US Housing in 2018: From strength to strength

The US housing market looks in robust shape going into the new year and should support GDP growth in 2018

Supply constraints support prices

2017 was a bumper year for US housing. Prices rose steadily, increasing by nearly 7% as of November, which is strong but well short of the unsustainable double-digit increases seen before the 2007 crash. Sales of existing homes continued to increase, reaching 5.57m annualised in December.

Construction of new homes continued to rise throughout the year. But new construction failed to keep pace with increasing demand; as of December, the inventory of homes for sale compared to the current rate of sales stood at the lowest level since 2005.

Homes available for sale fall to lowest level since 2005

Continuing momentum

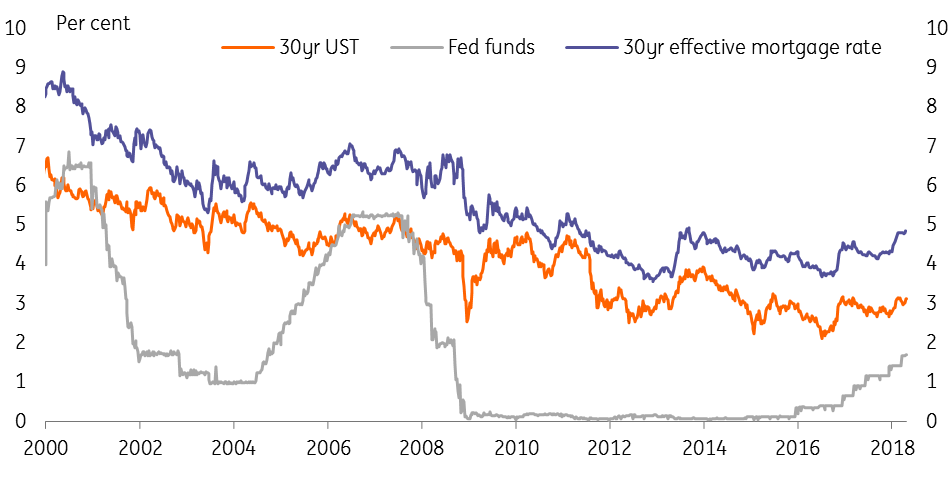

Given continued strong momentum in the overall economy and tight supply in the housing market, these trends are likely to continue in 2018. 30-year mortgage rates are likely to drift up in 2018 as bond markets react to an anticipated increase in inflationary pressures, strong growth and the prospect of the Fed hiking short-term rates plus some potential concern about the impact of tax reform on government finances. But mortgage rates won’t increase as rapidly as the Fed funds rate, leading to a flatter yield curve. Indeed, mortgage rates remained broadly unchanged in 2017, and have risen only marginally since the Fed started raising rates in late 2015.

Mortgage rates compared to Fed Funds and 30yr USTs

Still space for increased housing investment

There are two key channels through which the housing affects the overall economy:

- The ‘wealth effect’: as house prices rise, household wealth increases which boost consumer spending. And second,

- Investment in new homes boosts employment directly in the construction sector and throughout the supply chain for building materials and construction-related services.

The wealth effect from the housing market is probably a bit less prominent than in the past. Lending against housing equity is, sensibly, more restrictive than before the financial crisis (when many Americans used borrowing against their home equity finance consumption). And the current pace of house price increases pales in comparison with recent gains in stock market values.

Residential investment has made a positive contribution to GDP growth since the housing market troughed in late 2011. But the increase in housing construction has been gradual and, as a share of GDP, it remains quite a bit below the historical average. That suggests there is space for a further pick-up in investment, which could help support economic growth in 2018.

Housing investment remains below historical average

Tax reform a potential snag

The tax bill Congress passed in December could impact the prospects for US housing in 2018. Among the changes to the US tax code are two important provisions that will affect the housing market:

- The mortgage interest deduction (MID), which allows homeowners to offset interest payments against their tax bill, has been limited to mortgages below $750,000 (from $1m previously), though only for new mortgages.

- The maximum amount of state and local tax (including property tax) deductible from federal taxes has been limited to $10,000.

Both these changes will affect the top-end of the market the most and will hit states and cities with relatively high taxes and/or property values (e.g. California and New York) particularly hard. That may limit price increases in those markets in the near term. Set against that, buyers at the high-end of the market are more likely to be high-income earners who will see the largest gains from the overall tax cuts, which may offset some of the negative impact on prices.

In addition, the tax bill increases the standard deduction to $24,000 for a couple and $12,000 for a single filer, which means fewer homeowners will file using itemized deductions (including MID). The effect is to reduce the tax incentives for homeownership since taxpayers using the standard deduction gain little tax advantage from owning a house rather than renting.

It is difficult to say how much this will affect demand for homes. Even without the tax advantage, homeownership is still likely to remain attractive both financially (as the value tends to appreciate over time) and psychologically (as it provides security of tenure and, for many, a sense of accomplishment).

Support for prices

Overall, the US housing market is on a positive trajectory and looks set to continue that way in 2018. Tight supply and robust momentum in the economy will support prices, though gently rising mortgage rates and the recent tax changes are likely to moderate price growth compared to 2017 and 2016. We expect construction to increase further, helping the economy towards another year of strong growth.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).