What Yellen doesn’t say at Jackson Hole matters more

Don't expect any dramatic policy announcements from Fed Chair Janet Yellen at Jackson Hole. And this is why it matters.

Investors could be left clutching at straws

The annual get-together of central bankers in Jackson Hole this week is always keenly watched by investors, but how much will we really learn this year?

This year's major speakers, Fed Chair Janet Yellen and the ECB President Mario Draghi, are likely to keep their cards close to their chest. Both speeches are likely to be fairly "high level" and lack any major hints about future policy.

Carsten Brzeski has already offered his thoughts on Draghi's Jackson Hole speech, so in this article, we focus on three things Yellen will (or rather won't) say this week.

"Inflation: What's the problem?"

The Fed and markets are still at odds over the number of rate hikes expected this year and next. Even among the committee itself, there are increasing signs of disagreement. And it all centres around one thing: inflation.

A few months ago, the Fed was at pains to stress the recent dip in inflation was "transitory", and that's certainly still part of the story. For instance, a 13% year-on-year fall in the price of mobile phone services has recently knocked 0.2ppt off headline inflation as contracts with unlimited mobile internet become increasingly prevalent.

The Fed will be keen not to commit to anything in the near-term

But these one-off factors fail to explain all the recent falls in the Fed's preferred measure of inflation, core PCE. The latest 1.5% figure is sharply down since the turn of the year, and an increasing number of Fed voters are sounding the alarm.

We're still confident that inflation will head back towards 2% later this year, partly as the effect of a 10% depreciation in the dollar starts to nudge up import costs. The strength in the jobs market should also see wage growth gradually approach 3% again. That all means that the hawks are likely to prevail when it comes to a rate hike in December.

PCE = personal consumption expenditure (An alternative measure of inflation to the consumer price index)

| 0.8 |

Number of hikes effectively priced-in by markets by June 2018(Based on OIS curve) |

"We're going to hike again in December"

Having said all that, the return of inflation to target is likely to take time. This means the Fed will be keen not to commit to anything in the near-term - and markets will remain sceptical about the prospects for future rate hikes until they do.

With Chair Yellen likely to steer well clear of policy hints at Jackson Hole, the next big insight into the Fed's thinking will come with the update of the Fed's infamous dot plot - a graph of individual member's rate hike expectations - in September.

In spite of the concerns about inflation, we still think the Fed will continue to signal an additional hike this year. The bigger question will be how many members, if any, will drop their pledge to hike three more times in 2018.

"We're going to announce balance sheet reduction in September"

We now know quite a lot about the Fed's plan to unwind its $4.5 trillion balance sheet. But the closest the committee has come to signalling a start date is by saying the process will begin "relatively soon", assuming that things "evolve broadly as anticipated". That's a subtle way of saying the starting gun will likely be fired in September, assuming any wrangling over the US debt ceiling doesn't adversely impact markets in the meantime.

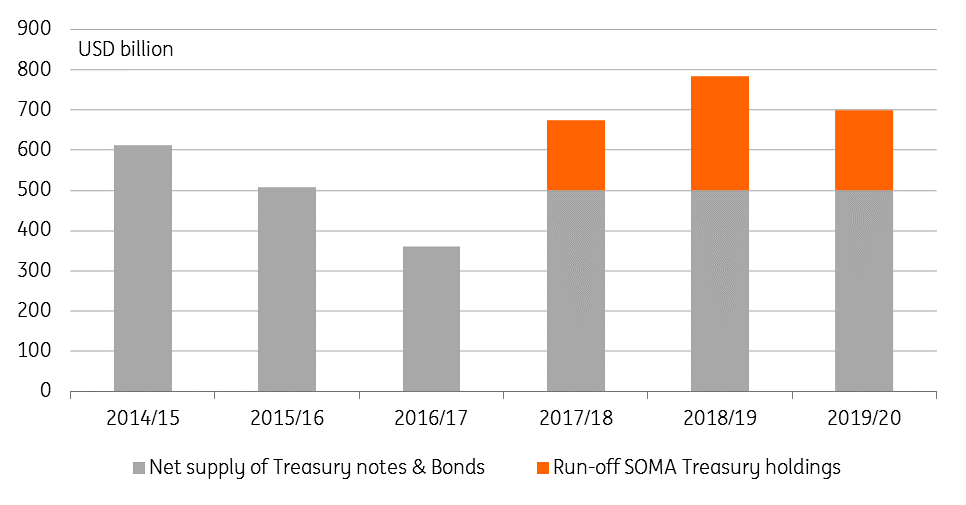

Chair Yellen is unlikely to provide any further hints on timings in her speech, but even if she does, markets are now relatively well primed on the finer details of the Fed's plans. That's not to say it doesn't matter for markets in the long-run. The chart below shows that there will be a significant amount of additional treasuries for the market to absorb when the Fed slows reinvestment. We think there is a risk that the curve could come under steepening pressure during this process.

For more info, see Five charts explain how the Fed plans to shrink its balance sheet

Fed's plan means plenty more bonds for markets to absorb

Time and date

Chair Yellen will speak on Friday 25 August at 15:00 UK/16:00 Europe/10:00 Eastern

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more