US import tariffs on steel and aluminium: Who stands to lose?

President Trump's clear intentions to slap import tariffs on steel and aluminium are causing a stir. A global response could have far-reaching impacts on world trade

America First

Donald Trump's announcement of 25% US import tariffs on steel and 10% on aluminium came earlier than expected, but the latest development in US trade policy is not surprising, following the US exit of the TPP trade agreement and re-negotiation of NAFTA, other policy changes with roots in the protectionist logic of America First.

The tariffs, which have been presented as measures to support domestic industries, are broadly in line with the recommendations made in a report published in February by the US Department of Commerce which found that “the quantities and circumstances” of US imports of aluminium and steel “threaten to impair the national security”. President Trump has chosen to implement tariffs on US imports from all countries, rather than a quota, or a combination of a quota and tariffs for selected countries, and go higher than the report’s recommended tariffs on imports from all countries (24% for steel and 7.7% for aluminium).

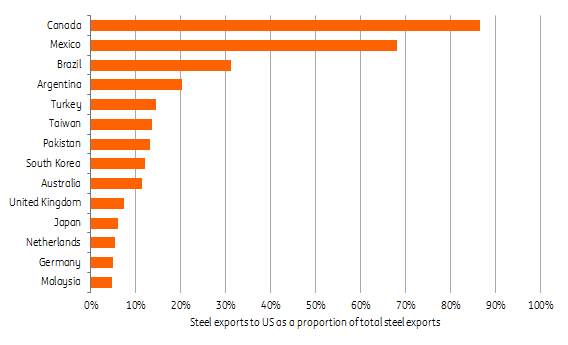

US is a significant destination for steel exports from Canada, Mexico, Brazil and Argentina

Steel and aluminium export flows

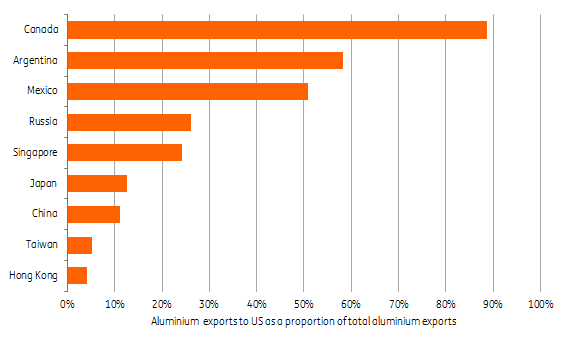

Tariff increases should not apply where existing free trade deals are in place. But the announcement raises the already-high stakes in the ongoing renegotiation of the NAFTA trade agreement, as Canada and Mexico send high proportions of their total steel and aluminium exports to the US. The US was the destination for 86% of Canada’s steel exports by value in 2016, and 88% of its aluminium exports. Just over 50% of Mexico’s aluminium exports were to the US. Argentina and Brazil, which are not protected by a free trade agreement, send high proportions of their steel exports to the US, and the US is also an important destination for Argentinian aluminium exports. Just over 10% of China's aluminium exports go to the US.

The US is also an important destination for aluminium exports from several countries

New phase for world trade

While the US is an important destination for some countries' steel and aluminium exports, these trade flows represent a small fraction of these countries’ total exports of all products, and by extension, world trade. Steel and aluminium exports to the US accounted for less than 1% of world exports of all products by value in 2016 (they were 3% of Canada's total exports and less than 1% of China's).

The significance of these tariffs will be partly determined by the responses of other nations. By raising tariffs on the imports from all countries, the US has invited reciprocal measures from a much wider set of trading partners than have yet been affected by the US exit from TPP, or re-negotiation of NAFTA. So even though the flows affected by higher tariffs are small in terms of world trade, a much greater set of countries will now be considering defensive responses, bringing world trade into a phase of more trade-restricting policy responses.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

2 March 2018

Trade war: What is it good for? This bundle contains 4 Articles