US: Smoke, mirrors and uncertainty by the truckload

Firm numbers for the start of the year have led the market to embrace a higher-for-longer narrative for interest rates. The Federal Reserve is indeed set to raise interest rates more than we expected, but higher borrowing costs in an environment of tightening lending standards and weak sentiment runs the risk of a bad reaction down the line

A higher interest rate peak, but cuts will come

Until recently, the market narrative had been that the most aggressive and rapid pace of Federal Reserve interest rate increases in 40 years would inevitably lead to a major slowdown in economic activity, with the Fed set to revert to rate cuts in the second half of the year as inflation subsided. However, the data released for January suggests the economy is still running hot, with half a million jobs added and retail sales jumping higher. Inflation is also proving to be stickier than expected, leading the market to price at least three further 25bp rate hikes by June.

Federal Reserve comments suggest a strong appetite to continue hiking interest rates and we now think it more likely than not that it will seek to raise the Fed funds target range to 5.25-5.50% in the second quarter. That said, we do not think that the economy is in as strong a position as the data prints indicate and continue to expect strong disinflation from the late second quarter onwards, with the Fed eventually cutting rates from December.

Weather and seasonal adjustments provided a boost

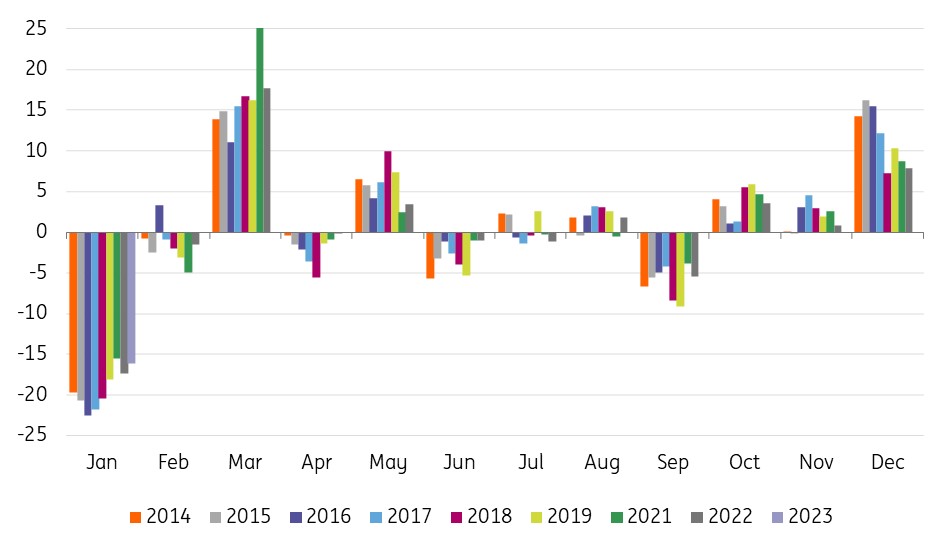

The January numbers have benefited from fine weather, especially considering the wintery conditions in December which led to depressed activity and disrupted holiday plans. Favourable seasonal adjustment factors also appear to have lifted the data. For example, the raw unadjusted data shows that retail sales fell 16% month-on-month in January 2023, which was comparable to the 15.5% drop in 2021 and the 17.4% drop in 2022. Yet on a 'seasonally adjusted' basis, which tries to smooth out seasonal holiday and working day effects, the 16% drop turned into a 3% gain. Likewise, the raw 2.5 million drop in January unadjusted payrolls wasn’t far from the 2.6mn decline in 2021 and 2.8mn fall in 2022 – and yet on a seasonally adjusted basis, we saw a 517,000 gain.

Retail sales rose 3%, but the raw data doesn't look as rosy – MoM changes in retail sales by month and year

The weather has since deteriorated and we don’t expect as much support from the seasonal adjustment calculations over the coming months. Consequently, there are likely to be more headwinds to activity for February and March, especially if warmer temperatures merely brought forward consumer activity that would eventually have come about anyway (a new home search or a car purchase, for example).

