How the plastics industry can go green and at what cost

Technology is slowly advancing in a way to green the plastics industry. Carbon Capture and Storage (CCS) and recycling are currently the most cost-effective ways to halve emissions. Heating with green electricity or green hydrogen could reduce emissions by up to 75% but costs a lot more

The plastic problem

From food packaging to housing to medical instruments like syringes, plastic is a vital material in our everyday lives. While the invention of this lightweight, strong, waterproof material has changed the world for the better in many respects, it comes with significant drawbacks: it’s based on fossil fuels, it’s hard to recycle and it barely degrades once it ends up in the environment. What’s more, plastic is cheap and demand is growing, so its climate impact is likely to increase. The good news is that technology is developing to such an extent that we can envisage a world where plastic production could be seen in a whole new eco light.

In this article, we’re going to look at all the ways of limiting the CO2 impact of fossil-based plastics, including capturing and storing the carbon emissions from plastic production, using recycled plastics, and changing the energy source from gas to green electricity or green hydrogen. To be sure, this will be an evolution rather than a revolution as plastics remain fossil-based. But it’s an important start and we’ll get to non-fossil-based plastics soon in another article.

The investment challenge

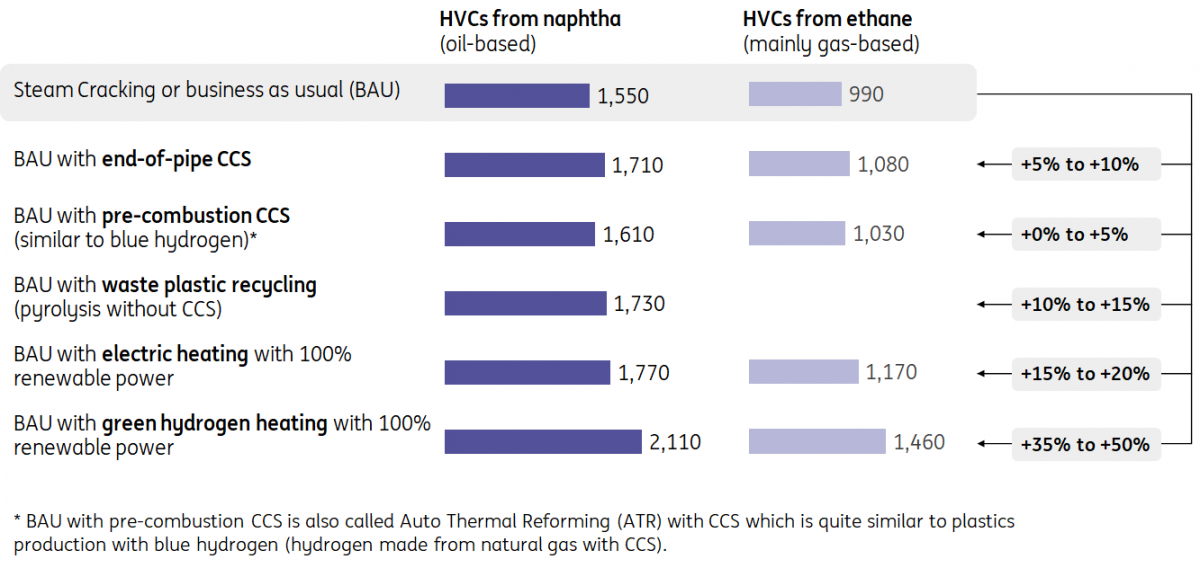

Greening oil- and gas-based plastics comes at a cost. From a North-Western European perspective, the capturing and storing of CO2 (a technology called CCS) is currently the most cost-effective technology to reduce emissions. This barely raises the cost of the High Value Chemicals (HVCs) out of which the many forms of plastics are made. And more importantly, the plastic carbon footprint is reduced by up to 60%.

The biggest climate impact comes from greening the vast amounts of energy needed in plastic production. Electric heating with renewable power or heating with green hydrogen can reduce emissions by as much as 75% and set the industry on a pathway close to net zero. But these technologies are less mature, more expensive and could increase the cost of plastic by up to 50% as a result.

