US shoppers pause after a record run

Retail sales were softer than hoped in November, but this follows a storming run of spending, fuelled by stimulus cheques and rising incomes. The Omicron variant poses near-term risks for consumer behaviour but high savings levels, rising incomes and massive increases in wealth provide strong underpinnings for future growth

| 21.6% |

Growth in retail sales from Feb 2020 pre-pandemic high |

Retail sales depressed by weak electronics and department stores

US retail sales grew more modestly than expected, rising 0.3% month-on-month versus the 0.8% consensus forecast. The "control" group, which excludes some of the more volatile components (such as vehicles, gasoline, food service and building materials) is particularly soft, falling 0.1% MoM versus a +0.8% consensus forecasts. This is a little worrying because it has a better correlation with the broader consumer spending data that feeds into GDP.

The main damage was caused by a 4.6% MoM drop in electronics and a 5.4% drop in department stores. There were more modest declines in health & personal care (-0.6%) and miscellaneous stores (-0.3%). The positive offsets came from a 1.7% gain at gasoline stations due to higher prices and 1.3% MoM increases at both grocery stores and for sporting goods plus a 1% gain for eating and drinking outside of the home.

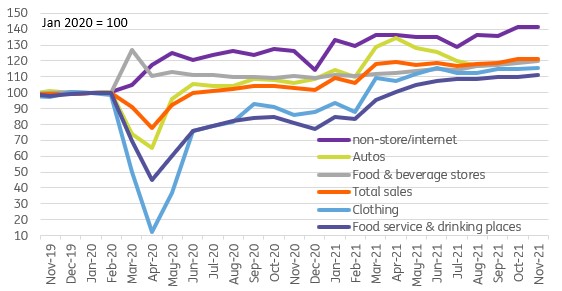

Level of US retail sales by sub-sector Feb 2020 = 100

Retail has had a phenomenal run

Nonetheless, we shouldn’t get too down about these figures. The numbers for October were revised up a touch and we need to remember that retail sales are actually 21.6% higher than they were before the pandemic struck in February 2020. In comparison with the performance of Europe this is a fantastic achievement (see chart below).

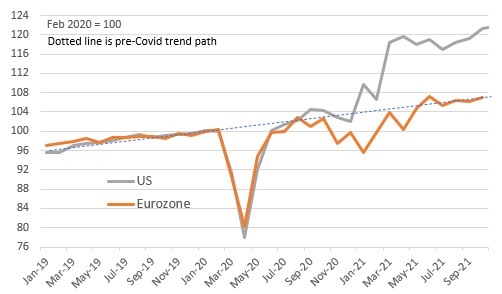

The reasoning for the US doing so well is down to the fact that while the US lost jobs (23 million or so), incomes rose in aggregate because of the stimulus cheques and extended and uprated unemployment benefits. In Europe, jobs were preserved by the furloughing schemes, but incomes fell because governments were not paying the full 100% of salaries. Note also that US household wealth has increased by the best part of $30tn on the back of surging equity markets and an increase in the savings ratio, far more than the increase in European wealth.

US versus eurozone retail sales performance

Fed still shifting in a more hawkish direction

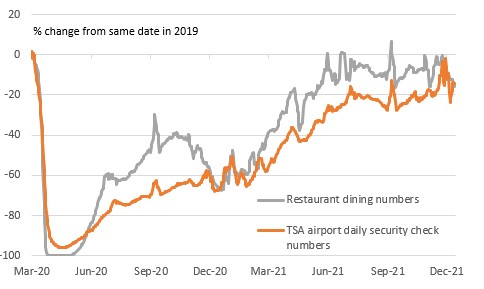

Nonetheless, the softer figure today and the uncertainty over Omicron should make it more likely that the Fed won't surprise with a more hawkish shift to three rate hikes for their 2022 dot plot estimates. High frequency data on restaurant dining and air passenger travel (see chart below) already shows that consumer caution is returning in the wake of the rise of Omicron.

In terms of the Fed decision, we expect “transitory” to be removed as a description of inflation pressures, QE tapering to be accelerated so it ends in February and the Fed to shift to forecasting to two rate hikes for next year from the current one they have in their dot plot.

High frequency data suggests consumer caution on Omicron scare

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more