US inflation surge heaps pressure on the Fed

Yet another blowout inflation reading makes it increasingly difficult for the Fed to stick to its position that elevated inflation readings are merely “transitory”. Pipeline cost pressures continue to build and corporates are looking to pass them onto customers in an environment of such robust demand. The case for a 2022 rate hike is strong

| 4.5%YoY |

Highest rate of core inflation since 1991 |

Price pressures are building

US consumer price inflation jumped 0.9% month-on-month in June after recording a 0.6% gain in May with 0.8% increases in April and 0.6% in March. This was well ahead of the consensus prediction of 0.5% while the core (ex food and energy) also rose 0.9% MoM versus the 0.4% consensus. Given the strong run of MoM readings over the past few months it makes it very difficult for the Federal Reserve to stick to their position that inflation is merely “transitory”. Today’s surprise outcome also supports calls for a swifter removal of the massive monetary stimulus the Fed have injected into the economy

There were 0.3% or 0.4% MoM component readings throughout, suggesting broad inflation pressures while the bigger gains were once again seen in used car prices (10.5% MoM) and new vehicles up 2% – consumers have cash in their pockets and rental car companies are looking to rebuild fleets at a time when auto output is being constrained by component shortages. Meanwhile, food rose 0.8% MoM, apparel was up 0.7%, housing rose 0.4%, gasoline rose 2.5% MoM with medical care the only component to post a decline (-0.1% MoM).

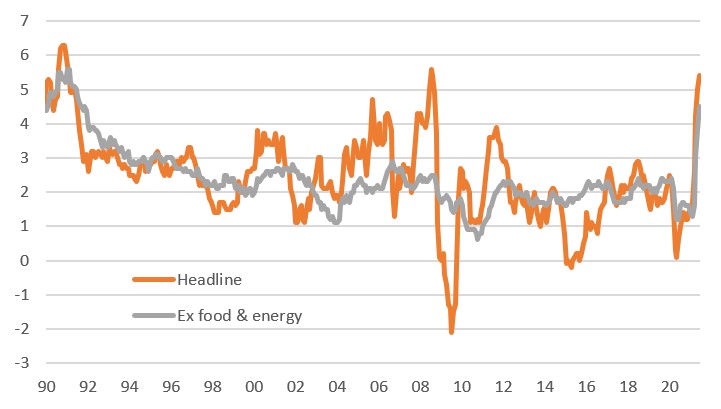

This means that the annual rate of headline inflation is now running at 5.4% – just below the 2008 oil price spike induced peak of 5.6%. However the annual rate of core inflation is now 4.5%, which it was last at in November 1991!

Annual US inflation 1980-2021 (%)

Past the peak on headline inflation, but the decline will be slow

Over the past few months annual inflation has surged as we compared price levels in a vibrant re-opened economy with those from 12 months before when the US was still largely in lockdown. This deep divergence should soon gradually fade with the annual rates of inflation edging lower as we move through 3Q. Nonetheless, we are not as optimistic as the Federal Reserve in thinking that we will quickly get back down to the 2% region. We continue to doubt the Fed’s narrative that inflation is “transitory” and instead see the risks that it stays elevated for many more months.

Demand will continue to exceed supply

The key reason is that the stimulus fuelled economy is booming. Demand appears to be outpacing the supply capacity of the economy given the scarring that the pandemic has caused. We see no imminent end to the ongoing frictions such as supply chain strains and a lack of suitable workers.

The fact that numerous surveys report inventory levels at record low levels while order backlogs are at record highs and supplier delivery times remain extreme shows that there are stresses throughout the economy. This is giving a sense that corporates have more pricing power then they have seen in years and therefore have the ability to pass higher costs onto consumers.

This was seen in today’s National Federation of Independent Business survey with a net 47% of respondents currently raising their prices – the highest balance since January 1981 – with a net 44% of firms looking to raise prices further over the next three months. This casts even more doubt on the Fed’s position that we should soon expect a significant decline in price pressures.

NFIB survey shows companies are looking to raise prices at record rates (1975-2021)

Watch housing costs in coming months

The upside inflation risks will be compounded by housing costs since primary rents and owners’ equivalent rent account for a third of the CPI basket. Movements in these components tend to lag 12-18 months below house price changes, as the chart below shows. We suspect that the housing components of inflation will be the story to watch through the second half of this year.

House prices and the relationship with housing CPI costs

2022 Fed rate rises are coming

We forecast that US headline inflation will stay above 4% through until 1Q22 with core inflation unlikely to get below 3% until the summer of next year. We also expect the strong growth to story continue and with workers remaining in short supply, we see further wage pressure.

Consequently, there appears little reason to continue with Federal Reserve QE asset purchases of $120bn per month and we will look to Jerome Powell’s testimony tomorrow and the August Jackson Hole Conference for hints of an upcoming taper. We are currently expecting the taper to start in 4Q and to conclude relatively swiftly before the end of 2Q22.

The Fed have shifted their viewpoint to a 2023 start point for interest rate increases, but we think this is too late and are now predicting two in the second half of 2022. We would not be surprised to see two more Fed officials switch their view in September and that would bring the median Fed position also into 2022.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more