The transition towards a circular economy can lower the plastic carbon footprint through recycling by as much as 45% at a +10% to +15% cost increase. But this is a less stable outcome as it depends on so many assumptions and best practices in the industry that are questionable. We’ll go into these complex issues in a bit, but first we present our main insights into costs and carbon emissions in two visuals.

Greening oil- and gas-based plastics comes at a cost; carbon capture and storage (CCS) is currently cheap, green hydrogen still expensive

Indicative costs for different oil-based plastics (naphtha) and gas-based plastics (ethane) in euros per ton High Value Chemicals (HVC)

Greening oil- and gas-based plastics can lower emissions by 40% to up to 75%

Indicative emissions for different oil-based plastics (naphtha) and gas-based plastics (ethane) in ton of CO2 /ton of HVC

The benefits of carbon capture and storage

CCS is a readily available and cost-effective technology in the fight against global warming.

CCS has not been applied a lot in plastic making yet, as it is not mandatory, and carbon is often not yet sufficiently priced across the globe. The European carbon price of around €85 per ton of CO2 has started to bite, but it has only reached these levels since 2022. That’s too early for CCS capacity to grow as it takes years before CCS projects are completed.

Our calculations indicate that CO2 emissions would be reduced by 50% to 60% if CCS were applied to the current or ‘business as usual’ technologies to produce plastics. And it is the cheapest technology available. But despite these impressive stats, CCS is subject to intense debate.

Pragmatists argue that CCS offers quite a substantial reduction that can be implemented relatively easily once the infrastructure to transport and store CO2 is in place. They advocate the view that the climate benefits from every ton of carbon that does not enter the atmosphere. Idealists argue that CCS does not bring about ‘true change’ that is so urgently needed and keeps alive an industry that is heavily dependent on fossil fuels. In their view, it matters how the emission reduction comes about.

We sympathise with both views and the decision is ultimately up to society, not us. As economists we point out that CCS is a technology that could substantially reduce emissions relatively easily, fast and cheaply. It can be a first step towards a full redesign of the complex petrochemical processes that make up plastic production. In the meantime, technologies that bring about more radical change could mature and become more readily available.

Don’t be overly optimistic on plastic recycling

Currently, used plastic is mostly incinerated or landfilled across the globe. Even in Europe, the continent that is quite keen on transitioning towards a circular economy, only 8% of plastic is recycled, according to Nova Institute. That is a shockingly low number given the fact that virgin plastic production is carbon-intensive and that plastic waste is very polluting to the environment.

So many agree that recycling rates need to increase. It turns out, however, that the carbon impact of recycled plastic is not straightforward. Plastic recycling is a process that generates CO2 emissions in itself. Think of emissions from the recycling plant (Scope 1 emissions) and the energy that powers it (Scope 2 emissions). Here, everything is quite clear.

The difficulty starts once one enters the complex, intransparent and very challenging world of calculating what is called ‘avoided emissions’, also called Scope 4 emissions. These are emissions that are prevented from arising by using recycled plastics instead of producing virgin plastics. Think of:

-

The avoidance of resource depletion as less oil is needed for recycled plastics compared to virgin production.

-

The avoidance of waste pollution (think of plastic soup) which has ecological benefits that can be measured in CO2-equivalents through a Life Cycle Assessment.

-

The avoidance of CO2 emissions from waste incineration or landfill. Plastics that are recycled are not burnt or landfilled and these avoided emissions could be seen as supportive of plastic recycling.

-

The avoidance of virgin plastic production by using recycled plastic. If one uses recycled plastic one does not have to produce virgin plastic that generates high emissions.

The basic question with plastic recycling is whether or not to attach negative carbon content to avoided emissions. If one does, plastic recycling becomes a carbon offset. The recycled feedstock counts for negative emissions while the recycling process itself has Scope 1 and 2 emissions. The net impact of Scope 1 and 2 emissions and the carbon offset (Scope 4) is highly debated at best, but more often it is simply not mentioned or not specified at worst.

Unfortunately, there is no policy rule or common practice that treats these Scope 4 emissions in the same way. That’s why one sees a very wide range of emission reduction potential for plastic recycling.

