US jobs report: Bumper wage growth - at last!

201,000 US jobs were created in August with unemployment at 3.9%. However, it's the surge in wages that catches the eye and will keep the Fed hiking rates

Good headlines - payrolls strong, wages bounce

The August US jobs report shows payrolls rose 201,000 versus the 190k Bloomberg consensus. July was revised down 10k with a 40k downward revision in June. The unemployment rate remained at 3.9%, but the big story is the pick-up in wages. It surged 0.4% month on month to 2.9% year on year versus the consensus 0.2% MoM/2.7% YoY. This report is strong throughout and with the economy likely to grow more than 3% again in 3Q18 it will keep the Fed hiking interest rates with another move in September with a further increase in December.

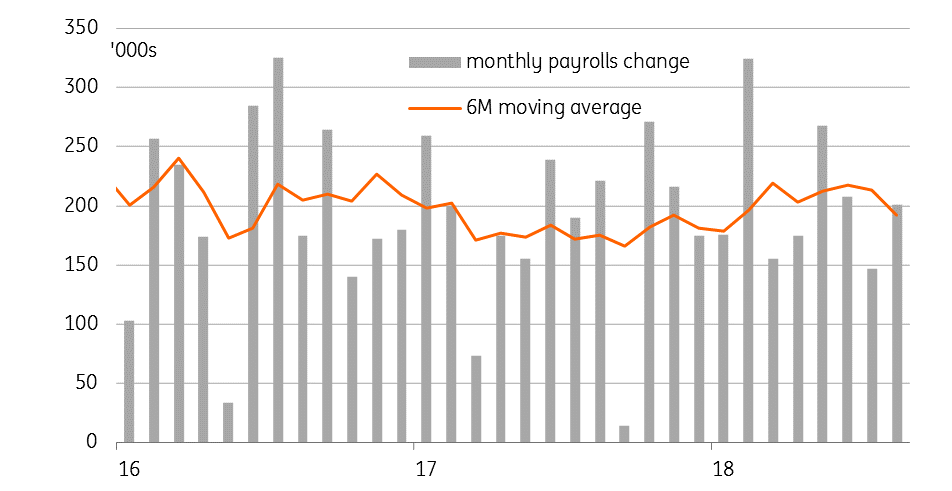

Both the manufacturing and non-manufacturing ISM reports had indicated an acceleration in demand for workers in August while the NFIB survey continues to show finding appropriate workers remains the biggest challenge for small businesses. After today’s report (and the negative revisions), payrolls have on average risen 207,000 per month in 2018 versus 182,000 per month in 2017. The biggest constraint on payrolls growth going forward is likely to be finding people with the right skill set.

Payrolls change

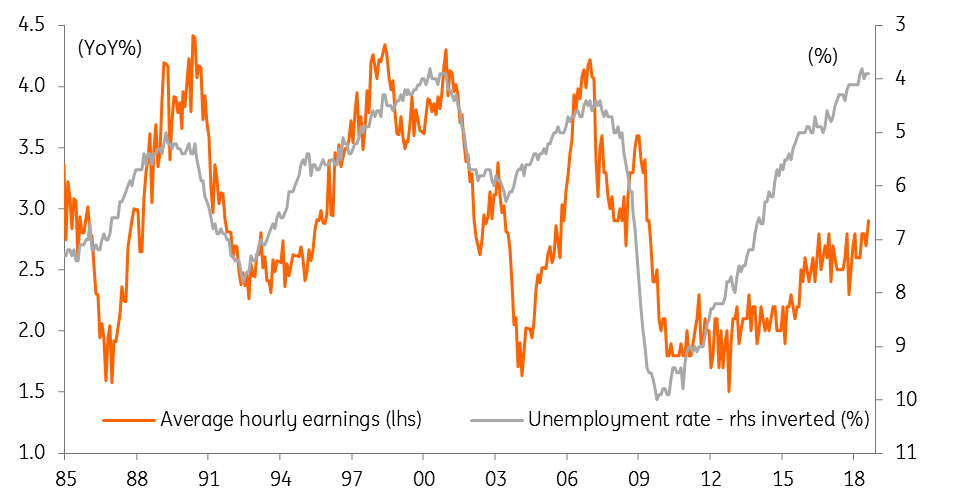

Pay set to rise further...

The wage growth number of 0.4% MoM (highest since last December) is really powerful given statistical headwinds. There were two more working days in August than in July so if you are on a fixed salary this means that your hourly pay rate will effectively be lower in August than it was in July as pay is spread over more days. Significantly, there are only 19 working days in September so this technical quirk will reverse and could result in another good wage growth figure next month.

The unemployment number of 3.9% also reflects some revisions and is above the 3.8% low in May. However you have to go all the way back to 1969 to find a sub-3.8% figure. As such this underlines the tight labour market story which will help support wage growth and possibly inflation more broadly.

Wages gradually responding to low unemployment

Keep on hiking rates...

So despite all of the worries about the impact from protectionism, Fed rate hikes and emerging market woes, the US economy continues to roar ahead. We look for GDP growth of 3-3.5% in 3Q18, but the Atlanta Federal Reserve’s NowCast GDP model suggests it could be even stronger at 4.4%! Inflation is grinding higher and the jobs market remains robust. As such the Fed’s message that monetary policy remains “accommodative” is accurate so we fully expect officials to continue with the strategy of “gradual” policy normalisation. To us, this suggests a rate hike in both September and December.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more