What is needed to increase renewables in the US power sector?

The Biden administration’s 100% clean power by 2035 target needs a huge increase in renewable energy use. But challenges around transmission lines, extreme weather events, supply chains and batteries hinder a faster deployment. Federal and state policies are crucial to address these challenges; corporate purchases are also key to speed up the shift

As part of its climate ambition, the Biden administration is targeting to transition the US to reach 100% clean electricity generation by 2035. This requires a comprehensive decarbonization process of the US power sector, which includes decreasing the use of coal and especially unabated coal, maintaining an adequate role of nuclear, and albeit not a popular choice today, exploring the use carbon capture and storage to reduce emissions from coal- and gas-fired plants.

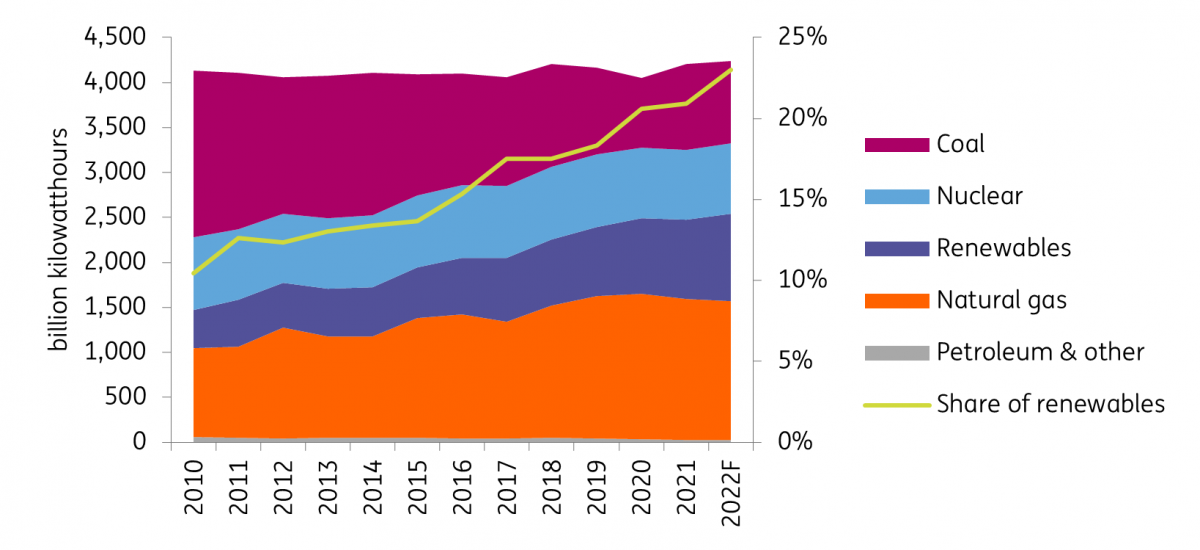

But the most important driver to decarbonize the power sector is to substantially deploy renewable energy, in particular solar and wind, which is the focus of this article. With continuing cost declines, electricity generation from renewable sources in the US jumped from 430 gigawatthours (GWh) in 2010 to over roughly 880 GWh in 2021. However, the percentage of electricity generation from renewables is at 21-23% today, and there is still a long way to go to help the US realize the 100% clean electricity target. Insufficient transmission lines and storage capacity will add difficulties for deploying renewable electricity; climate change induced severe weather conditions will disrupt grid stability; and the energy transition – such as the development of electric vehicles (EVs) – will add pressure to the grid. As such, federal legislation as well as state-level targets and incentives, will be crucial in improving needed infrastructure, facilitating coordination among grid operators, and preparing the grid for a smoother transition process. Meanwhile, corporate power purchase agreements have become an increasingly important factor to drive up the demand for renewable energy.

Electricity generation in the US

Insufficient infrastructure and interconnection difficulties hinder a faster development of renewables

The cost of renewable energy has plunged over the past decade. Global levelized cost of electricity (LCOE) of solar PV in the US decreased from more than $300/MWh in 2009 to $32-41/MWh in 2021, and the LCOE of wind fell from over $100/MWh to around $38/MWh during the same period. This has put the LCOE of renewable energy on similar levels with those of coal and natural gas.

