What to expect from the December US jobs report

Employment growth is slowing, but this is more to do with a lack of available workers rather than a drop in demand. The implication is wages will keep rising, supporting confidence and spending

Jobs growth – Its strength is its weakness

US non-farm payrolls rose a slightly disappointing 155,000 in November versus the 198,000 consensus prediction, but this wasn’t necessarily bad news. After all, payrolls growth has been choppy through the second half of the year, which was in no small part down to hurricane distortions. The storms initially prevented people getting to work (and therefore being counted as ‘on the payroll’), but the following month they would be added back in, plus there would be extra jobs created in the clean-up/rebuild efforts.

In fact, 2018 is on course to be the best year for job creation since 2015. On average 206,000 jobs were added in each of the first 11 months of 2018 versus the 182,000 average for 2017 as a whole and the 195,000 average for 2016. However, we think 2019 will see slower growth with the December 2018 report offering a prelude for this.

2018 is on course to be the best year for job creation since 2015

Financial markets are somewhat nervous about the US’ economic prospects. For certain, there are more headwinds for growth, including the lagged effects of higher interest rates, the strong dollar, fading fiscal support and trade protection worries at a time of already slowing global growth. However, the bigger risk for the US jobs report in the next few months is actually its strength – there aren’t enough available workers that have the skills employers require.

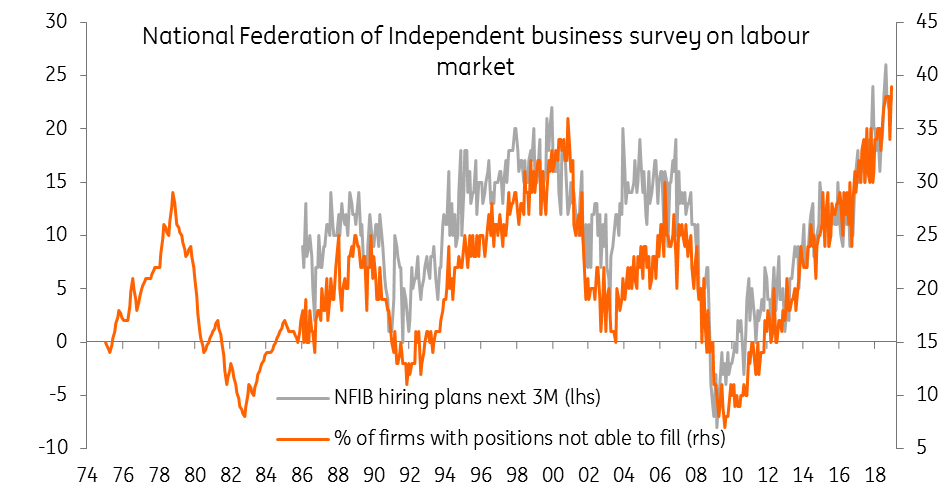

NFIB survey shows firms are struggling to fill vacancies

Indeed, the National Federation of Independent Businesses continues to report that the proportion of firms that can’t fill their current vacancies remains at an all-time high. This analysis was backed by the most recent Federal Reserve Beige Book, which suggested that “over half of the Districts cited firms for which employment, production, and sometimes capacity expansion had been constrained by an inability to attract and retain qualified workers”.

So, despite strong labour demand readings from the likes of the ISM reports and the decent chance of a rebound following last month’s surprise slowdown we see payrolls growth coming in at around 165,000 versus the 180,000 consensus. The range of forecasts amongst economists is 160-215,000.

| 165,000 |

Change in non-farm payrollsING Forecast |

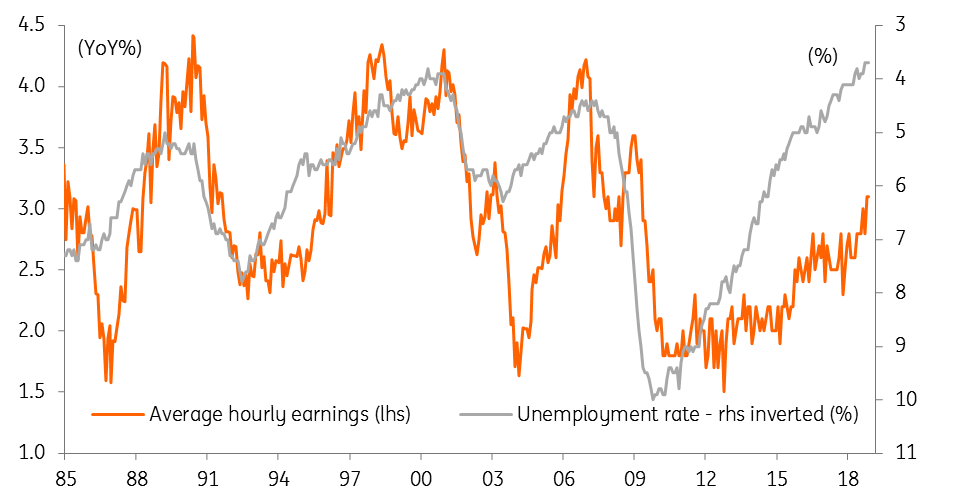

Wage growth – on the bid

Wage growth had been the key thing missing from the US’ strong economic run, but we are now seeing it. Average earnings are currently rising 3.1% YoY with the Beige Book noting that because of the lack of suitable workers and the competition to attract staff “most Districts reported that wage growth tended to the higher side of a modest to moderate pace”. This same report also signalled “in addition to raising wages; most Districts noted examples of firms enhancing nonwage benefits, including health benefits, profit-sharing, bonuses, and paid vacation days.”

Pay is finally responding to the tight jobs market

This increased competition for workers means we expect to see a decent rise in wages this month, which will also be helped by the fact there was one fewer working day in December versus November. Since most people are paid a salary, the way the survey works means that a worker’s monthly pay is spread over fewer hours, giving an uplift to the notional average hourly pay rate. As such, we look for a 0.4% MoM increase in pay versus the 0.3% consensus prediction. This will leave the annual rate of wage growth at 3.1%.

| 3.1% |

Average hourly earnings (YoY%)ING Forecast |

Unemployment rate – can it go any lower?

The household survey, which is used to calculate the unemployment rate, has also been showing impressive employment gains. Having started the year at 4.1%, the unemployment rate has held at 3.7% for the past three months, and we suspect it will do so again in December. We have to go all the way back to December 1969 to find a lower figure, which underlines how tight the jobs market is right now. After having ticked a touch higher last month, we expect the underemployment rate – a broader measure of underutilised workers, such as those that are working part-time but want a full-time job - to drop back to 7.4% (the lowest since March 2001).

| 3.7% |

Jobless rateING Forecast |

What it means for the Federal Reserve

Financial markets are clearly nervous about the US’ economic prospects with the government shutdown and clear disagreements between the President and the Federal Reserve on policy direction adding to the unease. However, business surveys remain in decent shape with any slowdown in jobs growth more due to a lack of available workers than any cut backs to business expansion plans - at this stage.

The positive from this is that competition for workers will advantage employees through higher wages and benefit packages, which should be supportive for confidence and spending. This will also add to inflationary pressures in the economy and will keep the Federal Reserve on course to raise interest rates further in 2019. However, officials will tread a more cautious path with intensifying economic headwinds coupled with the fact the Fed is also running down its balance sheet meaning we expect two 25bp rate hikes in 2019 versus the four experienced in 2018.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more