US: Trading on Trump

US growth appears to be bouncing back sharply in 2Q18, leaving the Federal Reserve on course to hike interest rates three more times this year. Nonetheless, how President Trump proceeds on trade will be critical for both the outlook for US growth and the US political situation

The US experienced its “typical” soft patch in 1Q18, with statisticians continuing to puzzle over the reasons for this multi-year phenomenon. GDP growth slowed to a still very respectable 2.2% from the 3% rates averaged in the last three quarters of 2017, but high-frequency data suggests that 2Q18 GDP growth will rebound above 3%. The Atlanta Fed’s “Nowcast” model suggests it could be as high as 4.8%. We are more cautious given that there is still a lot of data to come, but something north of 3.5% is possible.

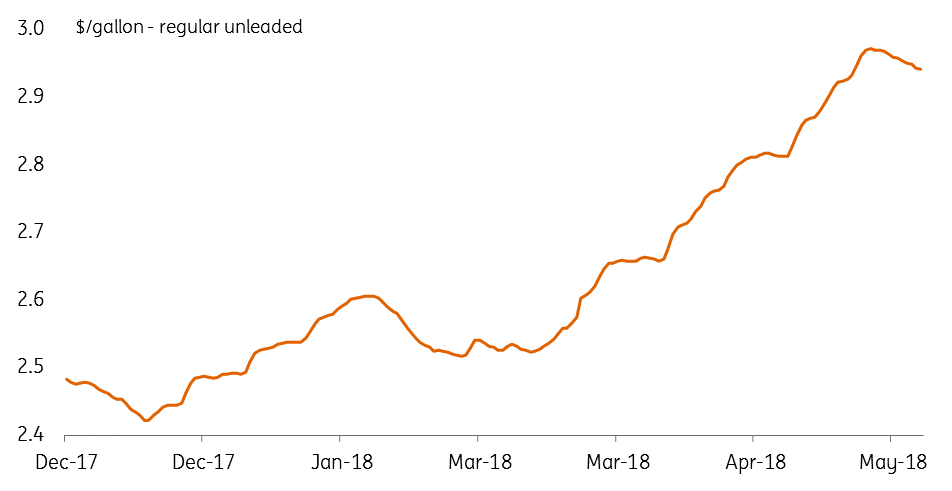

Either way, households and businesses appear to be brushing aside market fears of a trade war and the negative impact of higher gasoline prices and mortgage rates. The strength of the labour market and rising asset prices are driving consumer sentiment, which is at levels last seen 18 years ago.

We look for the Fed to hike rates again on June 13 and also expect them to follow up with additional rate hikes in 3Q and 4Q18

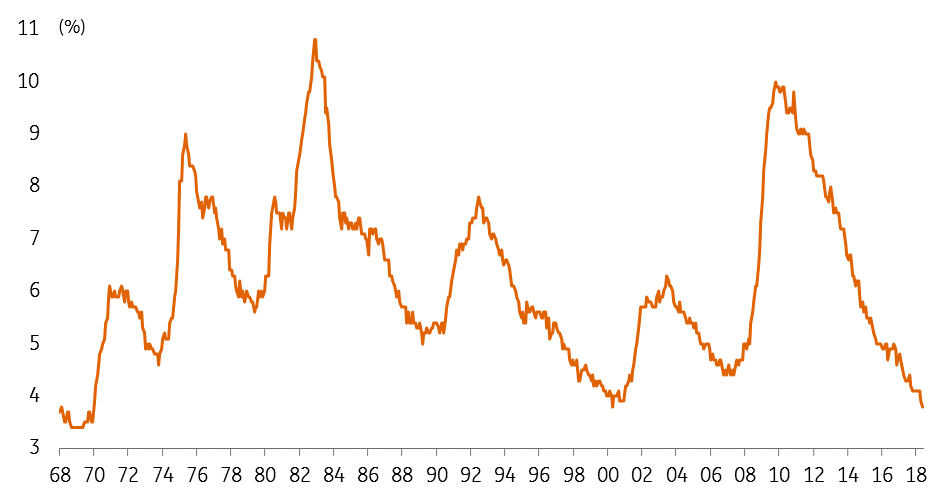

Employment growth is averaging 207,000 per month year to date in 2018 versus the 182,000 monthly average in 2017, and you have to go all the way back to December 1969 to find a lower unemployment rate. Wage growth remains disappointingly soft at 2.7%, but the broader employment cost index is rising more quickly at 2.9% for private wages. All of this coupled with tax cuts equating to around $900 per household; real disposable household income is rising 2% year on year meaning that there is plenty of cash in consumers’ pockets.

US gasoline prices

Likewise, businesses remain upbeat on their economic prospects despite concerns relating to the White House’s trade policies. The latest Federal Reserve Beige Book suggested survey respondents noted “some concern about the uncertainty of international trade policy” along with the “future effects on prices”. Nonetheless, the report concluded that “outlooks continued to be positive”.

