What companies and investors should know about COP28

COP28 will focus on ramping up efforts and investment in climate mitigation, adaptation and loss and damage control. It's now crucial that companies and investors invest in clean technologies, harness climate finance opportunities and contribute to systems change. Moving forward, they can expect more policy support – but also more policy dilemmas

COP déjà vu?

Do you remember the first COP meeting held in Berlin in 1995? We don’t, so we won’t blame you either. We definitely remember the epic 2015 meeting, however, when the Paris Climate Agreement was signed. It was this meeting that put climate change on the agenda of corporate decision-makers and investors. So, what can they find out from this year’s meeting in Dubai?

COP28 puts the climate challenge in the spotlight once again

The fight against climate change consists of three pillars. Climate mitigation, or bending the global emissions curve towards net zero emissions by 2050, is the first pillar and first priority as global warming continues as long as the concentration of carbon dioxide in the atmosphere increases. So, mitigation policies to reach the Paris Climate Goals will be a central theme for this year's COP as a warning against insufficient ambition and a call to close the cap.

Averting, minimising and addressing loss and damage from climate change

Indicative yearly costs for mitigation, adaptation and loss and damage up to 2030

Climate change adaptation

Adaptation to climate change is the second pillar and is all about minimising climate costs from extreme weather events such as droughts, floods, storms and tropical cyclones. Countries in the global south are expected to be severely impacted, and the 2023 UN Climate Adaption Report expects adaptation costs for developing countries to be around $400bn per year up to 2030.

Even if these mitigation and adaptation policies get financed and are able to materialise, the world will experience loss and damage from climate change – which for developing countries are of equal size as the adaptation costs. So, addressing the loss and damage from climate change is the third pillar of the fight against climate change.

Policymakers, corporate leaders and investors are likely to leave COP28 with the task of increasing investment in low-carbon technologies. Think of more renewables in the power sector, carbon capture and storage in industrial clusters, energy efficiency measures in housing, manufacturing and transportation, and the growth of the hydrogen economy. They will also leave COP28 with the task of speeding up climate-friendly behaviour. This could include increasing recycling rates, sharing cars, getting more people in trains and on bicycles as their primary way of transport, and even encouraging them to eat less meat. Both technology and behavioural changes are crucial in averting loss and damage from climate change and will require about $5,500bn in investment per year globally up to 2030, according to Bloomberg New Energy Finance.

The $400bn annual damage and loss from climate change by 2030 in developing countries represents about 1% of the size of their economies. This number increases to 2-3% by 2100 if global warming is limited to 1.5 degrees Celsius, which seems a manageable cost. However, this number increases to 10-15% if global warming reaches 2.5-3.0 degrees Celsius by 2100 (the current pathway for global warming). Not only is this a large economic loss, but it also requires profound changes in the economy as similar amounts of spending on healthcare or education need to go towards restoring loss and damage from climate change. Not as a one-off, but year after year – and this is a conservative estimate as it does not include the costs of climate tipping points that could accelerate global warming. It also only focuses on CO2 emissions, not a loss of biodiversity or other forms of pollution.

So, we can safely say that the cost of inaction is extremely significant and that there's a high payoff of mitigation policies for society. Climate scientists point out that every dollar invested in mitigation and adaptation policies yields $1.5 to $4 in terms of less damage and loss from climate change.

Can companies and investors harness opportunities from COP’s climate finance targets?

In 2009 at COP15 in Copenhagen, developed countries set a target of providing $100bn per year by 2020 to help developing countries combat climate change. That target has already been missed. Despite an increase in the pace of capital mobilisation, a recent OECD report suggests that by 2021, developed countries were still about $10bn short of the target. While the same report also estimates that the $100bn target is likely to be met between the end of 2022 and 2023, there has clearly been a delay in offering assistance to developing countries.

Target of $100bn in climate finance for developing countries by 2020 was not met

Climate finance mobilised and provided by developed countries for developing countries in 2016-2021 in billion dollars per year

Given the size of the challenge and slow progress – as well as new targets entering the picture – climate finance will feature prominently at COP28 too. A key outcome of last year’s COP27 is that developed countries agreed to form a new fund to specifically help developing countries cope with the loss and damage of climate change. But as the amount, form, and timeframe of this fund are undecided, there could be a few years before the money starts coming in for developing countries. There also remains the big question of whether developed countries will reach the (now undecided) target on time.

These climate finance targets may seem to only concern governments from developed countries. However, they can also provide opportunities for the private sector. Alongside a recognition of the need for a higher level of private-sector involvement in climate financing in developing countries, there are also calls for governments and international institutions (such as multilateral banks) to support, incentivise and de-risk projects in those countries. Supporting mechanisms include loan guarantees, risk insurance and syndicated loans. From the private sector perspective, companies and investors would benefit from building new businesses in developing countries, as well as harnessing opportunities for new technologies. This would also enhance a ‘just transition’ as they would be working to reduce emissions not only in their home countries but also in developing states.