Yet despite the drop in cost, wind and solar have not seen a rapid-enough deployment rate that many hope to see. So, what are the challenges to deploying renewable energy faster and effectively managing the grid in the US? The first is the insufficient transmission infrastructure. Currently, there is a mismatch between high generation regions (e.g. the Midwest and Southwest) and the regions with denser populations and higher demand (e.g. the Northeast). And because wind and solar plants require large land areas to be built, these plants are in general located far away from cities where demand is.

Therefore, a lot more transmission lines will be required to unlock the infrastructure bottleneck. A Princeton University study concludes that the transmission system in the US needs to triple to achieve 100% power sector decarbonization – that is roughly 400,000 miles of new lines. This equals about 30,000 miles of new transmission lines per year if the US is to reach 100% clean electricity by 2035, but in reality, only 1,800 miles were constructed per year in the past decade.

A lot more transmission lines will be required to unlock the infrastructure bottleneck.

Moreover, the regulatory design of the grid has made it harder for power projects – which are increasingly renewable – to be connected to the grid. When a project applies to be connected, the responsible regional transmission organization needs to study its impact on the grid and will the project owner bear the cost of network upgrades, which can be substantial. The fundamental problems are that first, the permitting process and staffing levels were designed to serve fewer larger developers as opposed to a large number of small renewable developers. Second, the cost for network upgrades can result in marginally profitable projects being shelfed rather than built.

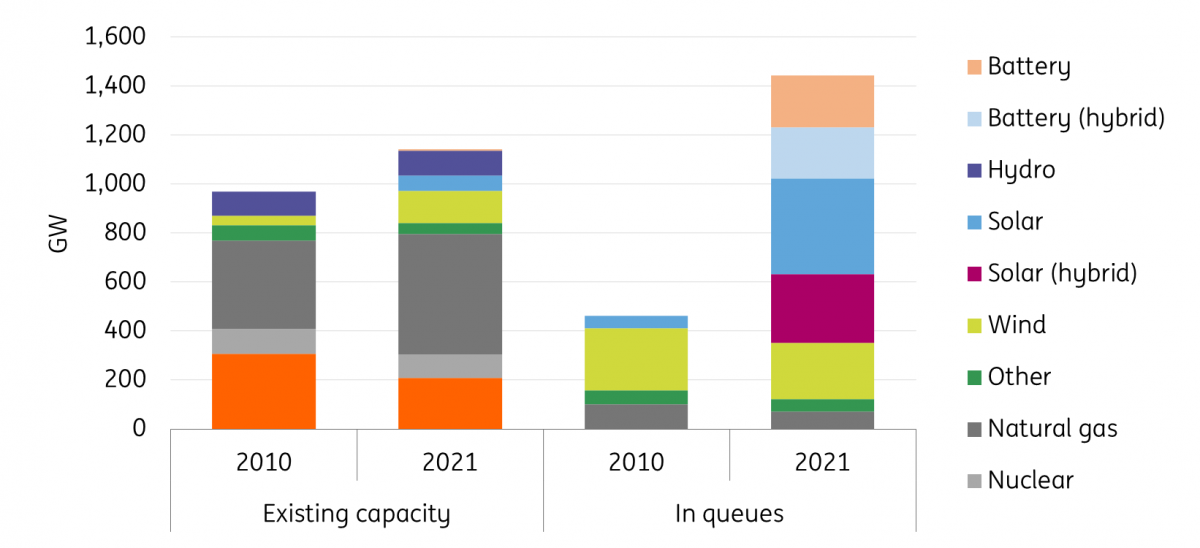

Consequently, there has been a backlog of proposed renewable projects in the interconnection queues of regional transmission system operators. It is estimated by Lawrence Berkeley National Lab that there were over 8,100 projects applying to be connected to grid interconnections by the end of 2021. This translates into to 1,443 GW of generation capacity and 462 GW of storage capacity that is waiting for feedback on interconnection feasibility and potential network upgrade costs. The time a proposed project needs to get to commercial operation went up from 2.1 years for 2000-2010 to 3.7 years between 2011-2021, and historically only about 23% of the projects actually get built. These challenges have hampered the construction of renewable projects and are expected to cause substantial delays in decarbonizing the power sector.