Since President Trump stepped up the protectionist rhetoric, business surveys have strengthened, and hiring remains robust with small business owners reporting having to raise wages more aggressively to fill positions - a net 35% of firms have to raise worker compensation, the highest since records began 32 years ago. In fact, supply bottlenecks are one of the biggest issues for companies with the National Federation of Independent Businesses reporting job openings are at an all-time high while nearly a quarter of firms are finding it difficult to get workers with the right skillsets.

US unemployment rate over past 50 years

The Fed looks set to hike three more times in 2018

Consequently, it looks as though the US economy is in a good position with the Federal Reserve set to continue implementing “gradual” monetary policy tightening. Given that we expect the economy to expand 3% this year and inflation measures to push above 2% - of the major inflation measures, the Fed watches only the core personal consumer expenditure deflator is below 2%. We look for the Fed to hike rates again on June 13 and also expect them to follow up with additional rate hikes in 3Q and 4Q18.

Nonetheless, trade fears could yet influence Fed policy. Should the situation escalate, this could weaken sentiment, investment and hiring amongst businesses, while also putting up costs. Fed officials have made it clear they are more concerned about potential negatives for growth rather than upside risks for inflation resulting from tariffs, implying that it could result in slower policy tightening from the central bank.

Given this uncertainty, we retain our forecast that the Fed will hike rates only twice in 2019. Higher borrowing and fuel costs will gradually act as a brake on activity, while the recent strength of the dollar suggests inflation may not accelerate as much as we had feared. However, should trade tensions ease and wage growth accelerate in response to the very tight jobs market then we could see the need to insert a third hike.

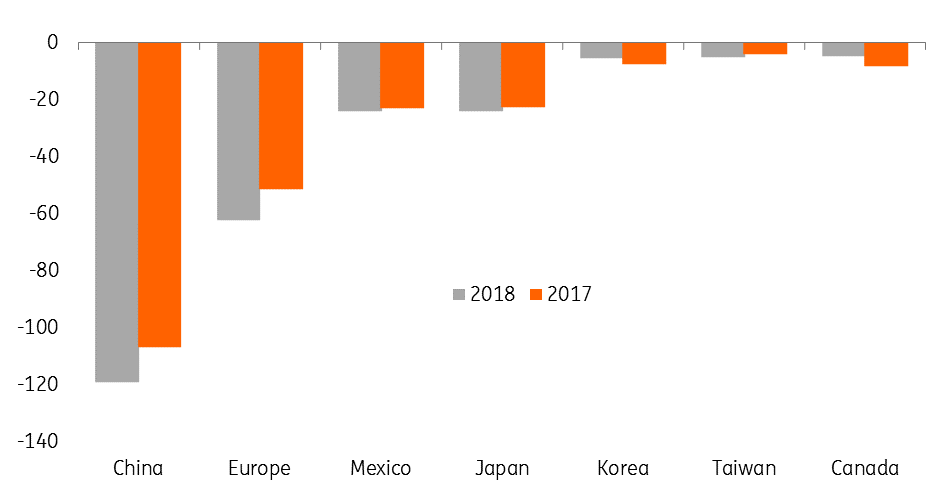

Rising trade deficits suggest near-term de-escalation is unlikely

Trade deficits with China and the EU continue to widen and will likely continue doing so given the $1.5 trillion tax cut the President handed households, so a de-escalation looks like wishful thinking. Trump has threatened a further round of tariff increases in response to China and EU retaliation measures, so room for a climbdown seems limited.

YTD US trade balance with selected partners

On the other hand, amid growing domestic corporate criticism regarding the economic damage tariffs can do, Trump may yet be prepared to let some of his more extreme demands slide. If other countries are prepared to offer concessions, then there is scope for deals to be made and he can still claim a “victory”.

Escalating trade tensions could also backfire

This is important given the upcoming November mid-term elections. Trump’s approval rating remains low at 40%, and the Republican party continues to lag in opinion polls. However, there have been some tentative signs of a narrowing and if he can take a “win” on global trade and the economy continues to motor on then the risk that the Democrats win control of Congress may recede. As such, he may be more willing to make concessions than is widely perceived.

Instead, if protectionist measures escalate and people start seeing prices rise and companies warn of tougher trading environments, then the electorate may give him more than a bloody nose. Defeat would make it much easier to block his legislative agenda and would also give the Democrats greater power to launch investigations into his administration.

It would also heighten talk of potential Presidential impeachment, with Trump’s recent comments about potentially being able to pardon himself regarding Robert Mueller’s Russia investigation adding a twist to the story.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

8 June 2018

ING’s June Economic Update This bundle contains 8 Articles