However, this is easier said than done. Companies and investors that hold a more international view of pursuing projects in emerging economies may run up against the current geopolitical discourse. So, discussions on risk mitigation strategies from the tense geopolitical landscape and those on climate support and opportunities in developing countries will feature prominently in boardrooms. As a result, companies and investors need to think about how to better balance the opportunities, risks, and potential resistance. Governments and international institutions need to provide consistent policy and support to minimise uncertainty which would slow down climate finance progress.

COP28 is about mitigation and adaptation, but companies and investors have a broader view

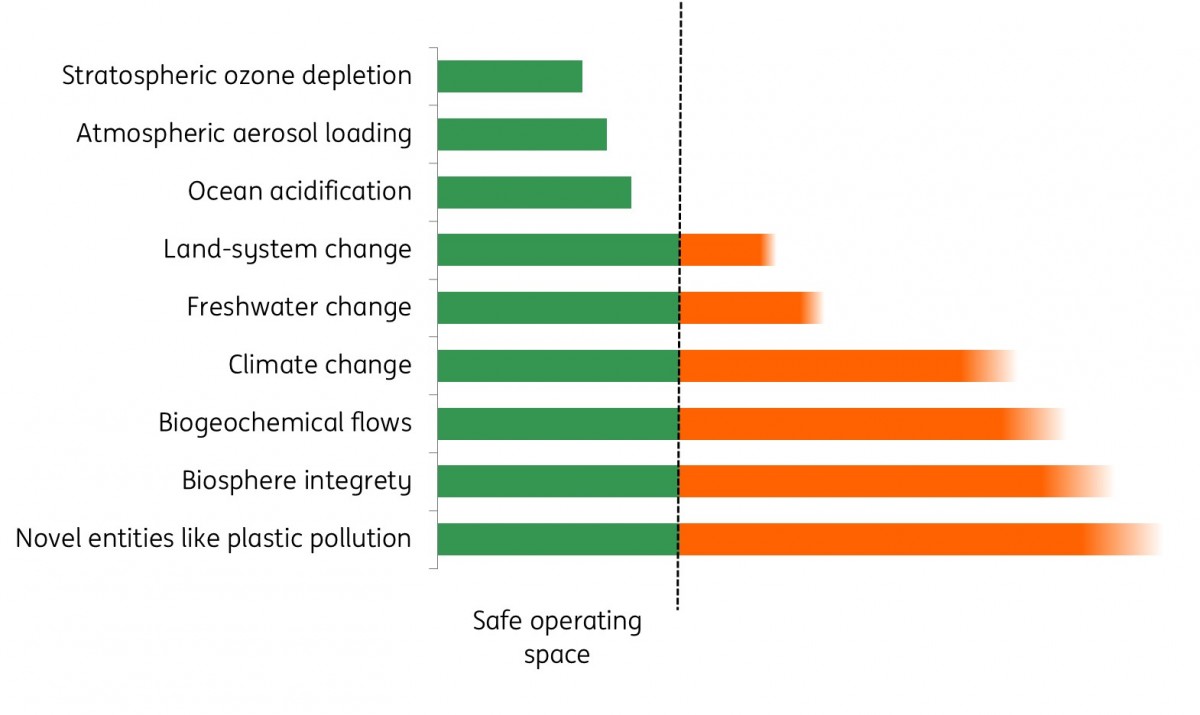

COP’s main focuses are centred on preventing climate change (mitigation), adapting to climate change (adaptation), and dealing with the negative impacts of climate change (loss and damage). But there’s still more to be done. The footprint of companies and investors needs to stay within the planetary boundaries, which is broader than reducing CO2 and protecting from global warming. According to the Stockholm Resilience Centre, planetary boundaries refer to the limitations within which human activities need to stay to ensure the Earth can maintain the stability and resilience of operation. The centre has pointed out that six of the nine planetary boundaries – including climate change, biodiversity loss, freshwater, and novel entities, e.g., plastics pollution – have already been breached as of 2023. This means that the Earth may have already permanently lost the ability to self-regulate and operate in these areas. And that action is needed to operate within the planetary boundaries again.

Currently, six out of nine planetary boundaries have been crossed

The concept of nine planetary boundaries within which humanity can continue to develop and thrive for generations to come

Many companies and investors are already actively tackling some of these problems beyond the core factors of climate change. For instance, petrochemical companies and their corporate customers down the supply chain are advancing plastics recycling technologies to tackle climate pollution. There has also been a surge in efforts from the private sector investing in preserving biodiversity. If carried out correctly, they can go hand in hand with the goal of reducing CO2 emissions. In order to effectively address the different planetary impacts of global warming more comprehensively, we need to see a significant step up in these efforts.

