish Riksbank: Tapering complete?

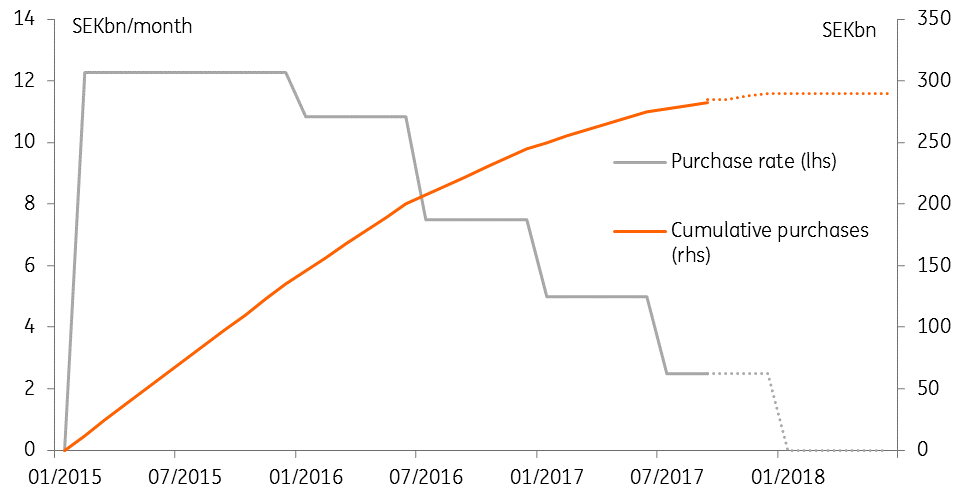

The Riksbank’s QE purchases are set to run until the end of the year and seem unlikely to be extended further. Three out of six MPC members voted against the two latest asset purchase extensions. As the domestic data continues to improve and the major central banks inch towards tightening policy, an extremely loose monetary policy in Sweden looks increasingly hard to defend.

But the Riksbank will be wary of getting too far ahead of the ECB, which, awkwardly, will announce policy just a few hours later on Thursday. Concerns about external factors pulling down on Swedish inflation is the key factor behind the Riksbank’s accommodative stance.

So look for communication to remain dovish and the Riksbank’s forecast for interest rates to remain largely unchanged (first rise in mid-2018). It may also extend the delegated mandate for currency intervention (which hasn’t been used but has some signalling value).

QE purchases coming to an end

Norges Bank: On hold as economy continues recovery

October is an ‘in-between’ meeting for the NB. There will be no press conference and no new forecast published. The key policy rate has been set at 0.5% since early 2016 and is set to remain there until early 2019 on the NB’s latest forecast.

The Norwegian economy is still recovering from the oil price shock of 2014-15. Inflation remains below target (1.6% in September vs the 2.5% target). While activity picked up in 2017, thanks in part to stronger growth in key trading partners such as Sweden and the euro area, policy is likely to remain accommodative.

Having nudged its interest rate forecast up slightly in June and September, the NB has tentatively started the tightening cycle. But with relatively little news since the last meeting, it would be surprising to see a major change in the NB’s stance.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more