Generation, storage, and hybrid capacity in interconnection queues

Battery capacity buildup provides additional flexibility to the grid but still faces challenges

As the deployment of solar and wind picks up, it has become more important to build more batteries that can store electricity and serve at peak demand hours, especially in markets with high renewable penetration. Utility-scale battery storage capacity in the US tripled to reach to 4.6 GW in 2021, from 1.4 GW in 2020 and less than 500 MW in 2016, thanks to a plunge in the cost of production. Over 66% of the added storage capacity in 2021 was co-located with solar projects, which allowed owners to take advantage of federal tax credits and increase expected returns on their investment.

In California, batteries have been playing a sizable role in shifting renewable electricity produced in the afternoon to meet peak demand in the evening. This has helped prevent rolling blackouts during summer heat waves. However, 10% of California’s battery fleet experienced outages during daytime, compared to an average of 4% of outages in the state’s gas fleet. While 10% is a decent number, there is still a large gap to bridge.

The much bigger challenge with batteries is the limited duration.

Moreover, the capacity that utility-scale batteries can provide is still a fraction of the total renewable capacity in the country, at 3-4% today. The much bigger challenge with batteries is the limited duration (max. 4 hours), which does not allow for full replacement of traditional dispatchable generation such as gas plants. What is needed are long duration batteries (8 hours) to fully replace gas plants. This technology needs to be developed, commercially proven, manufactured on a large scale, and then deployed in large quantities.

Supply chain uncertainty and bottlenecks can raise costs and delay deployment

Another headwind to stay is supply chain costs, which have been on the rise over the past two years because of geopolitics- and macroeconomics-induced disruptions and bottlenecks. China dominates the global renewable energy supply chain, manufacturing 80% of the world’s key solar panels components and almost 60% of nacelle, an important input for wind turbines. Since late 2020, the cost of solar components has jumped in the US, due to reasons such as tariffs imposed on materials of Chinese origin, certain restrictions on importing from China, as well as investigations on several Southeast Asian countries which allegedly export solar panel materials using Chinese inputs. What added to the supply chain disruption is the elevated shipping costs due to pandemic-related shipping bottlenecks between mid-2021 and the beginning of 2022. Shipping costs have largely fallen, but can easily go up again in case of future disruptive events.

Several recently passed federal legislations aim at domesticating clean energy supply chains. These measures will in the long run decrease dependence on China, but will in the short to medium term lead to considerable cost increases as the US does not currently have established manufacturing capacity to produce needed components. It is estimated that it would likely cost the US approximately $113bn to build the factories required for PV, battery, and electrolyzer plants to meet demand in 2030. This could hinder the speed of renewable development.

Climate change and electrification add further pressure to the grid

In addition, there are also exogenous, intensifying factors that are raising the hurdles for the power sector to be decarbonized on time. Two factors stand out: climate change and surging power demand from transport sector electrification.

Extreme weather conditions are making the grid more vulnerable.

Extreme weather conditions are making the grid more vulnerable. In early September, a record heatwave in the west coast triggered soaring demand for power and almost led to grid operators implementing outage rotations. This was the second power outage threat in the state since August 2020. And California is not the only case. In February 2021, Texas suffered from a two-week cold snap that resulted in massive blackouts; the state also experienced the hottest July in the last 128 years of record keeping.

The transmission network in the US has failed far more often in recent years, increasingly driven by severe weather conditions. According to the US Energy Information Administration, since 2013, the average of duration of power interruptions per year without major events has stayed flat at around two hours per customer, but power interruptions caused by major events have substantially risen from less than two hours in 2013 to more than five hours in 2021.

The second potentially disruptive factor is the need to support electrification targets. It is estimated that in the US, electricity generation will have to double by 2050 if two-thirds of the light duty vehicle fleet are electrified. This means that transmission owners will need to invest billions of dollars to upgrade the grid (substations, transformers, grid feeders, lines), with electric cars becoming an important part of managing reliability and supply in electric grid. For California, the state’s aggressive climate plan would increase electricity consumption by 68% by 2045, bringing enormous pressure for the grid to be modernized and capable of integrating electric vehicles.

