US jobs: Headline disappoints, but it will turn round

US payrolls growth of 157,000 is disappointing but there were upward revisions, and forward-looking indicators suggest more big jobs gains to come

| 157,000 |

Number of job gains in July |

Mixed report

The July US jobs report shows payrolls rising 157,000 versus the 193,000 Bloomberg consensus, but there were 59,000 upward revisions to recent history so overall it’s close to market predictions. Wages rose 0.3% month-on-month, in line with expectations, which leaves the annual rate of wage growth at 2.7%. The unemployment rate moved back down to 3.9% from 4% while U6 underemployment is at 7.5% versus 7.8% previously.

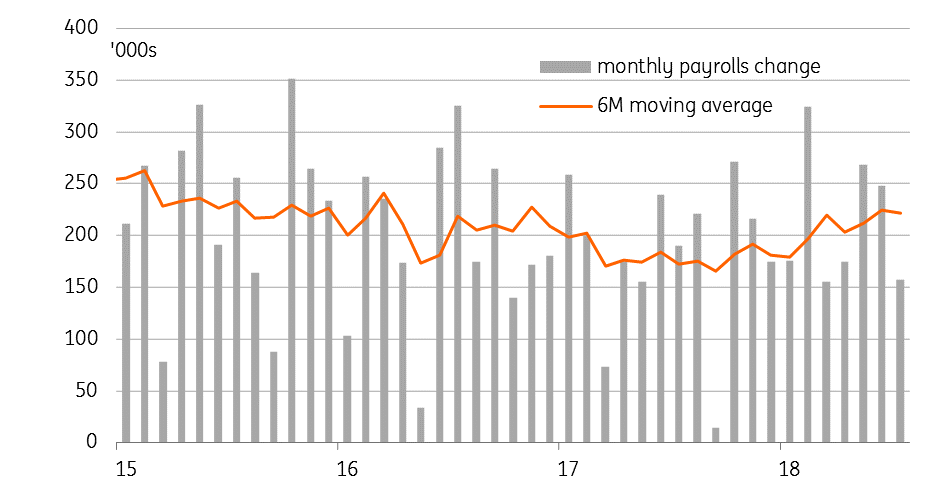

The headline payrolls number is softer than hoped given the rise in the ISM employment component, the strong ADP private payrolls report (219,000) and another really firm NFIB employment data release. Nonetheless, the marked step up in employment gains versus 2017 remains in evidence. Last year averaged 182,000 jobs per month whereas the first seven months of 2018 have averaged 215,000 job gains. This will help underpin consumer sentiment and spending through the rest of the year.

Monthly change in US nonfarm payrolls

Outlook still looks good

In terms of the outlook for employment, the fact that the economy is growing so strongly bodes well for ongoing job creation. There are certainly worries about protectionism and its potential economic impact, but we also have to remember that the stimulus from tax cuts dwarfs the tax hit from higher tariffs. As such we are still expecting the US economy to expand 3% this year.

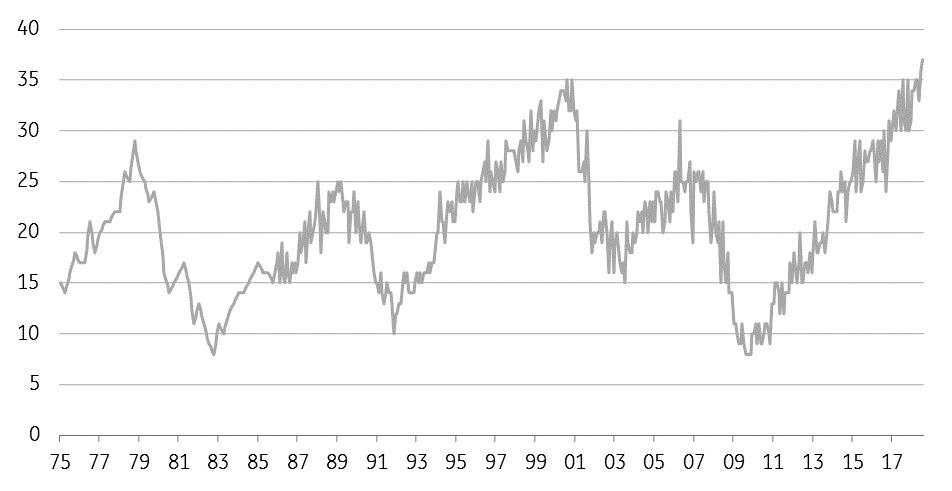

This view is seemingly supported by the employment numbers released by the National Federation of Independent Businesses yesterday. According to them, the proportion of small businesses with unfilled vacancies has never been higher in the survey’s 45-year history and nor has the “job creation plans” for the coming three months.

NFIB: Unfilled job openings (% with at least one unfilled opening)

So the US has an economy that is growing incredibly strongly with a robust jobs market. At the same time, consumer price inflation is set to hit 3% next week with the core rate (ex-food and energy) coming in at 2.3%. This will ensure the Federal Reserve keeps hiking rates, with September and December moves looking probable.

Download

Download article3 August 2018

In case you missed it: One hike, one tweak, one hold This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more