What to expect from European sectors in 2024

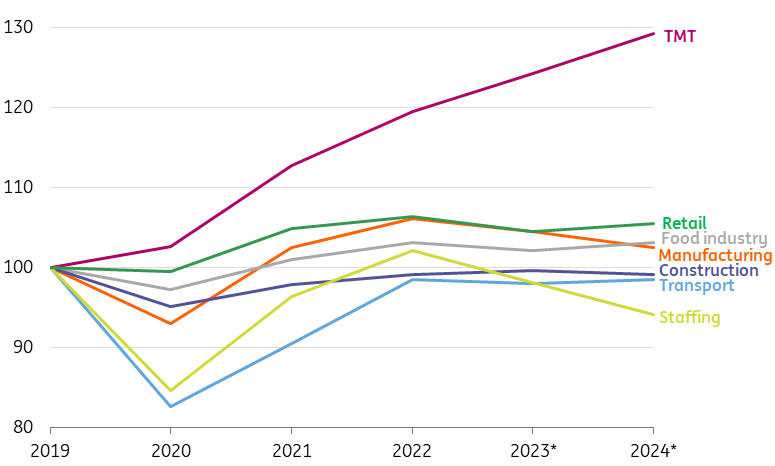

Many EU sectors are set to face weak development in 2024. Manufacturing, staffing and construction are likely to witness a decline, but not all sectors will lose their footing. Transport and retail volumes will see a slight recovery, and Technology, Media and Telecom (TMT) will show lower – but still high – growth figures

Many sectors struggle with slow development

Development production (volume value added) EU sectors (Index 2018=100)

Freight transport picks up after post-pandemic correction

The European transport and logistics sector is about to see a bit more of a return to normality in 2024 from the demand side – although the start of the year is set to remain pretty tumultuous for overseas trade due to the Red Sea crisis. After digesting the pandemic aftershocks of spending normalisation, inventory reductions and geopolitical headwinds sending freight and port volumes down, 2024 is bound to be a better year. The German economy and manufacturing slump (see below) will still drag on demand for (industrial) goods. However, compared to the low base of 2023 and some recovery in consumer spending on goods, volumes are not expected to sink further.

On the smaller passenger side, the post-pandemic pent-up demand of traffic has run out of steam. Working from home still weighs on public transport traffic in several European countries, but consumers seem eager to prioritise travelling and a strong labour market helps to bolster demand. Against this backdrop, European airline traffic will return close to pre-pandemic levels and the challenge now is to provide enough capacity to accommodate seasonal demand amid maintenance issues and lagging new aircraft deliveries. This also comes alongside supply chain issues. All in all, the total transport and logistics sector could see some – though not much – traction in 2024.

No signs of relief for manufacturing yet

Weak demand and high energy prices continue to weigh on European industrial activity. While the height of volatility is behind us, energy prices are still higher than before and much higher than, for example, in North America. Energy-intensive base materials industries have been in decline for a long time and stagnation is also gaining ground at the other end of production chains. That said, 2023 saw solid production growth in transportation equipment, especially in the automotive industry. Less volatile segments such as pharmaceuticals and electrical equipment also recorded positive figures. These two groups are growing steadily thanks to post-pandemic activities and energy transition investments respectively.

While the differences in activity between industrial segments are significant, the general picture of stagnation and moderate production declines is more or less the same across Europe. Orders are still steadily declining due to weak demand. A turnaround in the inventory cycle could provide some comfort later in the year. With a soft or hard landing for the US economy and still very little growth in China, external demand for European products is likely to remain weak. The current trade impact of attacks on merchant ships in the Red Sea is a clear example of the continued vulnerability in supply chains. Things could turn for the better, but substantial production growth in European industry this year seems to be wishful thinking.

European industrial order books on a low and deteriorating level

Assessment of order-book levels by manufacturers, EU-27

Room for growth in food manufacturing

The latest figures indicate that food manufacturing production volumes declined by approximately 1% in 2023, which was in line with our forecast at the start of last year. For 2024, we project production growth to pick up (+1%) as the European economy is expected to show modest growth.

Wages in many EU countries are catching up with inflation, and this could lead to a slight improvement for consumer spending power. For branded food makers in particular, this could mark a turning point in helping them win back some of the volume that they lost due to consumers trading down. However, since new food shopping and consumption habits have formed, it may take a while to recover lost ground. For most subsectors within food manufacturing, cost inflation of raw materials has eased significantly during 2023. But European companies sourcing sugar, cocoa and robusta coffee continue to face historically high prices at the start of 2024.

