US: Not to be underestimated

Many commentators scoffed when President Trump predicted he would get 3% growth in the US. Not anymore. Having already posted 3% annualised growth in 2Q and 3Q 2017, today's 4Q figure should be just as good

3% yet again...

We have already seen the economy grow an annualised 3.1% in 2Q17 and 3.2% in 3Q 2017 and we expect to see another 3% growth figure in today's 4Q17 GDP report. This would mark the first time the US has experienced three consecutive quarters of 3% growth since 2004/05, underlining how well the US economy is performing right now. The consensus forecast is also 3% with the range of predictions starting at 2.2% and rising to 3.8% among the 74 respondents to the Bloomberg survey.

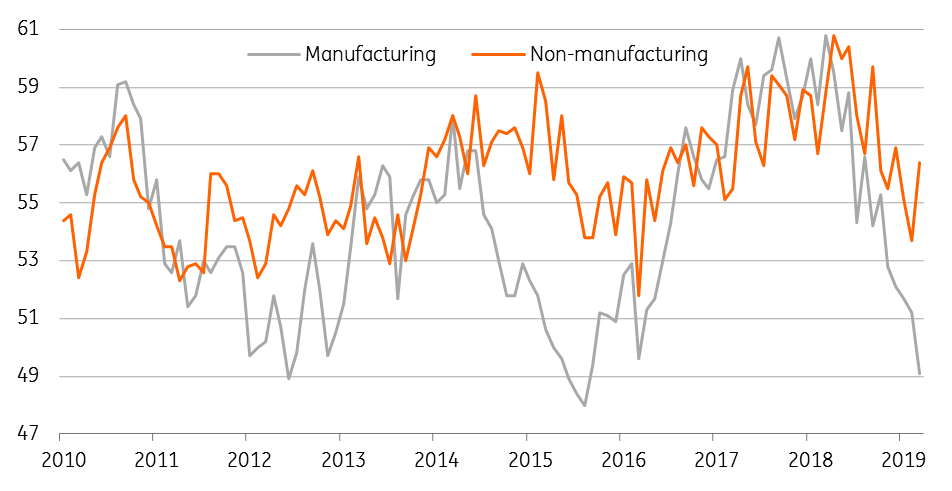

We suspect that the balance of risks to our own 3% forecast lies to the upside given the historical relationship with the key ISM business survey. It is also important to point out that the Federal Reserve Bank of Atlanta has what they term a GDPNow forecasting model. Based on the latest data it suggests GDP will come in at 3.4% with real consumer spending growth of 4%. We agree that consumer spending is likely to be the main growth driver, but we are a little more cautious here, predicting growth of just above 3% with investment and inventory building also contributing positively to growth.

| 13 |

Years since the US last recorded three consecutive quarters of 3% growth |

...and for 2018 as a whole

We think that this fantastic run can continue through 2018 given the great shape the economy is currently in. Domestic demand is powering ahead with housing numbers, retail sales, the state of the jobs market and business surveys all suggesting that momentum is very strong. Trump has also got his tax cuts through so there is going to be more cash in the pockets of businesses and consumers, which will add to the upside potential for investment and consumer spending.

The external economic environment is also very positive. Forecasts for economic activity in Europe and Asia continue to rise, while the dollar’s 10% trade-weighted decline over the past 12 months means that the US is in a competitive position to take advantage.

ISM points to upside risk for GDP

Three Fed hikes but it could become four

This strong growth picture will add to rising price pressures in the US economy and we see the potential for US inflation to hit 3% in the summer. Consequently, we expect to see a minimum of three Federal Reserve interest rate hikes this year, but are currently forecasting a pause in Q1. This reflects the changeover in the Fed committee happening in February with Jerome Powell taking over from Janet Yellen as Fed Chair. We are also a little nervous that the heavy winter storms at the start of the year will impact some of the activity numbers while core inflation is likely to remain below 2% until April. Once again, the balance of risks to our forecast probably lies to the upside and if the data doesn’t soften we will need to insert a further Fed rate rise for the March FOMC meeting.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more