US inflation slows, but price pressures remain

US consumer price inflation slowed in August, reflecting a moderation in the re-opening hotspots of the economy, where prices had been surging. Elsewhere, inflation pressures are broadening out while elevated inflation expectations risk keeping CPI well above target for much longer than the Federal Reserve currently anticipates

| 5.3% |

US annual inflation |

Inflation slows as re-opening hot spots cool

US headline inflation rose 0.3% month-on-month, a touch below the 0.4% consensus, while core rose a very modest 0.1% (consensus 0.3%). The year-on-year rates slow to 5.3% from 5.4% for headline while core slowed to 4% from 4.3%. A more benign outcome than expected, but inflation pressures are not going to disappear anytime soon.

US annual inflation

On the upside, food prices rose 0.4%, energy was up 2% and owners' equivalent rent increased 0.3%. However, used car prices fell 1.5% while airline fares fell 9.1% and motor vehicle insurance fell 2.8% MoM. Car and truck rental plunged 8.5% and hotel charges were also down -3.3%. So effectively we have a moderation in the re-opening hotspots of the past four months.

While the slowdown in inflation is welcome, we doubt headline inflation will move sustainably below 5% much before the end of 1Q 2022 and core inflation will struggle to get below 3.5% before 2Q 2022.

Companies are finding it easier to raise prices

Today's National Federation of Independent Business (NFIB) survey showed a net 49% of small businesses currently raising prices and a net 44% of small businesses expecting to raise prices further in the coming months (both are at 40+ year highs). Remember too the key quote from last week's Federal Reserve Beige Book...“Some Districts reported that businesses are finding it easier to pass along more cost increases through higher prices. Several Districts indicated that businesses anticipate significant hikes in their selling prices in the months ahead.”

None of this suggests we should be expecting a meaningful moderation in price pressures anytime soon.

NFIB data suggest price pressures are broadening out (prices charged 1975-2021)

Housing costs to add to upside risks

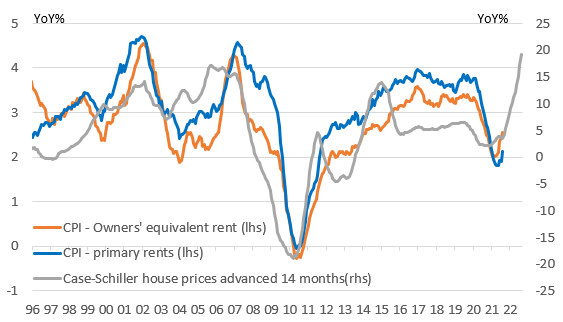

Another key reason why we think inflation will stay higher for longer is housing costs. Primary rents and owners’ equivalent rent account for a third of the CPI basket with movements in these components tending to lag 12-18 months below house price changes. The chart below suggests that housing components of inflation will be the story to watch through the second half of this year and could add nearly a full percentage point to annual inflation on their own. This will more than offset any weakness in car and vehicle rental prices we are likely to see in coming months.

Rising housing costs to offset to price declines in re-opening hotspots

Inflation expectations could risk a longer period of elevated readings

Moreover, inflation expectations continue to rise. The Federal Reserve continue to assert that "longer term inflation expectations remain well anchored at 2 percent". They can justifiably say that when talking about market inflation expectations. Using Treasury Inflation-Protected Securities, the breakeven rate 5 years out is 2.55% and 10Y it is 2.4%.

However, consumer inflation expectations are looking less and less anchored. Yesterday we had the release of the Federal Reserve's own survey (conducted nationally by the NY Fed), which showed 1Y ahead inflation consumer expectations rising to 5.2% - not really surprising as it tends to track actual inflation. However, the 3Y ahead inflation expectations rose to a new all-time high of 4% (from 3.7% last month).

Consumer inflation expectations continue to rise

Fed to dial back on the stimulus in November

On Friday we will get the University of Michigan sentiment index measure of long-term inflation expectations, which for 5-10Y ahead is 2.9%. If that moves up to say 3.1% or 3.2% it could mean more Fed officials getting twitchy and lead one or two more FOMC members to bring forward their first rate hike call to 2022 from 2023 for next week’s Fed ‘dot plot’. With demand for workers outstripping supply this makes it more likely that wage pressures will build and put up corporate costs that can then be passed onto customers.

Given the decent growth and elevated inflation environment in the US we expect the Federal Reserve to announce the QE taper process in November and expect the Fed to raise interest rates twice in late 2022.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more