US industrial output boosts 2Q growth hopes

The US consumer is in good spirits and industry appears to be, too. It increasingly looks as though the US economy is rebounding sharply in 2Q18

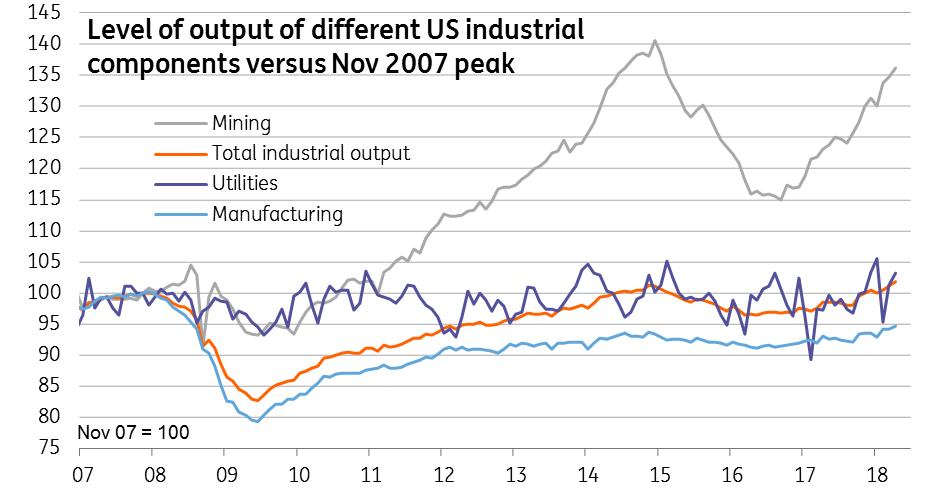

US industrial production rose 0.7% month on month in April, a touch above the 0.6% market prediction while growth in March was revised up from 0.5%MoM to 0.7%. There was good news in all the components, with manufacturing seeing output rise 0.5% while utilities rose 1.9% and mining was up 1.1%

The growth in mining reflects the rapid rise in oil and gas rig counts in response to higher prices. With oil not far from $80/bbl and US production efficiency continuing to improve, this component will continue making positive contributions to overall US economic activity. Meanwhile manufacturing looks in great shape with the ISM and durable goods reports suggesting order books are very healthy – note output would have been up 0.6% were it not for auto weakness. Utilities is a bit of a surprise given output had already been really strong because of a particularly wintery start to the year, driving heating demand. We suspect this component will weaken in coming months.

Overall the report suggests the industrial sector is in buoyant shape. Nonetheless, if it hadn’t been for the oil and gas revolution, the story wouldn’t be quite as rosy. Manufacturing output is still more than 5% down on the peak of November 2007 and employment is even weaker, which means President Trump is unlikely to reverse course on his claims of unfair foreign competition anytime soon.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more