That would not be much of a problem if recycled plastic still yielded lower emissions compared to virgin plastic. The problem is that Scope 1 and 2 emissions from plastic recycling can outweigh the emissions from virgin plastic production. In other words, recycling sometimes needs a carbon offset in order to beat virgin plastic production. If no credits are applied to recycled plastic for avoided resource depletion, avoided pollution, avoided incineration and/or avoided virgin production, the CO2 footprint of plastics recycling can be much worse compared to virgin production. The devil certainly is in the details when it comes to plastic recycling.

So we have looked at chemical recycling through pyrolysis. The 'tech explainer' at the bottom of this article outlines what pyrolysis is. We also applied a carbon offset for recycled plastic as that is common practice in the literature. However, we’ve noticed that many researchers work with the upper or most favourable values from the wide range of values for the carbon offset.

We are not so comfortable with these stretched values for carbon offsetting as the outcome is highly sensitive to this number. Lower values could turn recycling into a more harmful activity compared to virgin plastic production. So, we have applied a mid-range estimate for the carbon offset. In doing so, we acknowledge the fact that recycled plastic comes with avoided emissions, but we don’t stretch this to the max. Ultimately, global warming and climate change are determined by absolute emissions, not so much avoided emissions. In doing so, plastic recycling results in 40% to 45% lower emissions compared to virgin plastic production (see the emissions graph above).

Apart from the important question of whether or not recycled plastic should be viewed as a carbon sink, there’s another reason to not be overly optimistic about plastic recycling. Global demand for petrochemicals – including the raw materials for plastics - is likely to almost double by 2050, according to Bloomberg New Energy Finance and the Nova Institute. In such a world, and even if all plastic is reused, recycled plastic can only meet 50% of the total plastic demand. So recycling is part of the solution, but not the only solution. And one must always carefully gauge if emissions are lowered or not.

CO2 impact of electrification and hydrogen use depend on grid emissions

Plastic production requires high temperatures and hence a lot of energy. In Europe, the heat is generally generated by burning natural gas, which results in carbon emissions. By shifting to more sustainable energy sources, plastics remain oil- or gas-based, but the vast amount of energy needed in the production process comes from non-fossil sources.

Electrification with fully renewable power would lower emissions by up to 75%. And heating with green hydrogen from electrolysers that fully run on renewable power would lower emissions by up to 70%.

The power source matters a lot in electrification and green hydrogen. The climate is worse off if the power is mainly generated by coal-fired power plants. Emissions would increase compared to the current way of plastic production, especially with direct electrification of heat. In that case, it is better to use gas as a heating source in plastics production than to replace it indirectly with coal through electricity.

So, the prerequisite for electrification and hydrogen strategies in plastics production is that the vast amount of power comes from low-carbon sources such as solar panels, wind turbines, hydropower or nuclear power plants. Or from gas or coal-fired power plants that capture and store most of the CO2 emissions.

Whether or not electrification and green hydrogen are good for the climate depends on how the power is generated

Indicative CO2-emissions per ton High Value Chemical (ton CO2/ton HVC)

Companies tentatively invest in new technologies, but not on a large scale yet

All of these technologies are not simply theoretical exercises. This is what plastics producers are currently doing to green production.

Carbon capture and storage has not yet been applied although the sector is considering it. Project ONE, for example, is a game-changing investment by INEOS to construct an ethane cracker in the Antwerp petrochemical hub. Hydrogen is used as a zero CO2 fuel for its furnaces, all electricity will come from renewable energy through large wind energy contracts with Eneco, Engie and RWE, and – in the future – remaining carbon emissions will be captured and stored. Unfortunately, the project is currently on hold after the permit was rejected in a court appeal due to its nitrogen emissions.

Lyondellbasell has started operating a new pilot plant for chemical recycling based on pyrolysis (see the tech explainer at the bottom of this article). The plant converts plastic waste into feedstock for virgin plastic production. The demo project is still small and capable of processing 5–10 kg/hour of post-consumer plastic waste, but the company is planning for a final investment decision in a full-scale German plant later this year. The technology has been developed in partnership with Germany’s Karlsruhe Institute of Technology. Plastic Energy is doing similar things in the UK as it has built a chemical recycling pilot plant in its research & development labs.

