What can China’s key economic activity data tell us about growth drivers in 2024?

China's data featured soft consumer and real estate data but stronger-than-expected investment and industrial data ahead of a potential stimulus rollout, indicating a potential shift in growth drivers for 2024

Data confirming several trends for 2024

China’s National Bureau of Statistics has published the key economic activity data for January and February, our first look at the main “hard” data of the year, and filled in the gaps on how the economy started off the year.

There were mixed signals from the early data, but we can confirm several trends. First, overall economic momentum has remained soft in the first two months of the year, necessitating additional need for stimulus. Second, real estate will remain a drag on the economy this year, and other investment will need to pick up the slack. Third, a slowdown in retail sales illustrated that it will be difficult to rely on consumption alone this year to achieve the 5% growth target.

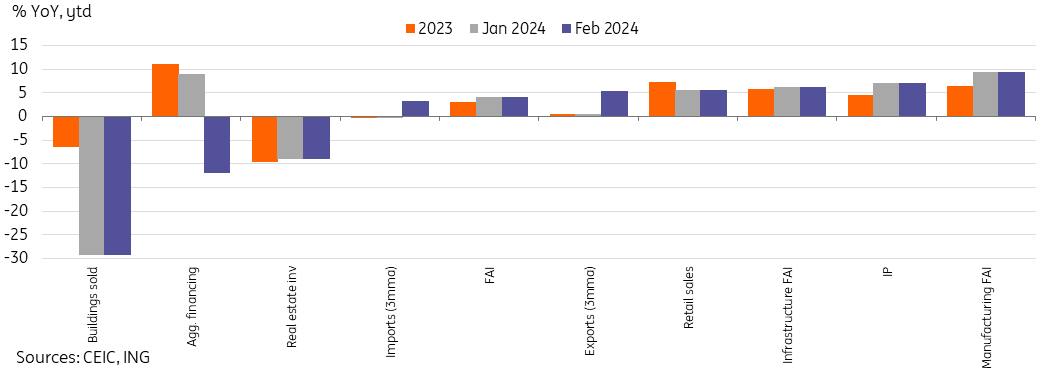

China activity monitor

Shifts in economic growth drivers can be observed in early 2024

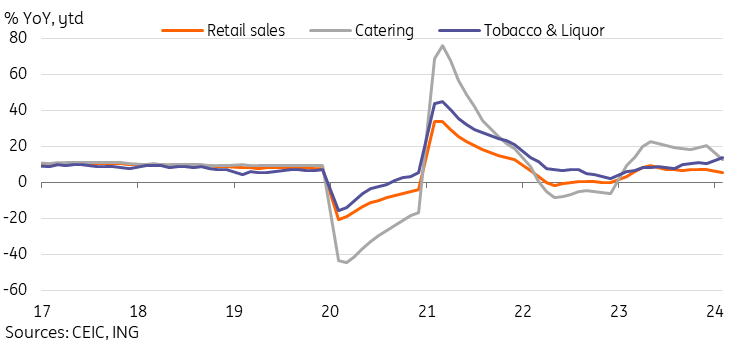

Retail sales slowed but “eat, drink, and play” theme off to a strong start

Consumption was the main driver of growth in 2023, but early data indicates that it will be difficult to rely on consumption alone to achieve the growth target this year. Retail sales slowed to 5.5% YoY ytd, which came in slightly below market but slightly above our expectations.

By sub-category, we can see that the “eat, drink and play” theme is off to a strong start. Catering, tobacco and alcohol were up 12.5% YoY ytd and 13.7% YoY ytd respectively. Sports and recreation goods also rose 11.3% YoY ytd. All of these were well over the headline growth number.

Communications devices and auto sales also saw a solid start to the year, up 16.2% YoY ytd and 8.7% YoY ytd respectively, as the replacement cycle benefits the former, and continued new energy vehicle (NEV) subsidies benefit the latter.

Online retail sales continued to grow faster than the headline numbers, up 14.4% YoY ytd. This category will likely continue to outperform as various forms of e-commerce continue to gain popularity.

Retail sales of housing appliances and furniture had a weak start to the year at 5.7% YoY ytd and 4.6% YoY ytd respectively, likely due to the weak property sector limiting demand. However, with this year’s policy expected to encourage trade-ins of old products for new, these categories should pick up later in the year.

China's retail sales slowed at the start of the year

"Eat, drink, and play" theme will outperform in 2024

Property remained a major drag at the beginning of the year

Unsurprisingly, after earlier-published 70-city home price data indicated that the trough for the property market had not yet been confirmed, real estate investment had a very weak start to the year.

Real estate investment fell by -9.0% YoY ytd, which was a smaller contraction than the -9.6% YoY seen in 2023, but still weaker than expectations. For new residential housing starts by floor space, the contraction widened to -30.6% YoY ytd.

The sales value of newly built residential properties contracted sharply by -32.7% YoY ytd. Office and commercial properties fared better, up 9.9% YoY ytd and 12.5% YoY ytd respectively.

The sentiment index has yet to bottom out as well, falling further from 93.34 at the end of 2023 to 92.13 in February, a new all-time low. With little sign of a turnaround in sentiment so far, we expect property to remain a major drag on growth this year.

Real estate related indicators have yet to confirm a bottom

Fixed asset investment beat expectations on stronger infrastructure and state investment

Despite this larger-than-expected drag from the property sector, fixed asset investment surprised on the upside to start the year, up 4.2% YoY ytd. This can be explained by the outperformance of two main categories.

As expected, infrastructure investment continued to outperform the headline fixed asset investment (FAI) growth in the first two months of the year, up 6.3% YoY ytd. We think that infrastructure investment will be a focus for fiscal policy support this year, as achieving the 5% GDP growth target will be challenging without ramping up investment, and as infrastructure remains an area where there can be productive investment. Manufacturing FAI also saw strong growth at the start of the year, up 9.4% YoY ytd, the highest level since October 2022.

Government and SOE investment also picked up to 7.3% YoY ytd in the first two months of the year, which may reflect the continued impact of last year’s fiscal stimulus package. With the fiscal stance remaining supportive this year, we expect this to translate into more economic activity data as the year continues.

Fixed asset investment beat expectations to start the year

Infrastructure and state-led investment should continue to outperform

Industry continued its recovery at the start of the year

Value added by industry saw a solid start, up 7.0% YoY in the first two months of the year, continuing a recovery that started in 4Q23. This recovery was significantly stronger than expected.

By industry, the main areas of strength were seen in the "computers, communications, and other electronic equipment" category, which rose 14.6% YoY ytd. Transportation equipment manufacturing also performed strongly, rising 11.0% YoY ytd.

In terms of commodities industries, rubber and non-ferrous metals performed strongly at 13.1% YoY ytd and 12.5% YoY ytd.

Amid encouraging industrial production data and a more favourable PPI-CPI spread, we expect to see industrial profits bottom out and gradually recover this year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more