Federal-level policy to address key challenges and spur more renewable energy deployment

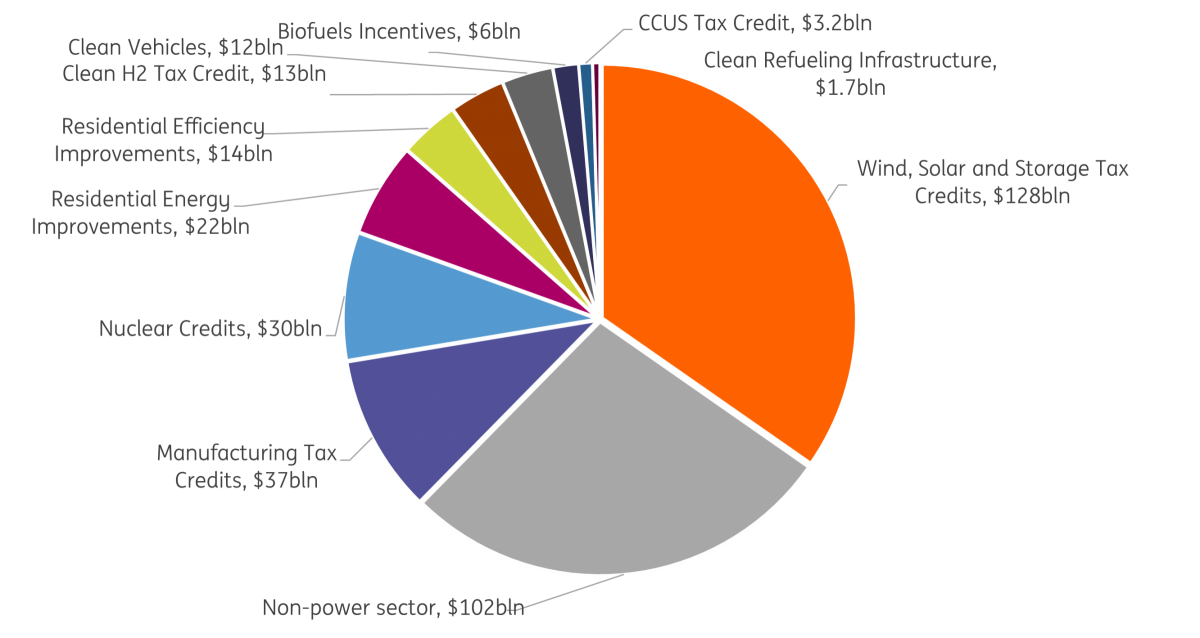

The above-mentioned bottlenecks call for stronger federal policies to incentivize renewable energy development. This is partly what the recently signed Inflation Reduction Act (IRA) and Infrastructure Investment and Jobs Act (IIJA) are designed to do and will hopefully tackle some of the challenges.

The IIJA plans to spend $73bn on updating and expanding the US power infrastructure, which is urgently needed for the renewable projects to move forward. The IIJA is also targeting power grid-related research and development. Moreover, the government is investing $47.2bn in addressing extreme weather events. The amount of investment is likely not enough but is important in getting the snowball rolling.