Finally, there needs to be a closer, more critical look at ESG from both the private sector and the government. Climate disclosure policies are being developed in various jurisdictions, with a harmonisation of standards on the horizon. More transparency will incentivise corporates to act, but climate disclosure policies will only be effective if they are supported by government policies facilitating changes to the real economy to stay within the planetary boundaries. This means that companies need to better understand how they can best align their own strategies with relevant government policies.

The fossil fuel debate continues at COP28

The run-up to COP meetings is often far from cheerful – and this year is no exception, with the UN publishing the global stocktake report which clearly shows that much more needs to be done to reduce global emissions. The phasing out of fossil fuels in general – and coal in particular – will feature prominently at COP28. As will efforts to reduce methane emissions and stop deforestation, two other sources of greenhouse gasses.

On the fossil fuel front, we expect more guidance on the topic of unabated versus abated fossil fuels. This could have important consequences for the design of transition pathways for sectors and individual companies.

Carbon capture and storage (CCS) could gain more traction if the importance of unabated fossil fuels is stressed, particularly for hard-to-abate activities like cement, steel, plastic and fuel production. Green technologies that reduce fossil fuel use or aim to phase it out completely will feature more prominently if COP28 takes a more negative stance on both unabated and abated fossil fuels and stresses the need to phase out fossil fuels.

COP28 to trigger discussion about progress on green technologies...

So far, progress on green technologies has been mixed over the past two years. Progress on solar panels, electric vehicles, batteries and heat pumps was more or less in line with scenarios for a net zero economy, although the pressure is on to accelerate towards 2030 and beyond.

But progress on energy efficiency, electrification, wind turbines, CCS, green hydrogen and nuclear power is not on track. Technologies for increasing energy efficiency are proven and mature; they just need to be implemented at a higher pace. Companies and investors should expect a lot more policies on that front if policymakers are serious about fighting climate change. The same applies to wind energy – although the sector is suffering from tough market conditions, so policymakers need to step in if they want to speed up the rollout of wind farms.

Other technologies such as large-scale electrification (think of industrial heat pumps), green hydrogen, and recycling technologies are often less mature but are much needed to green the energy-intensive sectors. Companies and investors need to invest in R&D and pilot projects so that these emerging technologies can be scaled up faster, and policymakers can provide support if they intend on following through with the greening of hard-to-abate sectors. Think of sustainable aviation fuels in shipping and aviation or increased recycling and green hydrogen use in steel and plastics production.

Important technology and policy milestones towards a net zero economy

IEA’s milestones in its’ updated 'net zero scenario'

...and system change

In addition to speeding up green technologies, the private sector also needs to think about decarbonisation from a systemic perspective. Currently, they tend to only focus on investing in clean technologies that make existing production less carbon-intensive. While greentech solutions are much needed, their impact is often significantly lowered by rebound effects. The electrification of light-duty vehicles, for example, goes hand in hand with the production of larger and heavier cars that are less energy-efficient. The greening of homes often encourages people to increase their comfort levels, as it's easy to turn the thermostat a little higher when the energy bill is lowered with better insulation.

This is why the transition towards a net zero economy requires system changes that go beyond technical solutions. For example, companies can promote environmentally friendly behaviour and implement accompanying supporting policies. The topic of system change has not featured prominently on the COP agenda yet, but we’ll expect more calls for it as governments, companies and investors try to close the emissions gap.

Low expectations for a smooth and linear transition

In the long term, companies and investors should expect policies to support new technologies and system change. But in the short to medium term, there are possibilities of policy uncertainties and even detours, depending on jurisdictions.

Europe is a pioneer in climate policymaking and has the highest level of policy consistency. However, there could be discussions about whether the region’s targets are too ambitious, especially given the many challenges in terms of labour shortages, congestion in power grids and long permitting procedures. And there might be a backlash when parties on the right wing of the political spectrum win elections, as we have seen recently in Italy and the Netherlands.

The picture in the US is far more mixed, where administration changes could continue to result in a back-and-forth on climate policy. Thus, companies and investors need to be prepared for policy disruptions and set up more resilient long-term strategies if they are serious about staying within the planetary boundaries.

In Asia (where there's a large percentage of developing countries) we would continue to expect pushback on climate target setting, with arguments that these economies still need fossil fuels (abated or unabated) to power economic development. In Asia, corporates and investors can expect a dual track of development with fast renewables adoption but continued reliance on fossil fuels.

Companies to become key players in closing the global warming gap

Despite increased efforts, there is still a huge gap between what is needed and what has been done to keep global warming within a 1.5 degrees Celsius increase. The consequences of climate change – including extreme weather conditions and related health and migration challenges – will become more evident in the coming years, fuelling the debate on mitigation and adaptation policies and measures to cope with loss and damage. Governments are the main players at COP, but companies and investors also have a significant role to play. We expect more companies at COP28 than last year – a trend that is likely to continue at future COP meetings.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article