US housing market motors on

The US housing market continues to strengthen, supporting the Fed's case for gradual rate hikes

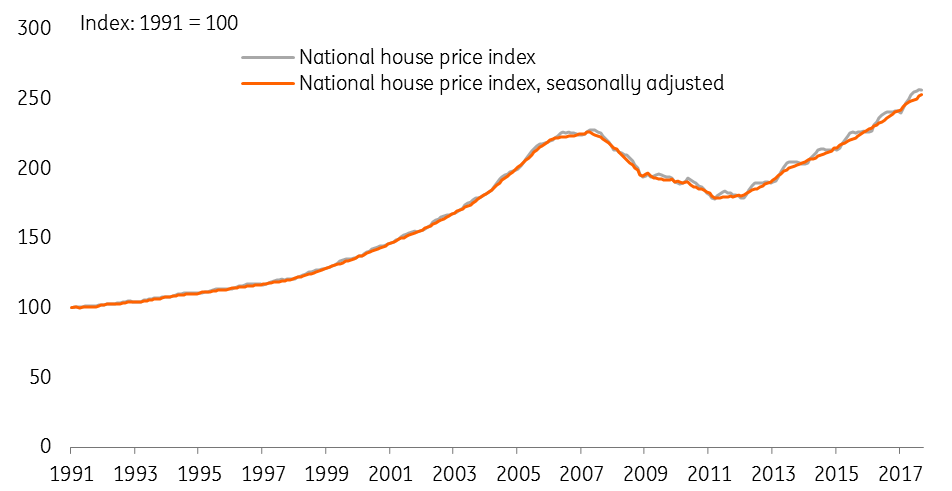

House prices increasing steadily

Yesterday’s data on the US housing market shows another solid increase in national house price indices, which increased by 6.3% YoY. This continues a decent run for US housing, which has seen a steady improvement since bottoming out in late 2011.

House prices in the US

Price increases look sustainable

The headline price index is now around 12% higher than the pre-crisis peak in 2007, which has prompted some talk of a new housing bubble. But in real terms (adjusting house prices for general inflation) national house prices are still about 10% below peak and, relative to disposable income or interest costs, house prices do not appear elevated.

Compared to other advanced economies, such as Canada, Australia and Sweden, where house prices have increased by double-digit figures in recent years, the pace of US house price increases looks relatively modest. Those markets are more likely to be in bubble territory, and now look set for an adjustment as macroprudential policy dampens demand even as additional supply comes onto the market.

That said, the national figures hide wide divergences between regions. Prices in the cities hit hardest by the housing crash (Florida, Las Vegas, Phoenix) remain well below the 2007 peak. On the other hand, fast-growing cities like San Francisco, Seattle and Denver have seen rapid price increases in recent years. These areas are probably more at risk of a period of adjustment as there are some signs that affordability limits are beginning to bite.

Though tax changes are an unknown

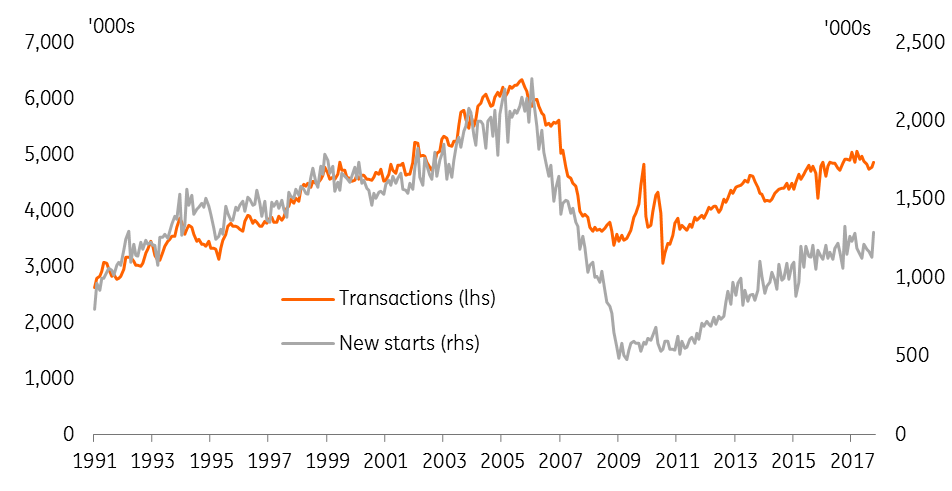

Solid price growth supports robust underlying activity in the housing market, with both new starts and sales growing steadily. As the economy improves further and disposable household income increases, we expect current housing market trends to remain in place. That will support the Fed’s ability to continue hiking rates in December and next year.

The tax reform bill currently under discussion in the US Congress is something of a wildcard for housing. While tax cuts could add further to household disposable income growth, proposed changes to deductions for mortgage payments and local property taxes could hit demand, in particular for high-end properties in high-tax locations that will be impacted the most by the current tax proposal.

Housing market activity

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).