US: “It’s great…”

Recent data, tax cuts and strong overseas demand suggest the US economy will expand 3% in 2018

US will grow 3% in 2018

Last month we suggested that 2018 will see President Trump get the 3% growth he promised during his election campaign. The data since then has only reinforced this view. The domestic economy is in excellent health with housing numbers, retail sales, the state of the jobs market and business surveys all suggesting that momentum is very strong.

Tax cuts add upside impetus to spending and equity markets

Trump has also got his tax cuts through so there is going to be more cash in the pockets of businesses and consumers, which will add to the upside potential for investment and consumer spending. Equity markets will also be kept aloft by the potential for share-buybacks, special dividends and the prospect of more M&A fuelled by the corporation tax cut and repatriation of foreign earnings.

The external economic environment also looks good. Forecasts for economic activity in Europe and Asia continue to rise, while the dollar’s 10% trade-weighted decline since Trump’s inauguration means that the US is in a competitive position to take advantage.

Inflation is becoming a hot topic

This strong growth, tight jobs market, soft dollar environment hints at upside risks for inflation too. Headline CPI inflation is currently at 2.2% year-over-year while core, excluding food and energy, is at 1.7%, but we think the latter will soon be above the Federal Reserve’s 2% target. Apparel prices have been surprisingly weak, while mobile phone charges have dragged the headline lower temporarily. These factors will unwind this year.

Housing too is likely to exert more upward influence given the strength in activity. This component accounts for over 40% of the CPI basket and is currently running at 2.8% YoY. Given the recent monthly percentage changes we see the annual rate of this key component breaking above 3% very soon. On top of this, geopolitical uncertainty, which we believe Trump is helping to stoke, and strong global growth means that we could see oil prices remaining high. This will add to the upside for inflation in 2018.

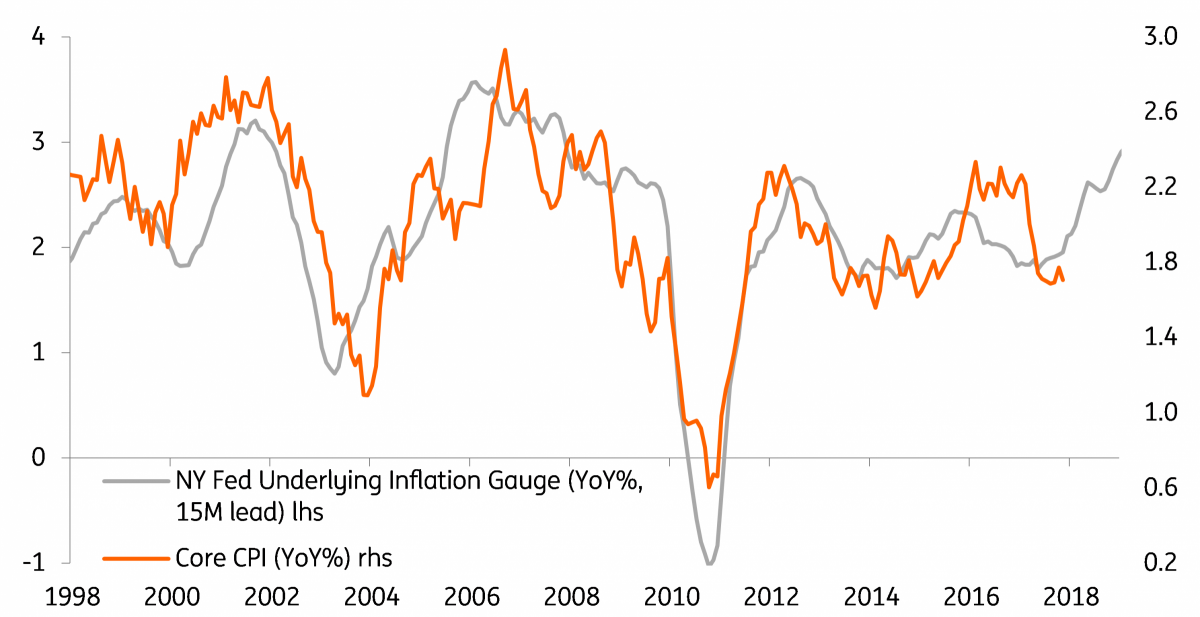

This prognosis is also receiving support from the New York Federal Reserve, which has created a new underlying inflation gauge. This is a model-based approach that provides a “more timely and accurate signal for turning points in inflation” using both prices and a “wide range of nominal, real and financial variables”. The NY Fed’s model suggests we could see core inflation heading sharply higher this year.

Core inflation and the NY Fed's underlying inflation gauge

Data supports three rate hikes this year

In an environment where growth is strong and inflation is likely to rise above the Fed’s 2% target, we continue to expect three 25bp rate hikes this year. Jay Powell takes over from Fed Chair Janet Yellen at the end of February and there are going to be several other changes in terms of Federal Open Market Committee (FOMC) voters. Two of the most dovish voters in 2017 - Neel Kashkari and Charles Evans – are to be replaced by two relatively hawkish figures in Loretta Mester and John Williams.

There is also a new vacancy at the NY Fed with William Dudley standing down from mid-2018 while there are still three vacancies on the Fed’s Board of Governors even if Trump’s latest pick, Marvin Goodfriend, is approved by Congress. The result is a smaller and more hawkish committee in 2018 versus 2017.

We see the risks skewed towards more, not fewer rate rises

That said, we feel that the imminent changes at the top of the FOMC could result in a pause in the first quarter as Jay Powell finds his feet, before consecutive quarterly hikes through the rest of the year. The skew for where we see the risks to our forecasts is to the upside though. The Fed remains nervous that the flat yield curve and dollar weakness means financial conditions remain loose, suggesting a more pressing need for Fed action at the short end. There is also a wariness that the prolonged period of ultra-low interest rates has changed household and corporate behaviour and could lead to increased leverage with “adverse implications for financial stability”. As such, we are open to the idea of a fourth Fed rate rise this year.

Some upside potential for the longer end of the yield curve

For now though, we think that the Fed’s decision to shrink its balance sheet will exert some upward influence on longer-dated yields through the year, which will reduce the necessity for that additional hike. With inflation likely to rise and the significant tax cuts likely prompting a wider fiscal deficit and more bond issuance the result is that the 10-year yield may edge towards 3% by year-end.

In terms of politics, January is likely to be another busy month. The focus on tax cuts meant that the process of agreeing to a budget was delayed, which also necessitated yet another temporary reprieve regarding the debt ceiling. The deadline to avoid a potential government shutdown has now been pushed back to 19 January. There does seem to be bipartisan agreement to increase spending, but the balance – Trump favours more of a focus on defence – is opposed by the Democrats. Consequently, while we feel progress can be made, there is probably too much work to do for it to be signed off by 19 January. Instead, the situation will likely require another short-term funding bill that will give breathing space through to March.

Possible infrastructure spending

We will also be looking to 30 January when President Trump will give the State of the Union address. Now that his tax reforms have been passed he is keen to make progress on another election campaign promise – infrastructure spending. He may set out more details of what he hopes to achieve and there is bipartisan support for more spending on the nation’s roads, air transport and rail networks, although there is less for 'the Wall'. However, there is a lot of disagreement on how contracts would be funded and Democrats are reluctant to give him an 'easy win' ahead of November’s mid-term elections. Nonetheless, if he can make progress, billions of dollars of infrastructure spending will be a further boon for the economy.

This article comes from our Monthly Economic Update. Download the full report here.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more