US: Groundhog Day

Indications point to a Joe Biden presidency, absent the 'blue wave' that markets had been anticipating. Political animosity means a substantial near-term fiscal support package is less likely at a time when incomes are being squeezed and rising Covid cases mean containment measures are looking more likely. Economic risks are mounting

Biden Constrained

Heading into election night there was an expectation that Joe Biden would win the presidency handsomely and this would help sweep the Democrats to an even bigger House majority and control of the Senate for the first time since 2015. While voters turned up in their millions for Biden, they did the same for Donald Trump, making it a far closer outcome than polling suggested was likely. At the time of writing, it looks as though the Republicans have just about clung onto the Senate and have weakened the Democrat House majority marginally.

Nonetheless, Donald Trump seems to be exploring all possible avenues to retain the Presidency. Recounts, legal challenges and possible court cases mean it could be a few more days or even weeks before we have a definitive outcome while a Senate seat run-off in Georgia won’t happen until January.

The initial market reaction has seen the Treasury yield curve flatten at lower levels on the basis that this outcome makes an aggressive reflationary fiscal stimulus - that would have led to greater debt issuance (like the $3.4trn package proposed by House Democrats) - less likely. Republican Senators will simply oppose it. Equities are also up strongly, likely reflecting an assumption that this outcome diminishes the prospect of major corporation tax hikes while regulations surrounding financial services, healthcare, big tech and real estate may end up being less onerous than feared. At the same time, a Biden presidency would likely mean a more predictable global trade backdrop, which is good news for businesses with international supply chains.

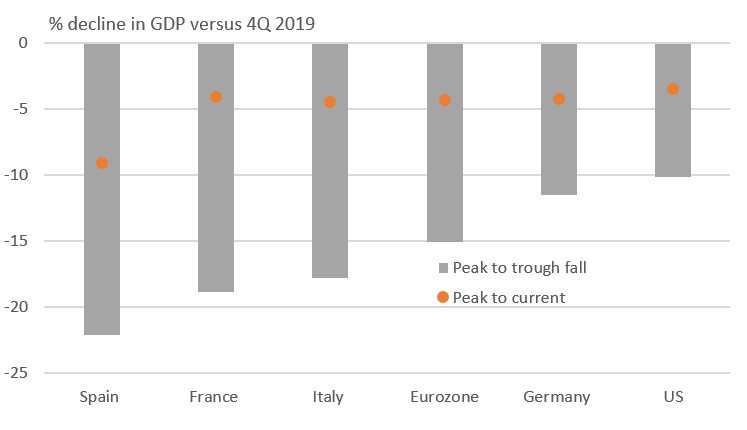

US economy still 3.5% smaller than 4Q19

A long time to heal...

However, this positive sentiment could swiftly dissipate. We must acknowledge the risk that political animosity between Democrats and Republicans, especially if there are lengthy legal battles over the election, scuppers the potential for another near-term fiscal support package. This would be very bad news for the economy. While the US recorded a 33.1% annualised growth rate in the third quarter, we should remember that output is still 3.5% below that of the end of the fourth quarter 2019 and there are 10 million fewer Americans in work than in February. There is a long way to go until the economy has fully healed and this process looks set to be further delayed by the headwinds from rising Covid cases and squeezed household incomes.