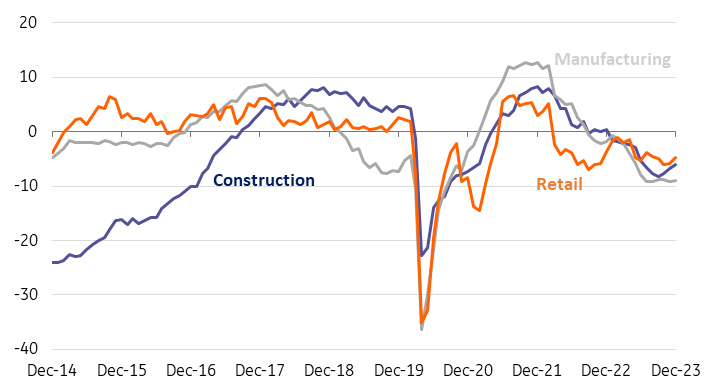

No miracles for the retail sector, but signs of recovery emerge

The retail recession has continued straight through 2023, marking two years of declining retail volumes in a row. Consumers hit the brakes amid high inflation and more economic concern, and were still rebalancing consumption away from goods towards more services.

Signs of recovery in 2024 are emerging, though. Unemployment just hit another record low and real wage growth is increasing, two signs that disposable income growth is looking better for the year ahead. After a long shying of goods, the replacement cycle will start to bring renewed popularity for some goods that were overbought during the pandemic. In December, retailers were becoming more optimistic about the months ahead. Don’t expect miracles, but a bottom and some recovery over the course of 2024 appear to be in the making.

Increase in sentiment indicators retail and construction sector in December 2023

European Union Sentiment indicators

Grim outlook for European staffing

2024 will be another challenging year for the European staffing sector. After two years of above-average volume growth in 2021 and 2022 for the European temporary employment sector, last year saw a turn to contraction territory.

For 2024, we expect the freeze on hiring temporary workers to continue. Sluggish economic growth and continuing staff shortages are the main challenges for the sector this year. Companies are reluctant to invest now that the market remains highly uncertain. This softens the demand for temporary workers, particularly in the manufacturing sector, which is an important industry for temporary workers. In the services sector, employment prospects for temporary workers are also set to deteriorate. Despite an economic slowdown and unemployment rising slightly, the labour market remains tight in most European economies. This will limit the growth potential of temporary employment agencies, as it becomes more difficult for them to recruit new employees.

Marginal decline in volumes for construction

In the second and third quarter of 2023, EU construction production decreased by -1.4% and -0.2%. High interest rates and a weak economy made home buyers and firms reluctant to invest in new buildings. The issuing of building permits (a good indicator for future building activity) also decreased for new residential and non-residential buildings. The current declining interest rates could stimulate investments in new construction projects. However, this will not boost new construction volumes before the beginning of 2025 as they are limited by the declining amount of issued building permits in the short run.

Construction companies have also seen a spark of hope with the EU construction confidence indicator improving slightly in the last three months of 2023 – but it still remains negative. Companies active in renovation are likely to be more on the positive side. In addition, the renovation subsector (including sustainability works) should see a structural growth in demand and EU contractors order books are still well-filled with almost nine months of work. We're therefore upgrading our previous forecast a bit and expect only a slight decrease (-0.5%) in EU construction volumes in 2024.

The issuing of EU building permits is declining

New non-residential buildings permits in m2 excluding offices & New number of residential buildings permits in the EU (index 2018 Q1 = 100, SA)

TMT growth set to remain high

Over recent decades, the European information and communication sector has grown much faster than the economy overall. We expect this trend to continue in 2024, although the difference will be smaller than in previous years. We estimate volume growth of just above 4% in 2023 and forecast a volume growth of 4% in 2024. This forecast is based on several expectations.

First, investment in automation, cybersecurity, software and artificial intelligence will increase, while investments in hardware will decrease. Moreover, spending on ICT in Europe is likely to increase by around 5% per year. Growth in the telecom sector will be more subdued in the software and services sector. Lastly, even though excitement is high, generative AI will not yet lead to increased volume growth in 2024. Many enterprise software companies expect to launch their initial versions of software packages that include generative AI in the first half of 2024, but the rollout of these packages will also take time. 2024 is therefore set to be a transition year.

Uncertainty in commercial real estate, but some room for optimism

2023 was the most challenging year for the European commercial real estate sector since the financial crisis. The fastest central banking tightening cycle in modern history led to a sector switching from expansionary mode to tightening mode, as transaction volumes fell by roughly 60% during the year.

While interest rates have come down from the peak, we expect 2024 to remain quite challenging, as the sector is less well equipped for structurally higher all-in funding costs. We do expect transactions to pick up, as some sellers will feel more pressure to sell assets in order to pay back liabilities coming due. In the case that interest rate cuts do materialise in line with market expectations, this would be supportive for the sector, as lower funding costs make real estate more attractive again as an investment. Overall, however, we think 2024 will be a transition year, and we don’t expect a full recovery until 2025.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article