US Treasury FX Report Preview: From trade war to currency war?

The US Treasury is set to release its FX report anytime now. While no major US trading partner meets the technical criteria to be labelled a currency manipulator, there are risks the US administration finds a loophole. Should the US opt to take the trade war into the currency arena, a market positioned long US dollar may quickly bail on the greenback

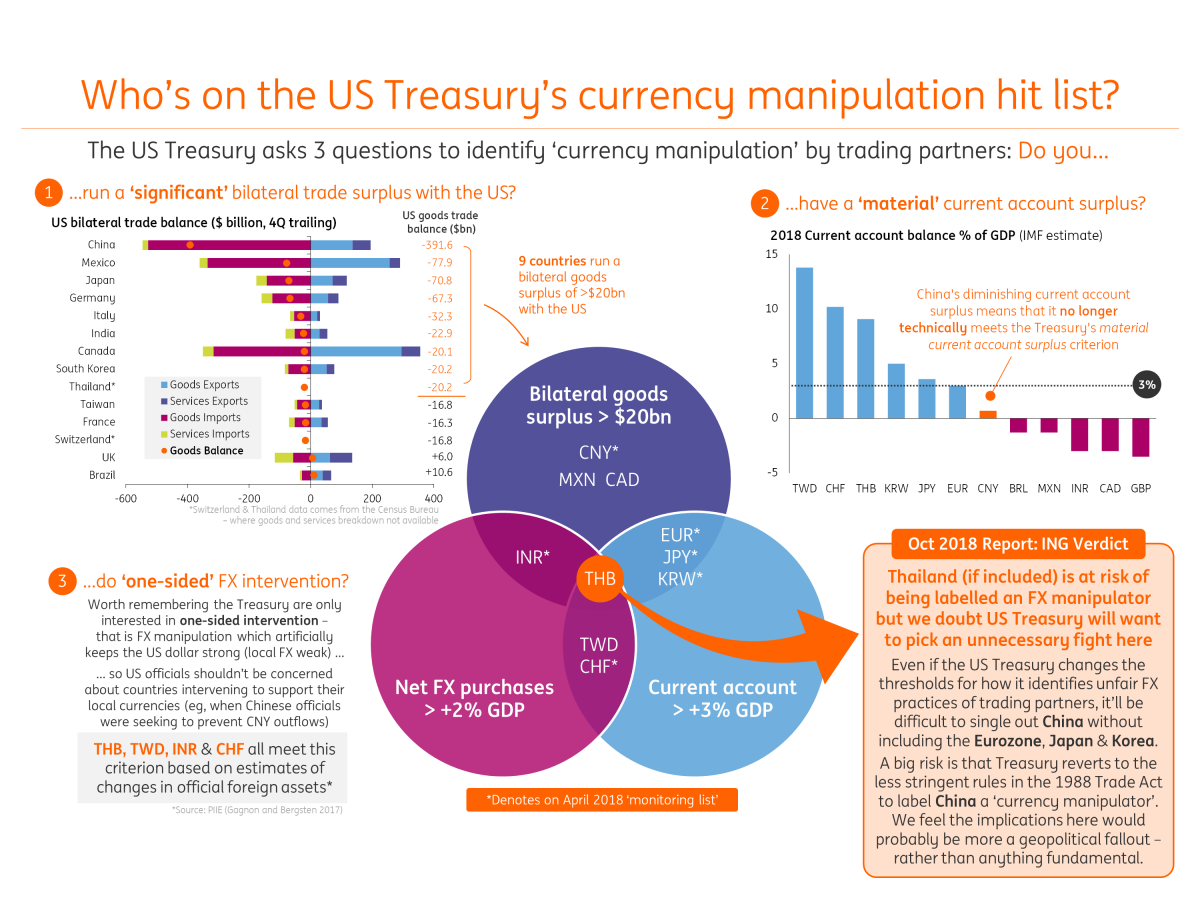

No 'major trading partner' of the US currently meets all of Congress's 'currency manipulator' criteria

Despite speculation that the FX report could be released this week, the general consensus is that it will likely be out next week after Treasury Secretary Steve Mnuchin returns from the IMF meetings. Here are some of our quick thoughts:

- Currently, no major currency meets all three criteria to be labelled a currency manipulator based on the ‘formula’ (as President Trump referred to it) outlined in the 2015 Trade Act. But Thailand and Switzerland are the closest to being labelled a currency manipulator.

