US inflation numbers boost chances of a pause in Fed rate hikes

While US inflation came in broadly in line with expectations, there are signs of softening in some key categories. While housing costs and vehicle prices continue to run hot, the outlook is improving rapidly. This should cement expectations for the Fed to keep rates unchanged tomorrow but the commentary around the decision is likely to remain hawkish

| 0.4% |

US core inflation in May5.3% YoY |

Inflation slowdown continues

US consumer price inflation for May is broadly in line with expectations. The headline rate rose 0.1%MoM or 4.0%YoY (consensus 0.1 and 4.1, respectively), down from 4.9% and the slowest rate of headline inflation since March 2021. Meanwhile, core CPI (excluding food & energy) rose 0.4%MoM / 5.3% (consensus 0.4% / 5.2%). This is down from 5.5% and is the slowest annual rate for core inflation since November 2021.

Contributions to annual US inflation

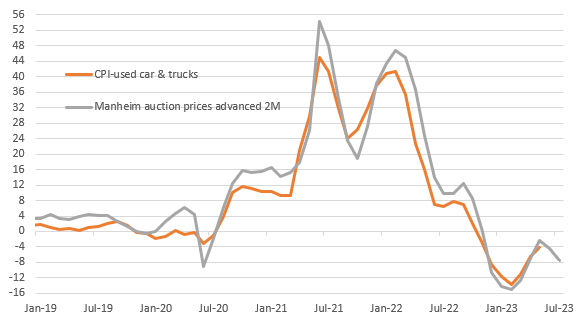

Car prices the main upside thrust, but this will change

The main downside pressures came from gasoline prices falling 5.6%MoM while airline fares fell 3%, with education falling 0.2%. The main upside pressures came from two of the biggest components. Shelter (43% weighting within core CPI basket) continues to run hot at 0.6%MoM while used cars jumped 4.4%MoM. This was the big upside impetus, and if it weren't for that we would have got a 0.3% or even a 0.2%MoM print for core CPI (4.4%MoM reading with a weight within the core inflation basket of 3.35% means it contributed 0.15pp of the 0.4% print).

This component lags behind Mannheim used car auctions by two months, and they have fallen 5.7% over the past couple of months. With new vehicle prices having fallen for the past two months as well, we look for used car prices to contribute to slower inflation annual numbers in the coming months.

Used car prices will turn lower again based on auction prices

Rent slowdown should see shelter costs slow

In terms of shelter, we are also seeing encouraging developments with the chart below showing Zillow observed rents clearly topping out. New York is a little different, but even so, nationally we see the shelter components slowing sharply through 2H 2023. This means that effectively more than half of the core CPI baskets (shelter & new & used vehicles account for 51.5% of the total CPI basket and 52% of the core basket) could be contributing very little by the end of the year.

Zillow observed rents (metropolitan areas $/month)

Service sector pricing slowdown should aid slower CPI

We then look more broadly, and the weakness in business sentiment (NFIB small business optimism and the Conference board measure of CEO confidence are at recessionary levels) implies business leaders are becoming more cautious and this is leading to a dampening in corporate pricing power and price intentions. Note, too, that the service sector ISM also points to the slowdown in inflation gaining more momentum.

ISM services prices offers hope CPI can continue to slow rapidly

Fed pause could mean the peak has been reached

All in all, today’s report is neutral to dovish despite the annual rate of core inflation coming in a touch above consensus. This should support expectations of a no-change outcome from the Fed tomorrow, and if we are right that CPI starts to show more meaningful signs of a slowdown, we think it will mark the peak for US rates even if the Fed does put an extra hike into its dot plot tomorrow.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more