US inflation remains sticky, but a slowdown is coming

US core inflation continues to track above the 0.2% month-on-month prints required to get annual inflation down to the 2% target over time, but at least the annual rate continues to slow. We remain optimistic that inflation can get close to 2% late in 2023, largely through flat to lower prices for shelter and a squeeze on corporate profit margins

| 5.6% |

Annual US inflation (excluding food and energy) |

Inflation continues its slow grind lower

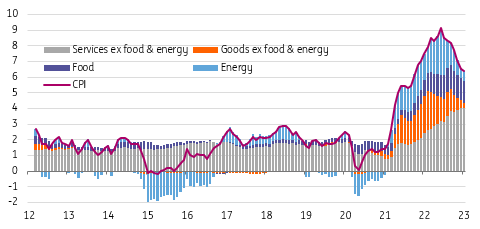

US consumer price inflation rose 0.5% MoM headline and 0.4% MoM at the core level (ex food and energy) in January, which was exactly in line with expectations. The year-on-year rates slowed to 6.4% (from 6.5%) and 5.6% from 5.7% respectively, which was a touch higher than expected and reflects recent revisions, but at least the disinflationary (slower inflation) trend remains in place. Nonetheless, we continue to track above the 0.17% MoM increases that over time would get us to the 2% target and with the unemployment rate at 50+ year lows the Fed will continue to hike rates at the March Federal Open Market Committee meeting and potentially also May.

Composition of US inflation (YoY%)

Cars and rents were where the surprises were expected

The focus ahead of time was on used cars and shelter. Those looking for a potential upside surprise pointed to used cars given movements in used vehicle auction prices pointed to an increase, but instead we saw a 1.9% MoM fall, so there is the potential of a big rebound next week. However, the re-weighting of the basket of goods and services means that this component has less influence this year (dropping from a weight of 3.624% in 2022 to 2.67% this year).

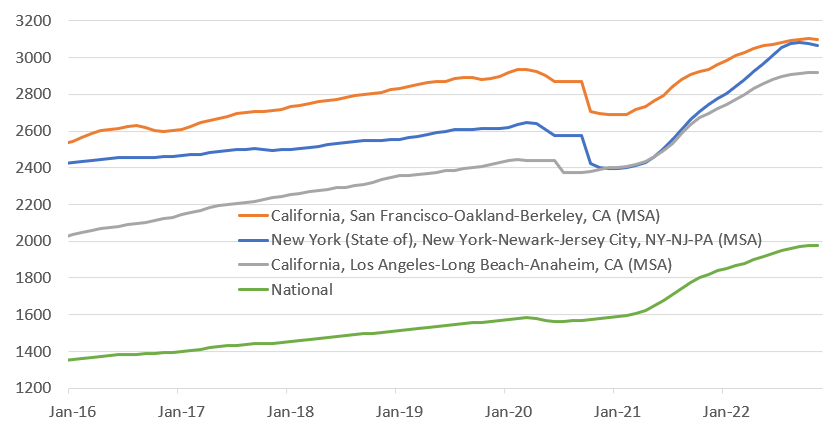

As for housing, the fall in house prices and the topping out of new rents led some to look for a softer core MoM% figure (see chart below), but in the end shelter remained high, rising 0.7% (its weight has risen from 32.9% to 34.4%). The re-weightings and the prospect of softer shelter numbers from the second quarter onwards means that we remain optimistic on the prospect of intensifying declines in the annual rate of core inflation from the summer onwards.

Zillow observed monthly housing rents ($000s)

Services ex housing are looking less threatening

Elsewhere, goods prices in general remain very soft, but there was a strong reading for apparel (+0.8% MoM), but this seems unlikely to last. Services is of more interest where recreation (+0.5%), education (+0.4%) and medical care (-0.4% MoM) offered a mixed picture. In general the story on services ex housing, which the Federal Reserve is focusing on, appears to be softening gradually. The concern being that a tight jobs market could keep labour costs more elevated and means inflation stays higher for longer, but there is nothing especially worrying here that points to the need for the Fed to ramp up its hawkishness.

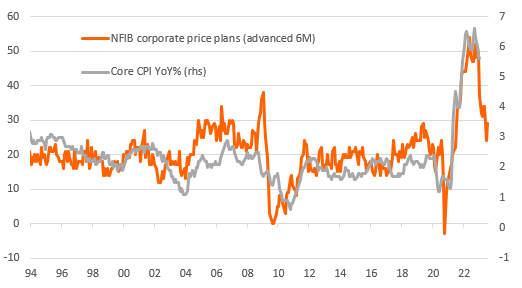

Corporate pricing intentions are moderating

Core inflation still likely to get close to 2% by year-end

Moreover, we expect annual rate of core inflation to continue slowing. The National Federation for Independent Businesses reported a weaker than expected increase in small business sentiment earlier today, but one of the most interesting sub-components is the price intentions series. This is a measure of the proportion of companies looking to raise their prices in the next three months. It moved a little higher today, but as the chart above shows, weakening business sentiment has translated into more cautious pricing behaviour – companies no longer think they can raise prices with ease and consumers will just accept it.

The chart has a decent correlation with annual core CPI inflation and indicates the potential for a sharp slowdown in inflation. This story, combined with housing means we continue to look for core inflation to drop to close to 2% by the end of this year, which will open the door to interest rate cuts in the second half if the activity numbers soften in line with our expectations.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more