US: Turning fortunes

The most recent US macro data suggests that the rate of deterioration in the economy is clearly slowing and in some sectors we are starting to see signs of more vigorous activity

The rate of descent is clearly slowing

It has been a really interesting day for US data with some clear positive surprises, although we have to remember the numbers merely suggest the rate of deterioration in the economy is moderating more quickly than anticipated, rather than things are actually getting better.

Firstly the ADP private payrolls series showed far fewer net job losses than anticipated – just 2.76 million in May versus the consensus expectation of a 9 million monthly decline in employment. Historically there is a good relationship with the official private sector employment number published by the Bureau for Labour Statistics, but we have to be somewhat cautious because these are clearly unprecedented times and the ADP calculation also incorporates other macro variables within its models to come up with its headline figure.

Nonetheless, on face value it suggests hiring has been more aggressive in the reopening phase than economists generally thought and the market should be positioned for a less bad figure for Friday’s official jobs report.

The caveat to that is this week’s ISM series do not suggest there has been a particularly vigorous pick up in hiring. Today’s ISM non-manufacturing employment number rose to just 31.8 from 30. It is an increase, but we have to remember this is a diffusion index centred around 50. Anything below 50 is still a contraction so all we can take away from today’s ISM report is employment didn’t fall quite as much as in April – and that was catastrophically bad.

ISM new orders and business activity rose more substantially to the low 40s, which although is also below 50, suggests that the rate of decline in activity is slowing. As such, these two reports offer encouragement that the bottom for activity is close to being reached and the long climb back up can soon begin.

Mixed news on employment

Clear good news in some sectors

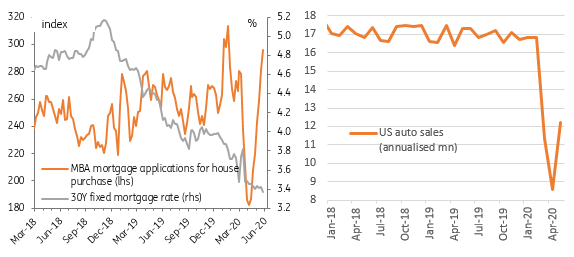

There is even more positive news from the housing market. This morning’s mortgage approvals data showed the seventh consecutive increase in applications for home purchases. As the chart below shows, this is clearly a V-shaped recovery, which is remarkable given the scale of job losses seen in the economy.

A key reason for this is that the average home buyer in the US is 47 years old, as reported by the National Association of Realtors. More affluent, slightly older workers have been less impacted by job losses than younger workers employed in retail and hospitality, for example. The rebound in equities may also have calmed any nervousness about making a potential purchase of a new primary or secondary home, while aggressive Federal Reserve action has eased financial market tensions, with credit continuing to flow and mortgage rates falling to new lows.

This is important because a strong housing market will support construction and employment in the sector. Housing transactions are also strongly correlated to retail sales – as people move to a new home they typically also spend more on furniture and home furnishings, garden equipment and building supplies such as paint for home improvement.

Yesterday’s car sales numbers also suggested a healthy rebound is materialising. Here too, demographics are the major story. The average age of a car buyer is nearly 50 and for those who feel secure in their job, there are some great financing deals to be had.

V-shaped recovery in housing and autos?

But a full recovery will take time

That’s not to say the rest of the economy will bounce back so vigorously. By way of reference it took the US 14 quarters to recover the 4% of lost economic output during the Global Financial Crisis. While the Federal Reserve and Federal government have come in with a raft of support mechanisms, social distancing constraints, travel limitations, consumer caution surrounding the virus and the economic legacy of millions of people out of work mean this recovery will take time. We continue to doubt that all of the lost output will be recouped before the end of 2022.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more