What a bearish re-steepening of the Treasury curve could mean for FX

The dollar continues to nudge lower as investors re-assess the Fed tightening cycle. Before the market rushes into 'risk on, dollar-off positions', we think US interest rates can actually rise over the coming months – particularly at the long end of the curve. So what would bearish re-steepening mean for FX markets?

A brief period of re-steepening

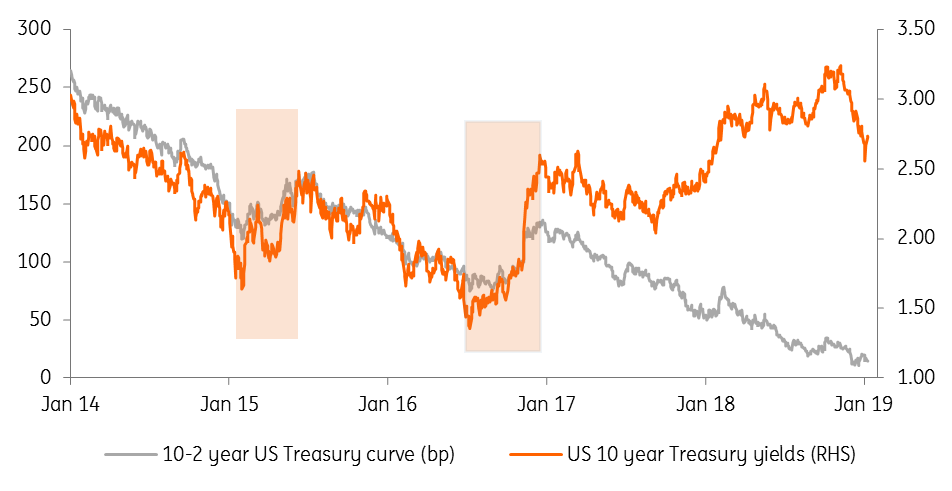

2018 was all about the bearish flattening of the US Treasury curve and whether a move in the 2-10 year curve close to zero meant a US recession was imminent. After the sharp Trump/Fed/equity-led decline in US rates over the last two months of 2018, our interest rate strategy team now think the next major move in the US curve is a bearish re-steepening – perhaps by some 25bp.

Some modest thaw in US-China trade relations, perhaps even a chance of a second UK Brexit referendum or US data showing the economy isn't slowing sharply could all drive ten year Treasury yields higher. US price data could also do it, since the US 10-year term premium at -47 basis points remains incredibly low – especially since our macro team sees US core inflation heading into the 2.4/2.5% year on year area this summer.

The short end of the US curve looks far more anchored given the Fed’s recently adopted stance of 'watching and waiting'. In this environment, our team sees the US 2-10 year Treasury curve re-steepening to the 35-40bp area from 15bp yesterday. What will all of this mean for FX?

Bearish re-steepening of US Treasury curve seen in 2015 and 2016

How did FX perform during prior periods of Treasury curve steepening?

Since the flattening of the US yield curve since the start of 2014, we identify two periods of bearish steepening: i) early 2015 and ii) late 2016. The first coincided with a sharp recovery in oil prices and the second was President Trump’s victory and the promise of reflationary policy.