It isn't hard to find areas for concern

Moreover, there are fundamental areas of weakness. Despite the positive reaction to the 517,000 job 'gain', the fact that full-time employment has flatlined since March 2022 (meaning that all job creation has been for part-time positions) was largely overlooked. Job lay-off announcements are also on the rise, so we're nervous that the jobs report may look fine on the surface while a compositional shift away from higher paid full-time jobs to lower paid, less secure, part-time positions could be taking place.

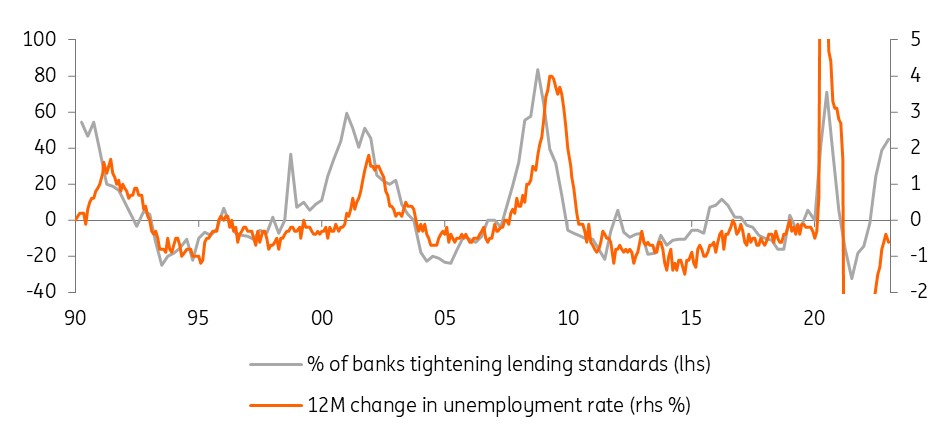

On top of this, the Federal Reserve’s Senior Loan Officer survey shows that banks are sensing the economy is coming under pressure and are rapidly tightening lending standards for both households and businesses. This is restricting the availability of credit to the economy at a time when borrowing costs are moving higher once more, and is likely to intensify the pressure on struggling households and businesses. The chart below shows how, over the past 30 years or so, the phenomenon of banks pulling back access to credit has led to the unemployment rate climbing within nine months.

Tighter bank lending standards lead to rising unemployment

We also know that household finances are coming under more pressure, with household savings rates in a 4-5% range after having been 6-9% pre-pandemic and up at 30%+ during the pandemic. At the same time, the proportion of income devoted to servicing debt repayments on consumer loans has risen to its highest since 2009. Then there is the renewed rise in mortgage rates that led to mortgage applications for home purchases dropping to a 28-year low last week – the monthly mortgage payment on a $400,000 mortgage taken out 12 months ago is now the same as for a $260,000 mortgage taken out today! With business confidence remaining weak, we suspect a more defensive mindset amongst corporate America will weigh on capex spending, adding to concerns about potential future job losses.

Disinflation leaves the door open to rate cuts before year end

Inflation has been running hotter than we expected, but the disinflation story remains in play with shelter-related components set to drag inflation sharply lower from the third quarter onwards. House prices are already falling, and this has led to rents topping out in all major cities. It's just a matter of time before this is reflected within the CPI and PCE deflator reports. We also expect the weakening activity to put downward pressure on corporate profit margins, which should also help lower inflation later in the year.

Given the Federal Reserve has a dual mandate of targeting inflation at 2% and maximising employment, we still think interest rate cuts remain on the cards for 2023. However, our previous call of a third-quarter start looks ambitious. We are now forecasting the first 50bp cut in December, with the bulk of the rate cuts occurring in 2024.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

2 March 2023

ING’s March Monthly: The search for a new equilibrium This bundle contains 13 Articles