US Industry: Room for improvement

US industrial production is robust, but it's important to remember manufacturing output remains 5% below pre-crisis levels

What the data means for Trump

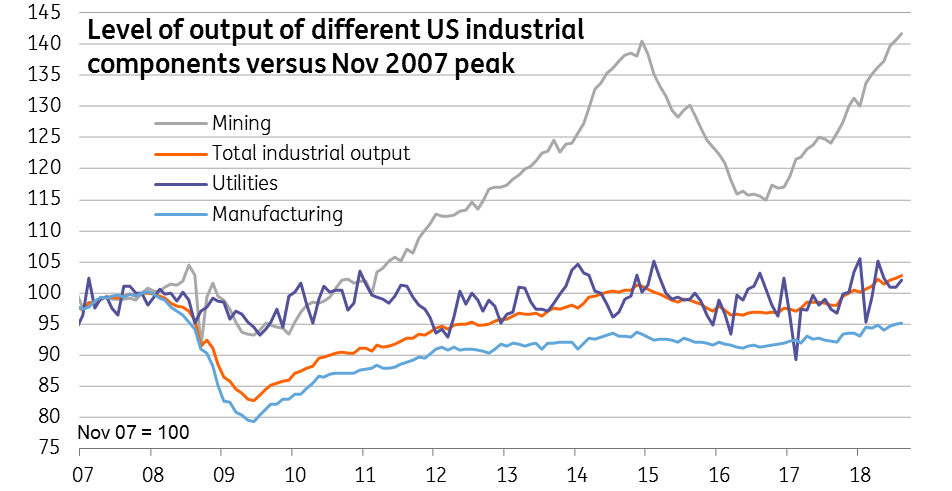

US industrial production rose 0.4% month-on-month in August, above the 0.3% market expectation, while July’s growth rate was revised up to +0.4% from +0.1%. Manufacturing was a little weaker, rising 0.2% in August after 0.3% in July, but it remains a really strong story. Utilities output was up 1.2% MoM, but this is a choppy, weather-impacted series. Mining rose 0.7%.

Looking at a longer history, while it has undeniably rebounded since the global financial crisis, manufacturing output remains 5% lower than ten years ago and total industrial output is only 2.7% above its pre-crisis high. This suggests that President Trump’s strategy to get more products made in America will continue, which also ties into Trump’s push on trade. Today's data is likely to be viewed favourably by the White House, but it could also incentivise him to keep pushing on China. The star performer within production industries has of course been the mining component, which is 42% above the pre-crisis levels thanks to the oil and gas “revolution” that continues.

US industrial production components

What it means for monetary policy

The Atlanta Fed GDP Nowcast model is currently projecting 3Q GDP growth of 3.8%, but this may get nudged a little lower by the combination of the August retail sales and industrial production numbers. Nonetheless, with the ISM manufacturing index pointing to strong new orders growth together with a rising backlog of orders, the prospects for manufacturing continue to look good. At the same time, consumer fundamentals are underpinned by tax cuts, employment, asset prices and increasingly, wages. Taking this altogether the US data still suggests to us the Federal Reserve will continue with its strategy of “gradual” rate hikes, including at the September and December FOMC meetings.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more