- Thailand hasn’t ever been part of the assessment – but could well be considered a ‘major US trading partner’ in this report given the net bilateral goods deficit is greater than $20 billion based on the US census data. Our economists in Asia argue that this figure is debatable – with the official Thai data putting the bilateral deficit at around $12 billion. If it is included in the assessment – then we note that it ticks the other two boxes (material current account surplus and one-sided FX intervention) and the Treasury will have no choice but to label Thailand a 'currency manipulator'. However, besides making an example of Thailand – we think there's no geopolitical reason to bring a small country like Thailand into the current US administration's clampdown on global trade imbalances. Hence, we put a trivial risk on Thailand being labelled a currency manipulator.

- Switzerland’s bilateral goods trade with the US doesn’t quite meet the $20 billion deficit threshold – currently a $16 billion deficit – which basically saves it for now.

- So our base case is that the US Treasury retains the same monitoring list: China, Japan, Korea, Germany, Switzerland and India.

But the less strict 1988 Trade Act could give the US Treasury Secretary the discretionary power to label any country a 'currency manipulator'

There are risks that the White House may bend the rules for the Treasury and invoke old US trade law to label China a ‘currency manipulator’. There is also the 1988 Omnibus Trade and Competitiveness Act which has less stringent rules for labelling any country a currency manipulator.

- Reading through Section 3004 of the act – it states that the “The Secretary of the Treasury shall analyze on an annual basis the exchange rate policies of foreign countries, in consultation with the International Monetary Fund, and consider whether countries manipulate the rate of exchange between their currency and the United States dollar for purposes of preventing effective balance of payments adjustments or gaining unfair competitive advantage in international trade. If the Secretary considers that such manipulation is occurring with respect to countries that (1) have material global current account surpluses; and (2) have significant bilateral trade surpluses with the United States, the Secretary of the Treasury shall take action to initiate negotiations”.

- That's quite a loose definition so, in effect, Mnuchin could make the discretionary judgement that China's large bilateral trade surplus with the US + current account surplus (albeit diminishing rapidly) + a long history of FX intervention (even though in recent times Beijing has been intervening to prevent the yuan from falling further - so not one-sided) = grounds for labelling China a currency manipulator.

- It seems like an implausible outcome – but one that we can't fully rule out given the significant protectionist shift in US trade policy that we've seen in 2018.

- In terms of implications, we feel that it would probably cause more of geopolitical outrage than any practical action - particularly if the US singles out China without also labelling any other countries that have far bigger overall current account surpluses.

- Moreover, it would put a serious dent in the ability of Congress to place checks and balances on US trade and foreign policy – which is arguably the more worrying outcome for global markets.

FX market implications: Reserve currencies like EUR and JPY would rally if China was branded a currency manipulator

Should any country – in particular China – be branded an FX manipulator by the Trump administration, we think the initial market reaction would be positive for non-USD major reserve currencies (the Japanese yen and euro) – while possibly initiating a broad-based sell-off in the USD given the extreme long dollar positioning in FX markets. Certainly, the uncertainty over US trade and foreign policy may command a greater risk premium in USD assets. Our preferred way to play the tail risk of the US taking the trade war into the currency arena would be via USD/JPY downside – with outside risks of a move to below 110 if global risk aversion remains as high as it currently is.

Either way, expect greater risks of Trump ‘currency manipulation’ cries in and around the release of the US Treasury’s semi-annual FX report. Our base case of China staying on the monitoring list could see Beijing opting to provide greater stability to the yuan ahead of possible trade talks – then a stable USD/CNY would take a major source of recent USD-EM FX appreciation pressure off the table.

A history of the Trump administration's dollar talk

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

FXDownload

Download article

11 October 2018

In case you missed it: A war of words This bundle contains 9 Articles