US: Weakening jobs market enters critical phase

A disappointing payrolls number could give way to even weaker figures over the next couple of months as the pandemic worsens and containment measures intensify. The need for fiscal support is only going to become more pressing

| 245,000 |

Increase in jobs in November |

| Worse than expected | |

Lost momentum

The US jobs report is a disappointing read throughout. The establishment survey shows US payrolls rose just 245k versus 460k consensus, while the household survey, which is used to calculate the unemployment rate, actually showed employment falling 78,000. These figures are substantially weaker than other labour surveys had indicated and leaves us in a troubling situation with more Covid cases, hospitalisations and movement restriction coming day by day.

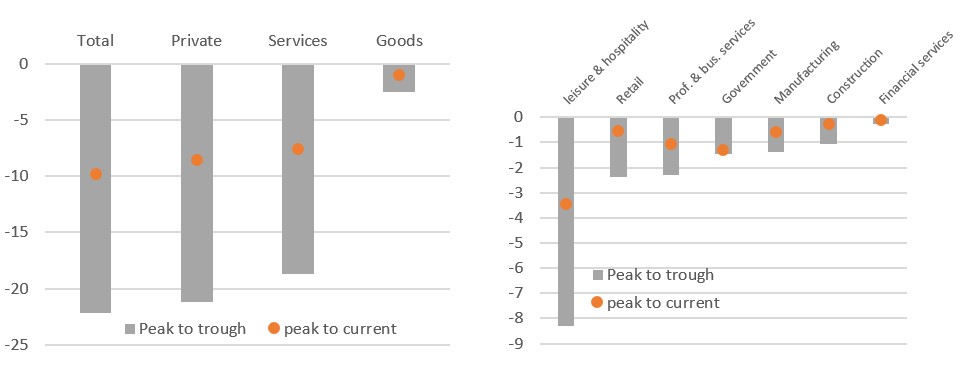

The details show private payrolls rising just 344k and government employment falling 99k, primarily due to census collection workers ending their terms. Private goods producing jobs increased 55k, split evenly between manufacturing and construction, while services rose 289k. The number of retail jobs actually fell 35k with leisure and hospitality posting a gain of just 31k and business services increasing only 60k.

As the chart below shows, net employment is still massively down in these sectors and with more restrictions likely to come into place over the next few weeks the December jobs report is likely to show only weak jobs growth. We could potentially see a negative January figure – remember the data collection period is the week of the twelfth every month.

US jobs lost since the crisis started by sector (millions)

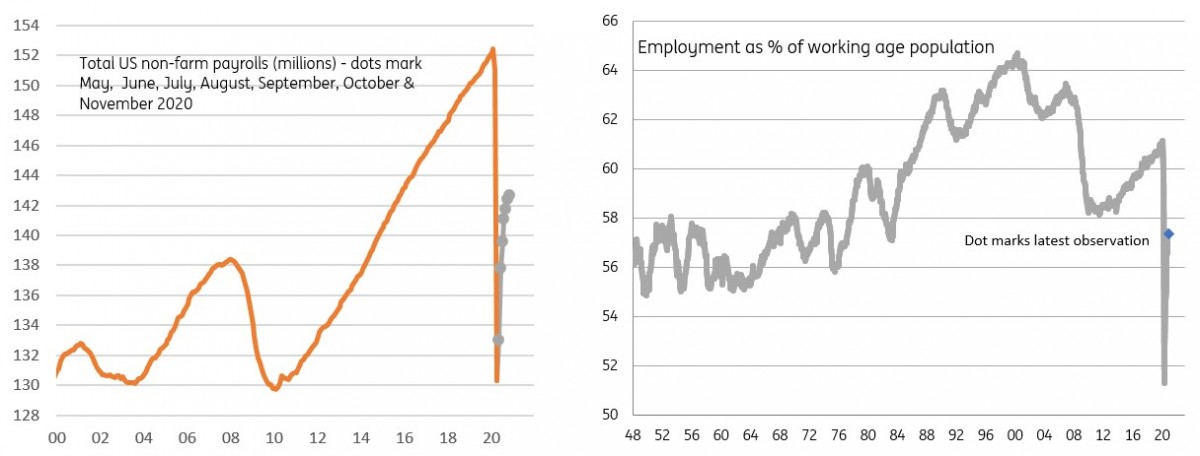

More challenges ahead

Even after November's 245k jobs gain, total employment still down 9.87mn versus February. Moreover, the employment as a proportion of working age population remains well down on even the worst readings of the Global Financial Crisis and is on a par with the early 1980s when female labour market participation was less. The charts below underline how far away the US jobs market is from a full recovery.

The outlook for jobs growth in December is less positive. Rising covid cases are putting hospitals under real pressure and we are likely to see more containment measures introduced to try and keep the situation manageable. But this comes at obvious economic cost with many businesses likely to struggle with the threat of job losses.

Moreover, we have to remember that the Federal Reserve’s Beige Book found four out of 12 Fed districts were already reporting they experienced “little or no growth” in recent weeks. It suggested that “activity began to slow in early November as COVID-19 cases surged” and that business optimism had “waned” as a result. That is not an environment that suggests vigorous hiring.

Employment tracking (millions in work) & employment as % of working population

A fiscal support package looks needed more and more

Comments from Federal Reserve officials have underlined their concern about the near-term economic situation. Only on Wednesday, Dallas Fed President Robert Kaplan warned that “growth could stall out” if we see the economy constrained in the absence of fiscal support.

In that regard, we continue to look for signs of a deal on a fiscal package to help households and the broader economy through this latest wave of the pandemic. House majority leader Nancy Pelosi’s endorsement of the $908bn bipartisan fiscal plan, after having held out for a $2tr+ stimulus for so long, suggests there is a real chance of a deal being struck in the next week or so. Remember we have recess coming up and a December 11 deadline on a funding bill that could in fact lead to a partial government shutdown.

As a minimum there will be intensifying pressure to extend unemployment benefits that are scheduled to expire at month end and to find money to fund the vaccination roll out. However, Republican Senate leaders continue to sound more cautious… for now…

But better times are coming

Despite all this near-term uncertainty and anxiety about the economy, we remain upbeat on the prospects for 2021 as a vaccination program allows a full re-opening of the economy with consumers able to fully re-engage with the economy. It also would give businesses the clarity to finally put money to work on investment and hiring (remember there are still 10mn fewer people in work than in February). Throw in a fiscal stimulus of the order of 4% of GDP and we see very vigorous growth from late 1Q21 onwards.

Download

Download article4 December 2020

Curb your enthusiasm, just a little This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more