BASF, SABIC and Linde have begun electrifying a steam cracker at the huge Ludwigshafen chemicals complex in Germany, as they seek to show through this demonstration project that the sector can electrify its heating source.

Shell and Dow have entered into a joint development agreement to accelerate technology to electrify ethylene steam crackers. The use of electricity instead of fossil fuel combustion to heat the cracker furnaces could yield a very significant reduction in carbon emissions. Innovation teams in both the Netherlands (Amsterdam and Terneuzen) and the US (Texas), are focused on designing and scaling ‘e-cracker’ technologies. First at the laboratory and pilot scale, after which commercial crackers will follow.

So, the sector is experimenting with all the technologies of this article. Unfortunately, most of the technologies are still in the pilot or demonstration phase, so there’s still a long way to go before they have a sizable impact. That raises the question of why change is taking so long.

Why it is hard to act fast

The petrochemicals and plastic industry is widely regarded as a conservative sector characterised by large incumbents that rely on fossil-based technology. Entry barriers are high and hence change has been slow.

The economics don’t help either. ‘Greener plastics’ are more expensive and, unfortunately, this price gap is not easy to close. Our calculations suggest that all else being equal, the following would make greener plastics cost competitive with current plastic production.

Carbon capture and storage: the cost of emitting CO2

An increase in the EU's ETS carbon price from €85 per ton of CO2 today to about €150 per ton would make many CCS solutions cost-competitive. According to the latest forecast from the Netherlands Environmental Assessment Agency, this will not happen before 2036 (base case scenario) or 2030 (high carbon price scenario).

Recycling: technology costs

The technology costs of chemical recycling need to be cut in half, which requires years of piloting and scaling up the technology as well as building the supply chains for recycled plastic.

Electrification: the cost of electricity

Power prices need to be half of the current €125/MWh to make electric heating cost competitive with gas-based heating at current gas prices of €55/MWh. This is unlikely to happen soon in Europe's main chemical cluster; the ARRRA-region which spans Antwerp, Rotterdam, the Rhine waterway, the Ruhr region and Amsterdam. In this North Western European power market, gas-fired power plants remain the price-setting technology for the coming years. As a result, power prices will only halve if gas prices come down a lot. But that would lower the cost of current plastic production too, so the price gap remains. As long as gas-fired power plants are an integral part of power systems, this will remain a catch-22 situation.

This is not the case in Scandinavian power markets, in particular, the northern bidding zones that benefit from a large supply of cheap hydropower and relatively low power demand. Here, power prices currently range from €18/MWh to €35/MWh instead of €125/MWh. And power prices are less dependent on gas prices. As a result, it is not surprising that new initiatives to green hard-to-abate industrial sectors are happening in these regions, for example in the production of green steel where Blastr is planning to build new hydrogen-based steel plants from scratch in Norway and Finland and source cheap electricity. But while these regions are likely to attract new initiatives for green plastics too, it is hard to see the vast industrial cluster in the ARRRA region relocating completely. And if it does, it is likely to be a long process in which current production has to become greener too, in order to meet the climate goals as the European Emission Trade System pushes heavy emitters to become net zero by 2040.

Green hydrogen: the cost of electrolysers and electricity

Green hydrogen heating would become cost competitive in the ARRRA region with current electrolyser costs if power prices drop from €125/MWh to €20/MWh. This is very unrealistic as it implies power prices that are twice as cheap as the long-term average and that are only seen during the Covid-19 pandemic when power demand was exceptionally low.

Green hydrogen heating can become cost-competitive through a combination of cheaper electrolysers and lower power prices. As a reference; a 90% drop in electrolyser costs combined with power prices of about 40/MWh (the long-term average) would make green hydrogen heating cost-competitive with current gas heating. But such a reduction in electrolyser costs would take years of R&D, scaling up and building the hydrogen infrastructure. It represents green hydrogen costs of around €1.5 to €2/kg, which in real terms, could be achieved somewhere between 2035 and 2040 according to Bloomberg New Energy Finance. Low-cost regions like China, Brazil, Africa, the Middle East and Australia are likely to see this sooner (around 2035) than high-cost regions like Europe (around 2040).