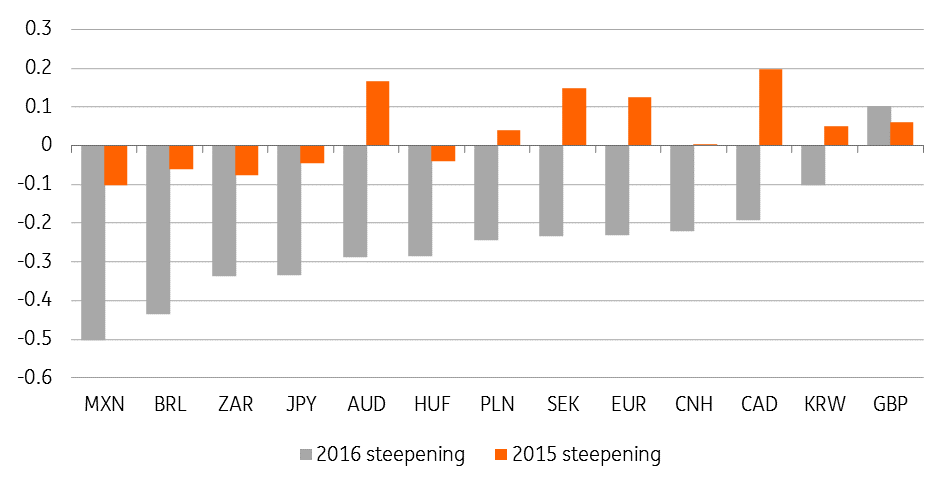

The dollar was generally firmer during both of these periods, though with large variations per currency. In the chart below, we highlight the daily correlations between the changes in dollar pairs and daily changes in the 2-10 year US yield curve during the two periods. 2016 steepening saw consistent positive dollar correlations but 2015 was more mixed.

Correlation between currency per USD and US 10-2 year Treasury curve

How will FX perform?

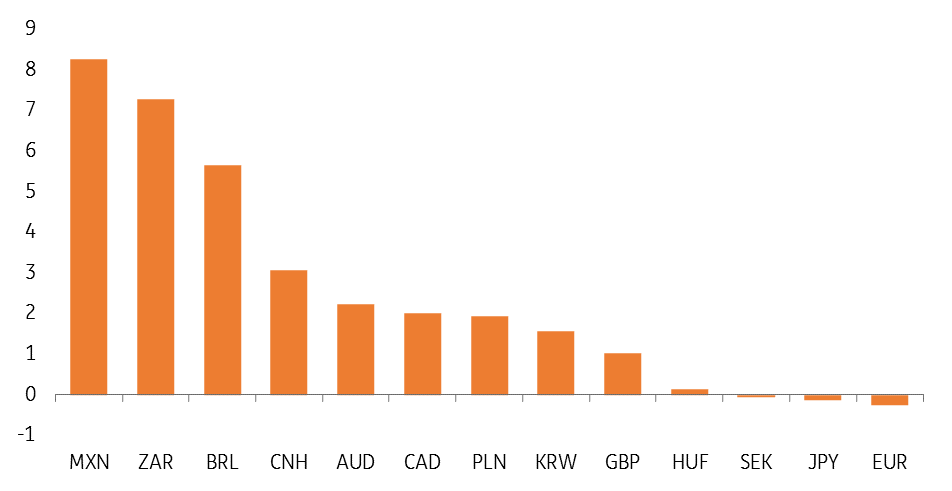

Historical correlations suggest a bearish re-steepening of the Treasury curve would see the dollar perform most consistently against the likes of MXN, BRL, ZAR and JPY. The problem for us is that investors are showing tentative signs of taking their money out of USD and putting it to work in emerging markets. We would also say that the MXN is a very expensive sell right now, with implied 3-month MXN yields at a huge 8.26%, which is not bad considering that inflation is running under 5%.

Instead, then we have greater confidence in a steeper yield curve driving USD/JPY higher (probably into the 110-112 area). And if: a) investors are putting money back to work in EM and b) Brent crude oil prices are heading back to the $65/barrel as our commodities team believe – we actually think the MXN can perform quite well after all. From 5.63 currently, we see MXN/JPY trading back to the 5.85 area – helped by those very attractive yields and the Latam bloc’s positive exposure to energy.

Despite yesterday’s rally, we’re not big fans of chasing EUR/USD a lot higher. There may indeed be a case for money to be put in emerging markets, which leaves the dollar lower across the board – but we’d certainly think the EUR would underperform any recovery in EM.

Implied 3-month yields across a range of currencies

(% per annum)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more