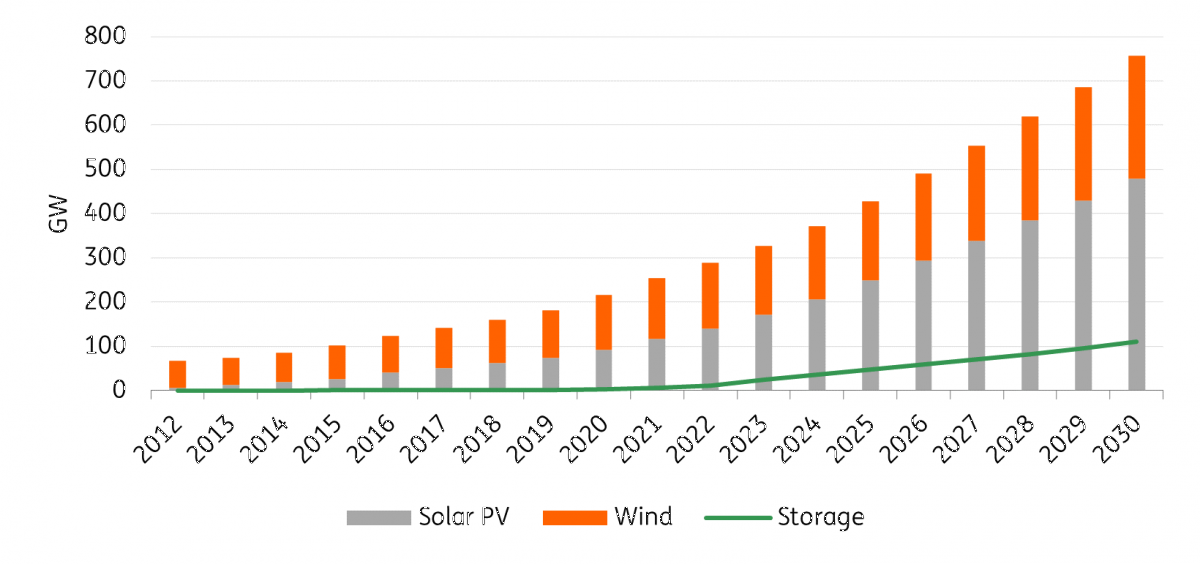

The landmark Inflation Reduction Act, which contains roughly $370bn of clean energy investment, extends current incentives for wind and solar projects for at least 10 years. The IRA has also created two new sets of tax credits for projects that are ‘technology-neutral’ – eligible power generation facilities will need to have net-zero emissions. The IRA also makes investment tax credits available for grid-connected stand-alone batteries – previously batteries needed to be coupled with renewable energy to qualify for federal tax credits. All these would help drive new renewable installations and further drive down cost. Bloomberg New Energy Finance – whose analysis is generally on the more bullish side – estimates that cumulative solar and wind capacity will reach 757 GW by 2030, up from its pre-IRA forecast of 650 GW by 2030. The IRA is also expected to boost storage capacity by 30 GW, hitting 110 GW by the end of the decade.

Estimated 2022-31 tax credits and incentives in the Inflation Reduction Act

Cumulative renewable and storage capacity

The midterm elections, where Republicans have regained control of the House, will to some extent frustrate the Biden administration’s climate agenda. While the IRA is unlikely to be repealed, a Republican-controlled House will add difficulties to the execution of clean energy tax incentives and funding under the IRA. Indeed, Republicans have already indicated they would strictly oversee the spending allocation process.

Besides legislation, the Department of Energy announced in October to have launched the Interconnection Innovation e-Exchange in partnership with several research laboratories. The initiative aims to improve clean energy interconnection through establishing a stakeholder engagement platform, providing data collection and analysis, as well as offering technical assistance to develop region- and state-specific solutions.

Supreme Court decision casts doubts on power sector emissions regulation

At the end of June, the Supreme Court ruled that the Environmental Protection Agency (EPA) does not have authority to put a limit on greenhouse gas emissions from power plants. The ruling was based on the "major questions" legal doctrine that requires explicit congressional authorization for action on issues of broad importance and societal impact. This decision dealt a blow to the Biden administration’s climate agenda by weakening the EPA’s power to issue sweeping regulations from the federal level to curb power sector emissions.

Nevertheless, the EPA is still in possession of power to limit emissions of pollutants such as carbon monoxide, lead, sulfur dioxide, etc.; it can also impose energy efficiency standards to be met by power plants. These measures will not be as effective as the EPA being able to directly regulate carbon dioxide and other greenhouse gas emissions, but it would still be useful in indirectly making it more expensive for coal-fired power plants to operate.

State-level efforts are crucial to renewables deployment and grid improvement

With insufficient federal regulation and a power stalemate in Washington DC, state governments and regulators need to ramp up efforts to decarbonize power plants. Two popular policies are renewable portfolio standards (RPS), which require utilities operating in a state to procure a certain percentage of renewable electricity, and clean energy standards (CES) in the supply of electricity to customers in their service territory. Compliance with the RPS is evidenced through renewable energy credits (REC) which are generated with renewable energy (e.g. 1 MWh of wind powered electricity produces 1 REC). By the end of 2021, 31 states plus the District of Columbia have adopted an RPS or a CES. Some states have also paired their requirements with cost caps to prevent huge increases in customer electricity bills. Bloomberg New Energy Finance estimates that if all current standards are met, renewable energy generation in the US would grow by 82%.