And power prices can only go back to their long-term average once geopolitical tensions ease and gas becomes a lot cheaper. And that would reduce the cost of gas heating too.

The Inflation Reduction Act offers green hydrogen producers in the US a subsidy of $3/kg. The European Commission considers a similar subsidy for European producers of green hydrogen (€3/kg), which would lower the cost of green hydrogen in the ARRRA region from €7/kg to €4/kg at current power prices. This is a sizable cost saving, but still leaves plastic production with green hydrogen heating 10% to 15% more expensive compared to the current practice of steam cracking with gas heating.

So, the cost competitiveness of green plastics is a complex and dynamic process that involves both making green technologies cheaper and current plastic production more expensive (for example through higher carbon prices or lower ‘fossil subsidies’). Substantial change is only expected if these things come together.

Greening the plastics industry is a global challenge

We’ve approached the greening of the plastics industry from a European perspective, but we acknowledge that most of the growth comes from outside Europe, most notably Asia. Greening the plastics industry is therefore truly a global challenge.

The vast majority of steam crackers across the globe that produce the high value chemicals for plastic production are located next to refineries as they produce the naphtha and ethane that feed the crackers.

Global capacity of these main petrochemical building blocks has grown by 56% between 2010 and 2022 to around 524 million tons per annum (mtpa). From the roughly 188mtpa of capacity added over this period, 82% of this was driven by Asia. And unsurprisingly, North Asia is largely behind this, making up 70% of total global capacity additions, which is mainly driven by China.

Growth in high value chemicals production is driven by Asia

Global capacity in petrochemicals in million ton per annum (mtpa), representing ethylene, propylene, butadiene, benzene, toluene and mixed-xylenes

In North America, capacity has grown by 22% since 2010. This increase in capacity will be largely driven by ethylene, where capacity has grown from a little under 33mtpa in 2010 to more than 51mtpa in 2022. The shale revolution in the US has enabled the growth, given access to cheap feedstock, particularly gas-based ethane.

In Europe, the industry has struggled. Capacity has clearly peaked and in fact, has fallen over the last decade. This is a trend that is unlikely to reverse given high energy prices, along with the growing regulatory and carbon burden on the European industry.

Therefore, any ambitions to reduce the carbon footprint of the petrochemicals industry and attempts to green it will need a coordinated approach in order to be effective. Given that around 60% of capacity sits in Asia, and the expectation that the bulk of future capacity growth will continue to be driven by Asia, it is important that the region is on board.

Europe and the US could become frontrunners in the development of green plastics and show the world that they are scalable. However, transferring these technologies to Asia will be a major challenge given Asia’s high dependency on fossil fuels, the higher costs involved in pursuing more sustainable production processes and increasing geopolitical tensions.

Conclusion: technology is important but not the only solution

We’ve looked at the economics and CO2 reduction potential of technological solutions to green the plastics industry. Luckily, a rich set of technologies is available to set the sector on a pathway to net zero emissions. But the industry should not solely rely on these tech-solutions. Policies to temper the demand for plastics also have a role to play as the UN Treaty to End Plastic Pollution rightly points out. Companies in the plastics industry and policymakers should embrace both if they are serious about solving the plastic problem.

Appendix: the 'tech solutions' explained

The process of making plastics is fairly complex. We are economists and focus on the business case of the different technologies both in terms of costs and carbon emissions. In doing so, we have stripped down the technology to its base. The industry also makes hundreds of different types of plastics that show up in end-products, but all are made from a limited number of High Value Chemicals (HVCs): the feedstock out of which end use plastics are made. We therefore follow the common practice of modelling the HVCs and omit the last step in the production process towards all the different plastics that we use.

This article focuses on the greening of plastics from naphtha (oil-based) and ethane (mainly gas-based)

The plastics value chain: from oil and gas to plastics, rubbers and fibers

Five ways to green fossil-based plastics

We identify and model five main technologies of oil- and gas-based plastics production in terms of costs and CO2 emissions. We start with the current way of plastic production through steam cracking with natural gas. Then we explore technologies to reduce emissions from steam cracking by applying carbon capture and storage (CCS), using recycled plastics, the electrification of heat or heating with hydrogen instead of natural gas.