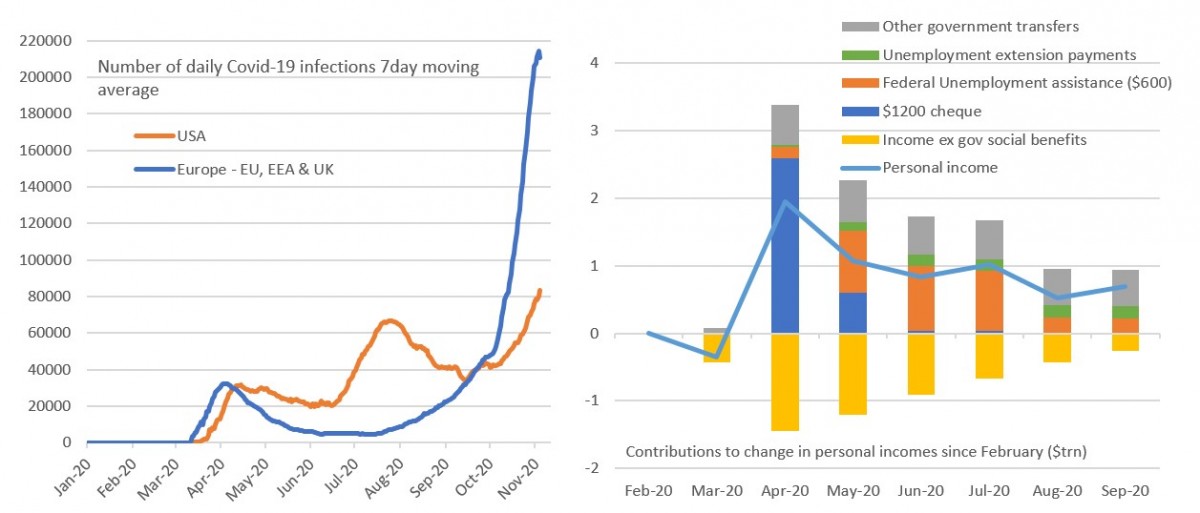

More than 230,000 Americans have already lost their lives to the pandemic and the fear is that the exponential growth rate in European Covid cases, followed by lockdowns, may be a prelude to what the US faces in coming weeks. Colder temperatures mean more people congregating inside and the potential for virus spread is growing – for example, Halloween parties and the Thanksgiving holiday could fuel the number of cases.

We are already seeing curfews and other restrictions re-introduced in some cities. Should hospitalisation rates rise and healthcare systems start to struggle this may necessitate the return of broader and more restrictive containment measures.

Covid spike and income squeeze threaten the recovery

With more pain to come...

Such action would inevitably bring economic damage. While the construction and manufacturing sectors may escape the scale of lockdown experienced earlier in the year, the service sector is unlikely to be as fortunate. Even if we see only limited action, health fears could mean consumers vote with their feet and not go to shops, restaurants and gyms. Activity would weaken in any case.

New business restrictions would mean rising worker lay-offs and weaker employee compensation at a time when unemployment benefit payments are being cut back. Remember that the $600/week Federal payment has been tapered to $400 (and to $300 in many instances) while millions more have now exhausted their 26 weeks of state unemployment benefits. As such, we have to contend with the very real possibility that household incomes fall in December in the absence of another short-term government support package.

Trying to quantify the impact of this is challenging. The economy has good momentum right now and we see this continuing through November, but December is the big unknown.

Remembering back to the beginning of the year, the economy started brightly and this continued through February. However, just a couple of weeks of lockdown in March was enough to turn what was looking likely to be a 2.5%+ quarterly expansion into a 5% annualised contraction.

Pencilling in a 3.5% month-on-month fall in consumer spending in December and a further 1% decline in January, with some weakness in other components of GDP, leads us to look for sub-2% growth in 4Q and an actual negative GDP reading for the first quarter of 1Q21. The more severe the restrictions, the more severe the contraction.

Vaccine remains critical for recovery

This development would be detrimental for risk appetite with the yield curve flattening at lower levels and be supportive for the US dollar against those currencies exposed to the recovery cycle as the reflation trade gets delayed. In the event of very limited fiscal support, the Federal Reserve may feel compelled to step up asset purchases at the longer end of the yield curve.

This is a more pessimistic forecast than what we were predicting last month, but we believe the set of containment measures will be shorter lasting and less restrictive than those experienced earlier in the year.

Obviously, a vaccine would be a huge boost to sentiment and would allow businesses to plan for the post-pandemic future, with economic activity rebounding once the rollout gets underway. We also still feel there is scope for a decent stimulus package in early 2021 with President Biden at the helm, but it may end up being closer to the $1 trillion (5% of GDP) package proposed by Senate Republicans rather than $3 trillion House Democrat package. If we can get this, combined with a vaccine, it still gives us optimism that the economy can post robust growth through the rest of 2021 and into 2022.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

5 November 2020

Making waves: Covid-19 and the US presidential election This bundle contains 12 Articles