However, these requirements in general are not aligned with the aggressiveness of the Biden administration’s goal. Of the states with an RPS/CES, 22 of them have a 100% clean/renewable electricity goal, but most of these goals are set for around 2050, more than a decade later than the Biden administration’s 2035 target. Moreover, Texas has already achieved its Renewable Generation Requirement established in 1999, and there has not been an updated one. This misalignment means that state-level support is there and will push for more renewable deployment, but are not enough just yet to fill the void of federal policy.

Much effort, such as demand management and weather preparedness, are being made by state entities to improve grid flexibility and stability.

Yet still, much effort, such as demand management and weather preparedness, are being made by state entities to improve grid flexibility and stability. For demand management, one common approach is to enhance reliance on variable retail tariff design and attract demand during non-peak hours. Another emerging approach is for utilities or demand service providers to manage residential load on behalf of customers and be compensated based on avoided costs. Moreover, regulators are experimenting imposing requirements that can facilitate the process. New York State’s Public Utility Commission requires utilities that are exploring transmission upgrades also consider demand management.

On adapting to climate change, California is one of the states that have begun to improve its power system to be better prepared for extreme weather events. After the 2020 heat wave, California has been building backup generation sites, connecting more storage facilities to the grid, and improving coordination mechanisms during emergencies. Admittedly, the state has also extended the life of certain thermal plants, which is evidence that climate concerns will make the power decarbonization path a lot bumpier.

Corporate ESG practices can further drive the demand for renewable energy

As more corporates announce sustainability targets and actions, Scope 2 emissions, or emissions from an entity’s purchased power and heat, have become a focus for companies to decarbonize their businesses. Most companies reduce their Scope 2 emissions through corporate power purchase agreements (PPAs), a long-term contract under which a corporate agrees to buy electricity and the associated RECs from a renewable energy project.

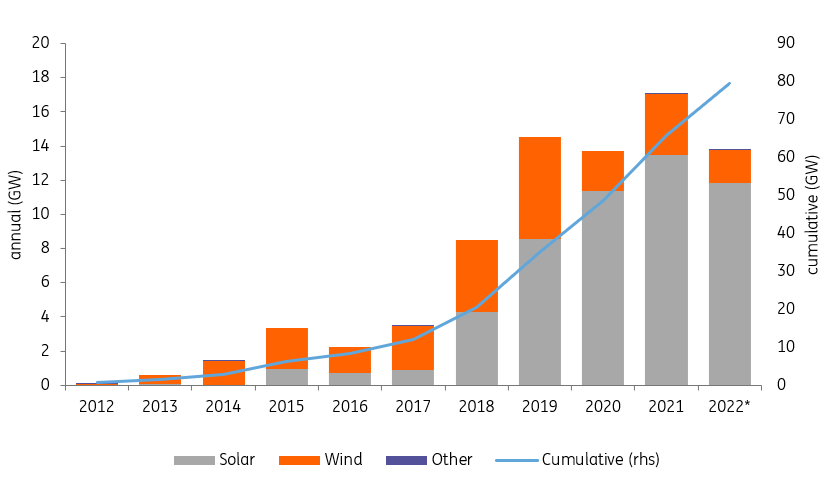

The US has seen tremendous growth of corporate PPAs in recent years: renewable capacity contracted by companies soared from a little over 3 GW in 2017 to 17 GW in 2021, with solar dominating the purchasing portfolio. Such a growth has largely been supported by purchases by tech companies, who are committed to decarbonize their data centers and other operations. While 2022 is likely to see a slowdown in total corporate PPA purchase, there has been a continuing diversification of top buyers, including telecom company Comcast and chemical companies LyondellBasell and BASF. And there is a strong favour for virtual PPAs over physical PPAs, as the former allow the buyer to be in a different electricity market than the renewable project. The share of virtual PPAs of all deals in the US went up from 70% in 2021 to 95% from January-July 2022.

Admittedly, there are challenges for the corporate PPA market. For virtual PPAs, for instance, fixed PPA prices need to be competitive with wholesale market prices for the corporate PPA market to be sustainable, which is not the case all the time. Nevertheless, because of growing corporate sustainability practices, corporate PPAs will continue to play a key role in the long term in driving renewable energy demand in the US.

US PPAs by technology

Top buyers of clean energy in the US in 2022 (Jan-Jul)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article