Steam cracking is the common way of making high-value chemicals. It cracks or breaks down the long strings of hydrogen and carbon atoms from naphtha and ethane into smaller strings of ethylene, propylene and aromatics through the use of steam. It requires a lot of energy and thus creates a lot of CO2 emissions. Hence, the business case is driven by prices for naphtha, ethane, CO2 and energy and the technology costs.

Steam cracking is the common way of making high value chemicals (HVCs)

From oil and gas to HVCs

The carbon emissions from steam cracking can be captured and stored underground (Carbon Capture and Storage or CCS) or used in other parts of the economy (Carbon Capture Utilisation and Storage, or CCUS). CCS can be applied at different stages in the process: at the end of the chimney (end of pipe or post-combustion CCS) or earlier on in the process (pre-combustion CCS). CO2 capture rates for pre-combustion CCS are slightly higher as the CO2 stream is purer and easier to capture. We have assumed that 75% to 85% of the emissions can be captured with CCS and hence do not enter the atmosphere so they don’t contribute to global warming.

Steam cracking with end-of-pipe CCS

From oil and gas to HVCs

Steam cracking with pre-combustion CCS

From oil and gas to HVCs

More plastic recycling reduces the need to produce virgin plastics. Plastic recycling re-uses the carbon content of existing plastics so they don’t enter the atmosphere once the plastics are burnt in a waste incinerator that does not capture and store CO2 emissions (the current way of plastic disposal apart from landfilling). For sure, recycling activities also create emissions as used plastic needs to be collected, transported and processed. It is the net balance that matters and if done correctly, recycling can lower emissions.

Recycling can be done in two ways.

Mechanical recycling cuts plastics into small pieces through a process of grinding or granulating out of which new plastics are made. It is hard to model mechanical recycling as waste collection varies from country to country and even between municipalities. It is a very local business and prices differ based on local circumstances. Usually, this is a process of downcycling; since there are so many types of plastic, recycling yields a blend of plastic out of which only lower-grade plastics can be made.

Chemical recycling provides a way to recycle the carbon content on a molecular rather than product level. It provides a pure carbon source out of which all kinds of plastics can be made again, both high and low quality. It can be done through gasification where the plastic reacts with oxygen to form syngas which can act as a feedstock to produce HVCs. Or through pyrolysis where the plastics are heated (but not burnt) to form for example pyrolysis-oil which can be a feedstock to produce HVCs (comparable to oil-based naphtha).

Both gasification and pyrolysis are chemical processes that operate on typical petrochemical sites rather than the typical waste recycling and incineration sites. Note that the process of chemical recycling generates considerable CO2 emissions. These are quite dirty processes. But they also prevent CO2 emissions from the incineration of existing plastics. On balance, it can lower carbon emissions from plastic production, but we’ll present more on this in the main text as the details matter a lot.

Emissions from chemical recycling can be reduced further by applying CCS, but this is not done in practice yet. We have modelled the pyrolysis route based on current market prices and technology costs in the North-West-European market without the application of CCS.

Steam cracking with chemical recycling of plastic

From oil and gas to HVCs

Steam cracking operates at temperatures between 800 and 900 degrees Celsius and thus requires vast amounts of energy. Usually, these high temperatures are generated by burning gas (in Europe and the US) or coal (in China and India) which results in high CO2 emissions. These temperatures can also be generated by electric furnaces that run on (renewable) power. Therefore, we’ve also analysed the business case of replacing a traditional gas furnace with an electric furnace.

Steam cracking with electric heating (electrification)

From oil and gas to HVCs

Last but not least, the heating can also be provided by burning green hydrogen instead of gas. Note that plastics production in this case remains fossil-based, but the energy is provided by the non-fossil source of green hydrogen. In a forthcoming article, we’ll also model plastic production based on green hydrogen: a methanol solution that can be completely fossil-free.

Steam cracking with green hydrogen heating

From oil and gas to HVCs

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more